Weekly Technology Improvement Series:

Data “Writeback” in MCTlive!

Published 9/24/2021

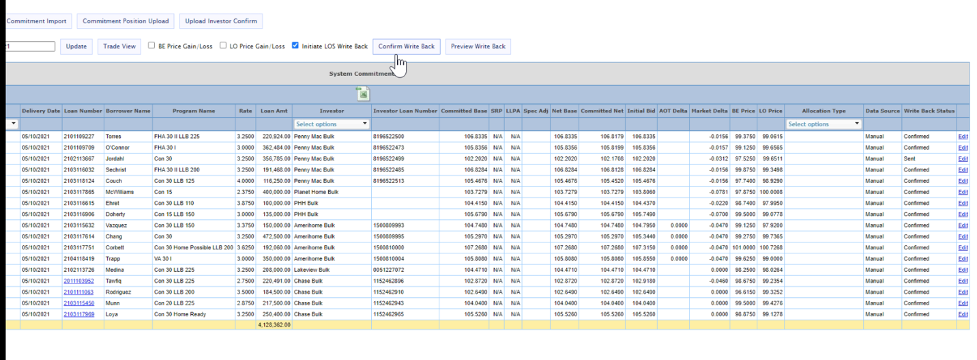

Looking to conduct your “write backs” from the MCTlive! platform?

Our Commitment Tracker Tab confirms come in via API or are uploaded by investors.

All that information is organized and displayed on a loan level in the commitment tracker.

You can initiate, preview, and confirm data write back to your LOS.

We conduct error checking to catch things such as duplicate sends or missing data to prevent mistakes.

Differentiators MCTlive! has that others may not include: populating custom fields, doing custom calculation and doing write backs at the loan-level rather than the trade-level.

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

MCT First to Integrate with Freddie Mac’s Income Limits API

MCT is pleased to announce it is the first secondary marketing platform to integrate with Freddie Mac’s Income Limits application programming interface (API) created for the first-time home buyer area median income (AMI) limits. Income Limits allows for the accurate pricing of Credit Fee in Price (Exhibit 19, or “Credit Fees”) waivers. This is the latest in a series of successful API integrations between MCT and Freddie Mac, and helps promote both pricing transparency and housing affordability.

MCT Whitepaper: Mortgage Pipeline Hedging 101

This whitepaper will review information on moving to mandatory loan sales through mortgage pipeline hedging, the strategy of hedging, the benefits of hedging, and how to determine if you are ready.

Phil Rasori Named Industry Titan by NMP

MCT COO Phil Rasori was named to National Mortgage Professional Magazine’s Industry Titans list for 2023. NMP recognizes the key players who have dedicated their expertise and years of experience to the mortgage business, and represent the industry with professionalism and pride.

Housing Market 2022 End of Year Summary

I’m sure there are plenty of us who would love to forget 2022, but let’s recap what happened in the bond and housing markets and put a bow on the year before we move to a hopefully more profitable 2023

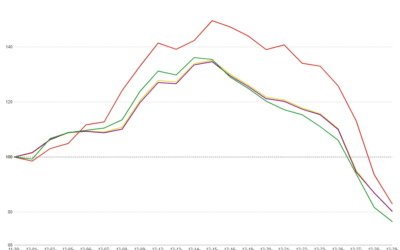

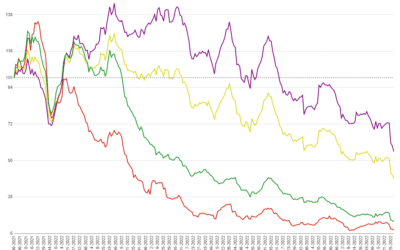

MCTlive! Lock Volume Indices: December 2022 Data

MCTlive! Mortgage Lock Volume Indices covers the period from December 1 through December 31, 2022, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.

Justin Grant Named to NMP’s 2022 40 Under 40

Justin Grant, was recognized by National Mortgage Professional Magazine’s (NMP) for his industry accomplishments, landing him on the 2022 ‘Top 40 Most Influential Mortgage Professionals Under 40’ list.

Employee Spotlight: Decades of Dedication

Voted for Best Work Place year after year, MCT has a long-standing history of team members staying with the company for 10 or more years.

MCT’s Azad Rafat Named 2022 Tech Trendsetter by HousingWire Magazine

Azad Rafat, MCT’s Senior Director of MSR Services, has been selected as a 2022 HW Tech Trendsetter. Azad is credited with driving innovation in the housing market specifically with his work on MCTlive! 2.0, a new software update to the original MSRlive! MSR software trading platform and portfolio system.

MCTlive! Lock Volume Indices: November 2022 Data

MCTlive! Mortgage Lock Volume Indices covers the period from November 1 through November 30, 2022, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.

San Diego Business Journal Names Natalie Martinez Finalist for 2022 Business Women of the Year

Natalie Martinez, Manager of the MSR Services Department & Client Success, was selected as one of the finalists for San Diego Business Journal’s 2022 Business Women of the Year.