Weekly Technology Improvement Series:

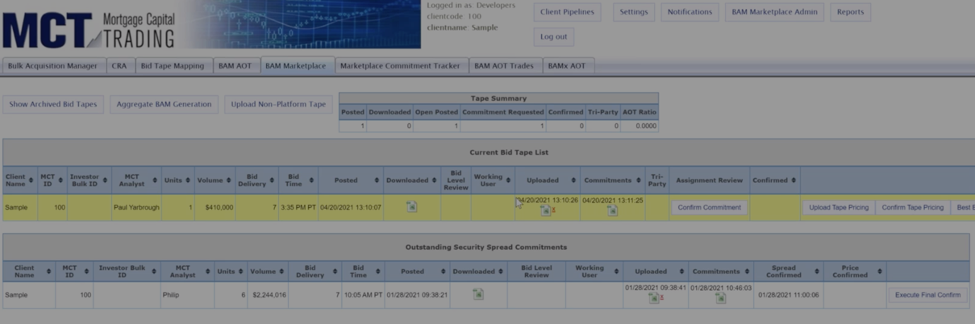

Bid Tape Mapping for Non-Platform Tapes

Published 9/17/2021

We aren’t naïve. Sellers use other services than ours, such as Resitrader, to sell loans.

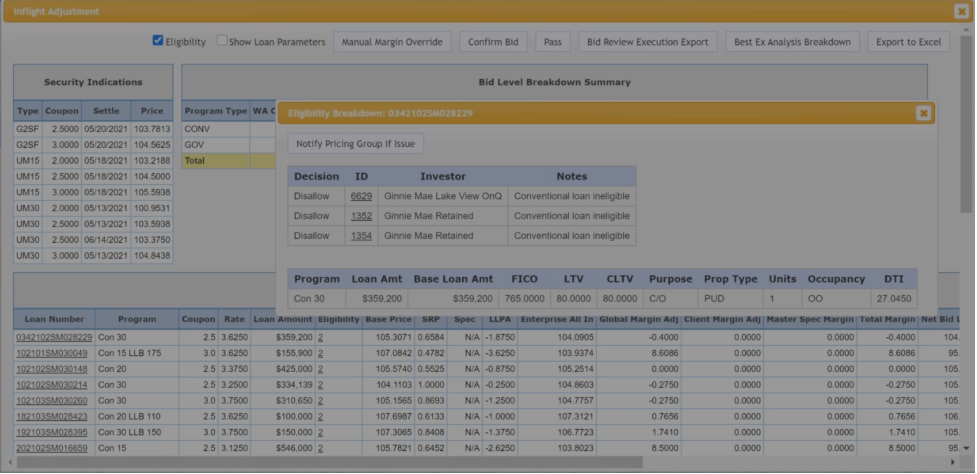

With our easy and robust tape mapping tool that includes eligibility breakdown, we map and normalize tapes for you.

Pull rules that make a loan ineligible for a particular pricing institution. It is a quick and easy way to see eligibility that lets you get as granular as you like.

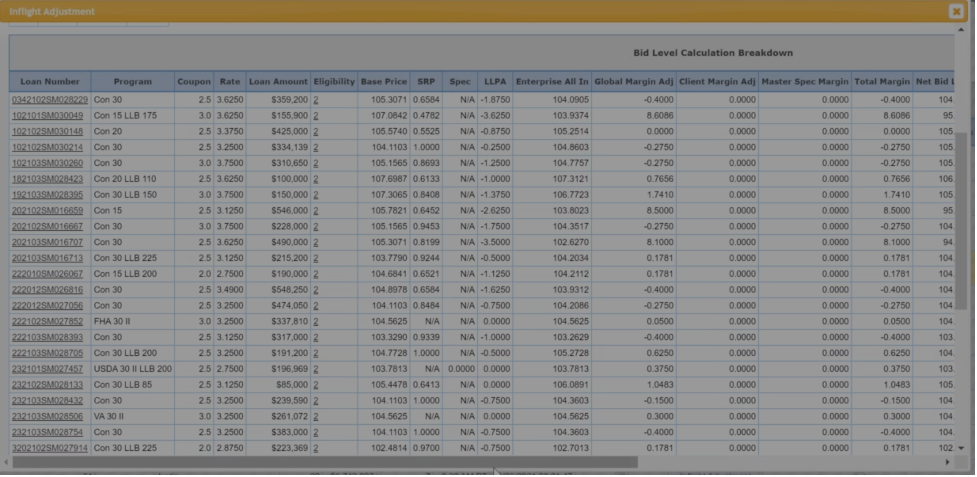

We also provide a pricing breakdown, which tells you exactly what you need to pay for a loan.

Autobid generates pricing once you hit a button, but you don’t actually need to hit a button.

You can employ Autoprice, which also has controls surrounding tape size, etc.

Price every loan without extra work, providing you with a massive time savings.

Have confidence in the ability to turn tapes without a secondary employee watching it all day.

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

MCT’s Client Success Group – Going Above and Beyond

In this video, MCT’s Paul Yarbrough, Sr. Director, Head of Client Success Group and Jessica Visniskie, Sr. Capital Markets Technology Advisor, discuss how MCT’s Client Success Group goes above and beyond to create the most memorable and valuable experience possible for clients.

MSR 101: Reviewing MSR Principles, Advantages & Disadvantages, & Key Portfolio Valuation Drivers [MCT Industry Webinar]

In this webinar, MCT’s MSR experts, Bill Shirreffs, Azad Rafat, David Burruss, and Natalie Martinez will provide MSR insights, elaborate on their advantages and disadvantages, describe the difference between fair, market, and economic value, and give a current market update.

MSR Market Monthly Update – July 2024

Click to read the most recent MSR Market Update! – Mortgage rates and other rate indices have managed to remain at relatively about the same level as they were at the closing in the month of May. Mortgage rates managed to end the month of June with a marginal increase of about three (3) basis points, while float income rates decreased by about eight (8) basis points during the same period. MSR portfolio holders should expect values to remain about the same level as they were at the end of May results. However, those levels could vary depending on portfolio vintages and other portfolio characteristics such as agency and GNMA mix. The downrate risk and its potential impact on MSR values continue to persist as we navigate through the balance of 2024.

MCTlive! Quarterly Release Notes in Q2 2024

Welcome to MCT’s Quarterly Release Notes! Described within relevant tabs, you’ll find a listing of our Q2 2024 technology developments. This update also includes technology release notes for MCT’s MSRlive! and Business Intelligence tools. Improvements span general platform maintenance, feature and function enhancements, and entirely new development. Should you have questions or comments about our latest releases, please reach out to your MCT representative.

The MCT Difference with Brian Gilpin of Embrace Home Loans

Brian Gilpin, CFO and Head of Capital Markets at Embrace Home Loans, sits down to discuss his experience switching to MCT and the level of customer service. Watch the video to hear more!

Preserve Margins and Improve Pricing with the Base Rate Generator

In this video, Mr. Barnhill shows step by step how to utilize all the elements of the Base Rate Generator with a demo recording so you can really get a look inside this new technology. Watch the video to see what Mr. Barnhill says about the Base Rate Generator.

MCT Whitepaper: Mortgage Pipeline Hedging 201

In this whitepaper, various hedging instruments will be explored, baseline inputs used in mortgage pipeline hedging will be examined, and recent industry advancements that have reshaped the hedging landscape will be discussed. Data integrity remains crucial to maximizing opportunities in hedging, and its importance will be emphasized throughout the discussion.

MCT Reports an 8% Mortgage Lock Volume Decrease in Latest Indices Report

Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced today a decrease of 7.84% in mortgage lock volume compared to the previous month. This decline follows a brief uptick in volume at the beginning of the buying season, suggesting a continuing stalemate between limited housing supply and higher interest rates.

Why MCT? Information on MSR Services & Interview with Bill Shirreffs

Read this blog to see why secondary market professionals continue to choose MCT for their MSR needs. Plus, view the interview with MCT’s Bill Shirreffs.

MCT Integrates with Fannie Mae’s Mission Score API and New Product Grids to Empower Originators to Take Advantage of Market Incentives for Mission-oriented Lending

SAN DIEGO (June 27, 2024) –MCT announced the launch of new integrations with Fannie Mae’s Mission Score API and product grids that provide better transparency and pricing for mortgages aligned with Fannie Mae’s mission objectives.

![MSR 101: Reviewing MSR Principles, Advantages & Disadvantages, & Key Portfolio Valuation Drivers [MCT Industry Webinar]](https://mct-trading.com/wp-content/uploads/2024/12/MCT-Lender-Price-MSR-Webinar-Title-Slide-400x250.png)