Weekly Technology Improvement Series:

Bid Tape Mapping for Non-Platform Tapes

Published 9/17/2021

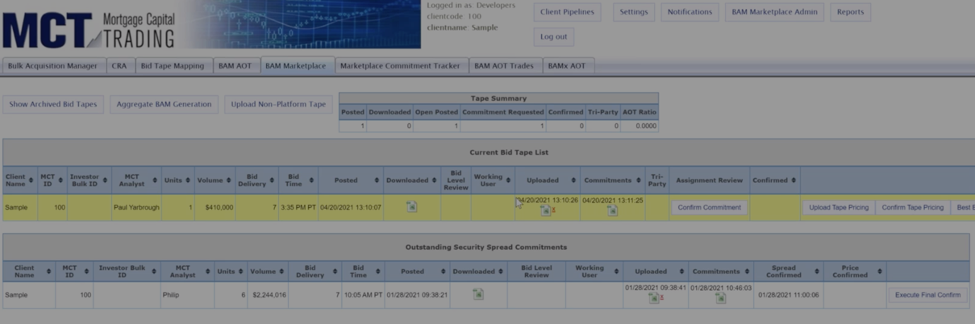

We aren’t naïve. Sellers use other services than ours, such as Resitrader, to sell loans.

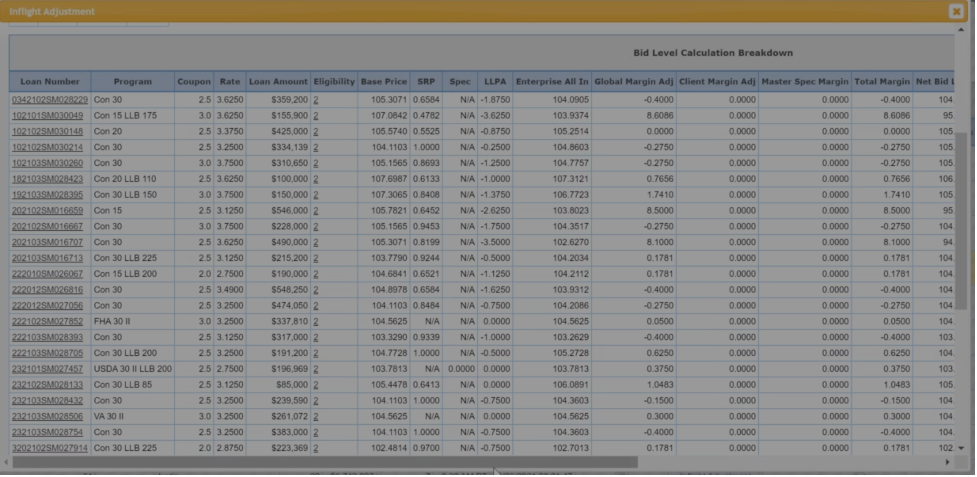

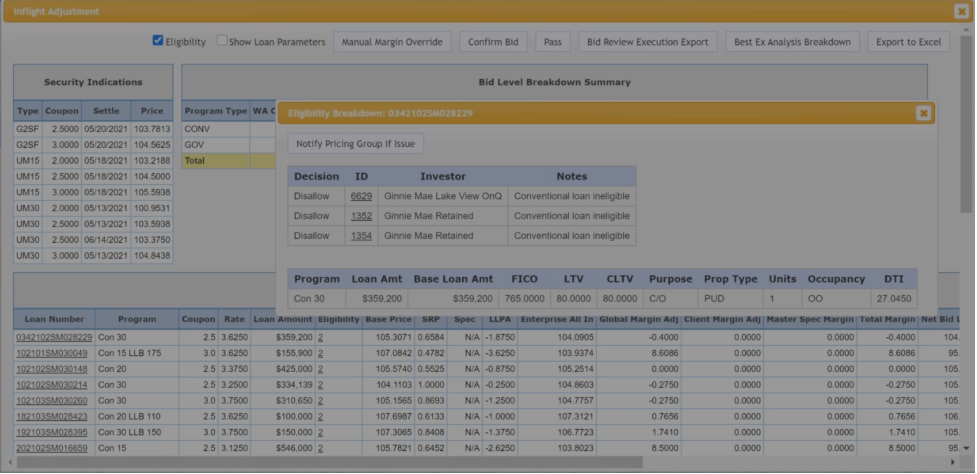

With our easy and robust tape mapping tool that includes eligibility breakdown, we map and normalize tapes for you.

Pull rules that make a loan ineligible for a particular pricing institution. It is a quick and easy way to see eligibility that lets you get as granular as you like.

We also provide a pricing breakdown, which tells you exactly what you need to pay for a loan.

Autobid generates pricing once you hit a button, but you don’t actually need to hit a button.

You can employ Autoprice, which also has controls surrounding tape size, etc.

Price every loan without extra work, providing you with a massive time savings.

Have confidence in the ability to turn tapes without a secondary employee watching it all day.

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

MCT Bolsters MSR Division with Hire of David Burruss to Address Demand for MSR Services

MCT® announces that David Burress has joined the company in the position of MSR Sales Director, directly addressing the increase in market demand for MCT’s MSR products.

Recapture: Impact on Servicing | Servicing Insights Vol. 10

In this servicing insights article, we will provide some guidance on the MCT’s approach to recapture and its impact on servicing. We will define recapture, how to measure it, how to include it in MSR valuation exercises, and whether it should be included in a fair value assessment of MSR.

MCT Webinar – Fannie Mae Approval: the Process, Timing, & Advantages

Join us for a webinar on Fannie Mae approvals as we go through the process, timing, and advantages so you can have a smooth approval process for your business.

Sarah Hellman Selected as Finalist for San Diego Business Journal’s 2020 Business Women of the Year

Mortgage Capital Trading, Inc. (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, announced that Senior Trader, Sarah Hellman, was selected as one of the finalists for San Diego Business Journal’s 2020 Business Women of the Year.

How News Impacts the Secondary Market

This article gives advice to capital markets staff about which news sources to follow, how the interpretations of that information influence the market, and how to use this information to protect your margins.

7 Benefits of Best Execution with a Loan Trading Platform

Learn the process and benefits of whole loan trading platforms so your secondary marketing staff can achieve their best execution while reducing risk for the company.

MCT Whitepaper: Non-Price Considerations in Your Best Execution Analysis

In this whitepaper, Freddie Mac teams up with Mortgage Capital Trading to expand on interest following her panel appearance during the MCT Exchange client conference in 2019. The focus of this whitepaper is to identify unexpected costs associated with your loan sales to improve profitability.

MCTlive! Pool Optimizer Technology Sets New Bar for Best Execution Loan Sales

Mortgage Capital Trading, Inc. (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, debuted upgraded MCTlive! Pool Optimizer functionality at its MCT Exchange client conference last month. The technology enables secondary marketing managers to use actual cash window execution for optimization on each individual loan rather than using a dealer survey for spec pay-ups.

History of Best Execution for Mortgage Loans

Learn the past and future of best execution in the secondary mortgage market so that you can get ahead of the competition and be a well-informed mortgage professional.

Alexa Voice Integration – Rasori’s Relentless Releases Episode 5

In MCT’s fifth episode of Rasori’s Relentless Releases, Phil Rasori announces the first stage of Alexa voice integration for the MCTlive! platform. This new integration will include command chains that allow for full remote secondary execution, including loan sale commitments and TBA positions.