The Largest Loan Trading Exchange for the U.S. Secondary Market

MCT Marketplace® is liquidity. We connect mortgage loan traders in a unique, digital auction regardless of counterparty approval status.

Correspondent Sellers

Correspondent Buyers

Delegated Loans Sold

Through our patented technology, sellers have access to the most robust set of take-outs, while buyers are seamlessly connected to the largest community of sellers in the U.S.

MCT Marketplace helps find best execution at EVERY OPPORTUNITY by eliminating barriers between EVERY EXECUTION TYPE and EVERY COUNTERPARTY.

Every EXECUTION TYPE

More execution types with better transparency and more supporting automation compared to any other loan trading exchange.

Every OPPORTUNITY

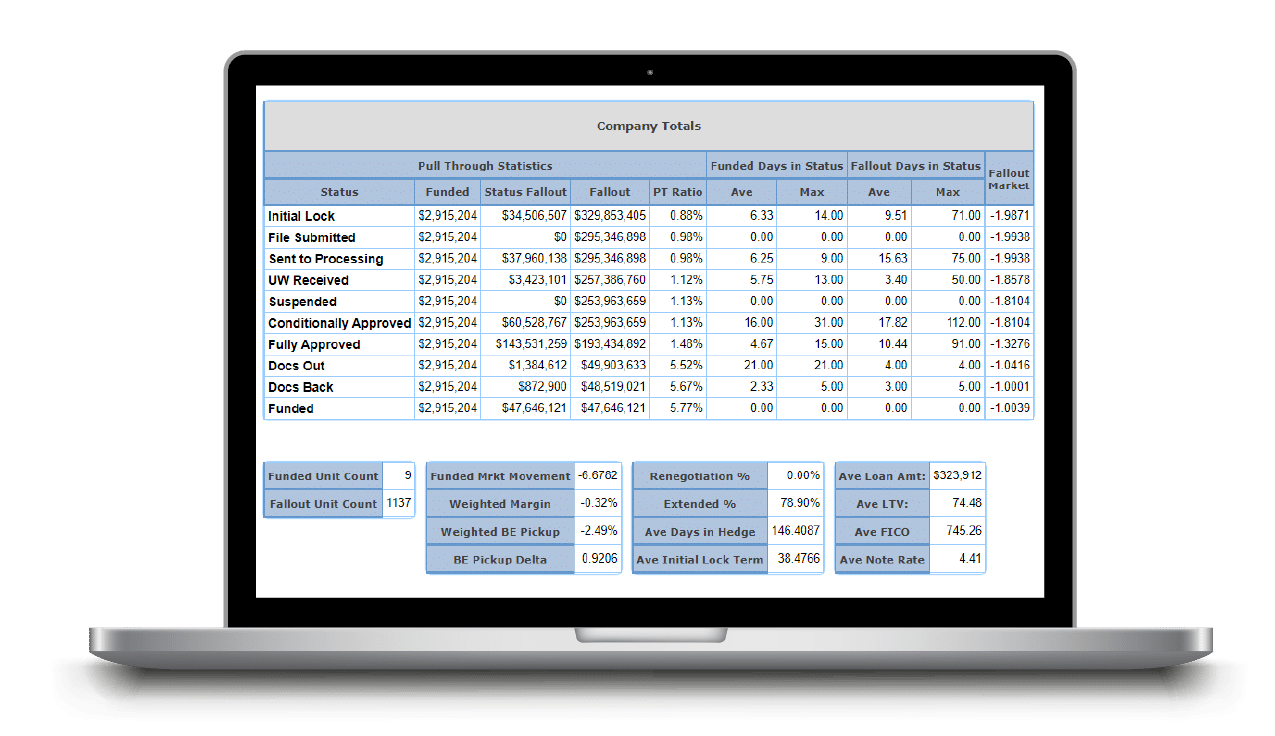

Embedded, powerful analytics allow users to target, measure, and take advantage of every loan trading opportunity, every time.

ACH/Towne Mortgage

American Financial Resources

AmeriHome Mortgage Company

ARC Home

Bayview Loan Servicing

BSI/Servis One Inc.

Capital Mortgage Services

Chase

CitiMortgage

CMG Financial

Colonial Savings

Essex Mortgage Company

Fannie Mae

FHLB

Fifth Third Bank

First National Bank

Flagstar Bank

Franklin American

Freddie Mac

Freedom Mortgage

Gateway First Bank

Genway Home Mortgage

Ginnie Mae

Guild Mortgage Company

Lakeview Correspondent

Loan Stream

M&T Bank Corporation

Marlin Mortgage

Matrix Financial Services Corporation

MAXEX

Maxwell Capital

Merchants Bank of Indiana

Mission Servicing Residential

Mortgage Solutions Financial

Mr. Cooper

NewRez

NexBank

Onslow Bay Financial

Paramount Residential Mortgage Group

PennyMac

Pentagon Federal Credit Union

PHH Mortgage Company

Planet Home Lending

Plaza Home Mortgage

Provident Funding Associates

Radian

Seneca Mortgage Servicing

Specialized Loan Servicing

Standard Mortgage Corporation

Sun West Mortgage

The Huntington National Bank

The Money Source

Truist Bank

US Bank

Village Capital & Investments

Loan Trading Perfected with MCT Marketplace

Upgrade your loan trading process, stop missing opportunities, and be confident that you achieved the best possible execution.

1. Investor Set-Up & Recommendations

AI speeds investor pricing set up, while MCT’s experts personally guide the process. Reporting is in place from the start to track progress and opportunities.

2. Best Execution Analysis

The bid tape platform aggregates and analyzes pricing with your controls and overlays. Automated, hittable shadow bids ensure you don’t miss out.

3. Retain/Release Decisioning

Customized assumptions calculate the cash and economic value of servicing, deploying your MSR strategy while uncovering valuable retention opportunities.

4. Electronic MBS Pool Bidding

Optimize the creation of your MBS pools and then get the best possible execution, streamlined with no clunky spreadsheets or emails.

5. Commitment

Automated, intelligent commitment with agencies (Rapid Commit®) and select aggregators reduces formerly manual processes while avoiding human errors.

6. Data Write-Back

Direct integrations protect data integrity and prevent labor-intensive rekeying. MCT leads with the broadest range of options for connecting with client data.

Looking for Pipeline Hedging?

Taking advantage of mandatory loan sales requires protection against interest rate risk. Learn about mortgage pipeline management and hedging with MCTlive!

Best for SELLERS

Best for BUYERS

Combining decades of loan trading experience with cutting-edge technology innovation, MCT Marketplace benefits all market participants by improving liquidity and efficiency.

“We used MCT Marketplace to find additional investors. Had I not had Marketplace, we would have been holding onto a few million dollars in funded loans and I might not have this job to be telling the story to you now.”

“Given the advancement of MCT Marketplace technology, MCT brings incredible selling efficiencies and pricing resources to the industry. Mr. Cooper is excited to be a first adopter of MCT Marketplace and we look forward to working with our clients, MCT, and the agencies to further the expansion of co-issue sales.”

MCT Stands Singular in Mortgage Capital Markets

| Company 1 | Company 2 | Company 3 | Company 4 | |

|---|---|---|---|---|---|

| Loan Trading Exchange | ✓ | ✓ | |||

| Electronic TBA Trading | ✓ | ✓ | |||

| AOT Automation | ✓ | ||||

| Customized Spec Durations | ✓ | ✓ | |||

| Full Integration with GSE APIs | ✓ | ✓ | |||

| Mobile App | ✓ | ✓ | |||

| Cloud-Based Tech | ✓ | ✓ | ✓ | ||

| Client Success Group | ✓ | ✓ | |||

| AI-Enabled | ✓ | ✓ |

Learn More About Loan Trading

Frequently Asked Questions

Explore common questions about loan trading, bid tape platforms, optimizing profitability, and best execution analysis with MCT Marketplace.

What is Loan Trading?

Loan trading is the process of exchanging mortgage loans between buyers and sellers on the secondary mortgage market. The vast majority of mortgages that are originated are ultimately sold to investors, in order to free up liquidity for further origination rather than holding that debt on the books for the full term of the loan.

The process of managing counterparties, analyzing best execution to determine the best price, delivery method, and investor, and committing loans to be sold to that final investor are all functions that a loan trading exchange like MCT Marketplace is designed to optimize.

Learn More: Why Your Loan Sale Process is Holding You Back

How Does Loan Trading with Unapproved Counterparties Work on MCT Marketplace?

- Step 1: Post bid tapes to MCT Marketplace, which includes MCT Marketplace Buyers

- Step 2: Thanks to MCT AutoBid, MCT Marketplace bids are returned instantly

- Step 3: Security Spread Commitments and Co-Issue are clearly highlighted in Best Ex.

- Step 4: Sell side contact info is transferred upon selection of Security Spread Commitment

- Step 5: Buyer and Seller execute Buyer MLPA bilaterally (and in most cases a short application) and complete loan sale

Why Do You Need a Loan Trading Platform?

Our experiences over the last two decades in the housing market has taught us that seamless trade execution through a whole loan trading platform saves time, minimizes errors, and leads to higher profitability.

From integrations with GSEs to Tri-party agreements and bid tape AOT, the right platform selection is crucial to maximizing profitability in the secondary market. Automation is the key to scaling operations and when all data remains in one platform, you can feel more confident about your workflow.

What’s the Benefit of Moving to Mandatory from Best Efforts?

Mandatory delivery typically yields a major lift in loan sale profitability compared to best efforts. Lenders have historically experienced a 20 basis point pick-up on conventional volume and a 40 basis point pick-up on government volume. Note that a sound pipeline hedging strategy is essential to mitigate interest rate risk until the loan closes and can be confidently sold using a short-term mandatory commitment.

Learn More: Introduction to Mandatory Loan Sale Delivery

What is Bid Tape Assignment of Trade (AOT)?

MCT Marketplace facilitates more AOTs than any other platform, and is the only one with complete automation of the complex calculations and agreements involved.

Bid tape Assignment of Trade (AOT) is a loan sale execution type which involves three parties: the mortgage originator, the investor, and the broker-dealer. The originator transfers loan collateral and hedge positions to the investor, with all parties signing a tri-party agreement.

This agreement notifies the broker-dealer to move the TBA position from the originator’s account to the investor’s. The investor then adjusts the loan’s final price to reflect the hedge’s gain or loss, streamlining the process and enhancing liquidity and price efficiency in the secondary mortgage market.

AOTs allow the originator to save the bid-ask spread on their TBA trades, which averaged 11.3 BPS in 2023. AOTs also act as a key cash management tool in shifting markets. Unique automation of AOTs in MCTlive! increases efficiency of these complicated transactions, which is why MCT clients conduct the vast majority of AOTs, according to leading investors.

Learn More: Assignment of Trade (AOT) Executions 101

Does Your Exchange Support Bidding With Unapproved Counterparties?

MCT Marketplace is the only loan trading exchange that lets you see and execute on live bids from new, unapproved counterparties – leading to significant pickup.

This is accomplished through MCT’s patented Security Spread Commitment. Rather than committing to a fixed price, buyers bid in the form of a spread to the underlying security associated with the loan, giving the seller certainty while allowing market movement to continue.

Learn More: Patented Technology Allows Mortgage Buyers to Transact with Any Seller on MCT Marketplace

Does Your Exchange Have Unique Co-issue, CRA, and Whole Loan Buyers?

MCT Marketplace is the only loan trading exchange that offers full support for co-issue or flow-based MSR sales as well as functionality to help lenders find loans to satisfy their Community Reinvestment Act (CRA) requirements. MCT Marketplace buyers have unique prices and axes not available on other platforms.

Learn More: Getting Started with Co-Issue Transactions

What are the Features for Sellers on the Platform?

MCT Marketplace offers automated live bids, bidding regardless of approval status, every loan priced to every investor and co-issue buyer, automated and simplified AOT executions, and a streamlined process for new investor approvals (averaging five days).