In this article, we will discuss how credit unions can leverage mandatory loan sale delivery to improve profitability and manage risk with pipeline hedging, as well as all the operational changes needed to move from best efforts to mandatory loan sales. It is a change that will allow you to provide better prices to your members.

Table of Contents

When mortgage bankers sell their loans on the secondary market, most begin using the Best Efforts loan sale delivery method.

There are risks associated with best efforts loans, such as being locked into the price with the borrower or being at the mercy of the investor when it comes to underwriting or delivery guidelines.

As volume begins to pick up, mandatory loan sale delivery becomes attractive for not only the increased profits, but also for the ability to better manage risk and enhanced flexibility in loan delivery. Credit unions can also gain operational efficiencies by moving to mandatory.

Keep the following three considerations top of mind as you look at your existing book of business and consider ways to streamline your operation, increase your revenue, and provide value to your members by moving to mandatory loan sales.

1. Managing Risk with Pipeline Hedging for Credit Unions

Managing the interest rate risk of a pipeline of mortgage loans with an opposite position of other mortgage loans, called “hedging” or being “interest rate neutral” is a prudent and beneficial strategy that will reduce or transfers risk of loss from changes in market interest rates. Being interest rate neutral makes you indifferent to what happens economically speaking because having a proper hedge allows you to keep the margin that is baked in at time of lock.

As pull through percent increases toward end of pipeline, your hedge provider should add TBA coverage as the loan waterfalls toward closing. This provides surety of purchase and surety of managing and protecting in-house margin. This also means no more assigning loans on an individual best-efforts basis at the time of lock. The loans are simply placed into hedge and covered with TBAs. Efficiency is rewarded!

“To-be-announced” (TBA) is a forward contract on mortgage-backed securities and are the associated hedge instrument recommended for mortgages. With TBAs, your loan position and the TBA position move in opposite directions (e.g., A market rally means value of TBA position decreases while the value of your loan pipeline increases). They trade in three-month increments with loans winding up in TBAs becoming mortgage-backed securities (MBS). There are monthly cash settlements based on a net position, with either the dealer or individual lenders owed money when securities are paired out of or rolled forward. This allows mortgage bankers to hedge their pipelines. Behind the U.S. Treasury market, TBAs are the second most highly traded security, making it easy to enter or exit into them.

Assignment of trade (AOT) trading allows you to eliminate bid-ask spread and receive cash sooner on transactions. The process is now highly efficient, even down to the automation of the Tri-party agreement at the click of a button to send documents to all parties. Without the Tri-Party agreement automation for bid tape AOT transactions the time cost might outweigh the pick-up from the bid offer spread and the dealer savings. The AOT screen in MCTlive! helps select the trades to assign and send out the commitments to investors. MCT has recently integrated MCTlive! with Freddie Mac’s Rapid Commit and added additional investors to the bid tape AOT automation in the MCT Marketplace platform. Rapid Commit intelligently completes product selection and delivers commitments for all loans with a single click.

MCT Technology Adds Value When Moving to Mandatory

MCT Technology Adds Value When Moving to Mandatory

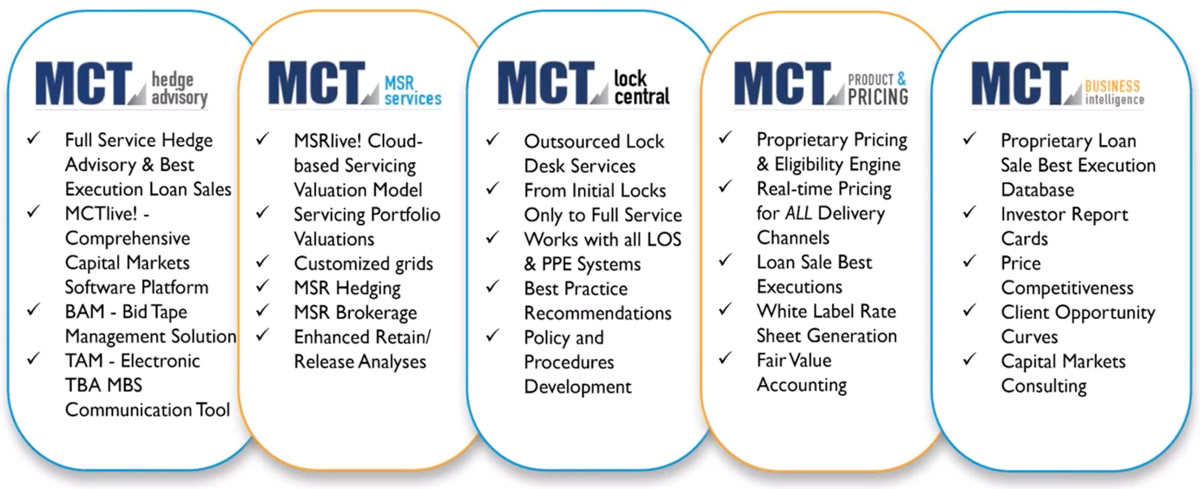

MCT is the industry leader in helping lenders move from best efforts to mandatory loan delivery. Technology is making an impact for lenders at every stage of growth. MCTlive!, MCT Marketplace and Rapid Commit have been especially helpful in saving time, generating better returns, and improving efficiency.

- MCTlive! – A powerful platform available for day-to-day loan pipeline management, trade positions management, and loan sale best execution. MCTlive! automates repetitive tasks and frees your time for other high-value functions.

- MCT Marketplace – MCT’s digital whole loan trading platform within MCTlive! that integrates with existing lender and investor processes to increase the speed and security of bid tape management while achieving true best execution.

- Rapid Commit – New integrations that automate Fannie Mae and Freddie Mac loan pricing and commitment with intelligent best execution capability. MCT was the first vendor to successfully complete a loan commitment with Freddie Mac’s new API.

Leverage the power within MCTlive!, MCT Marketplace, and Rapid Commit to save time delivering loans and improve margins.

Contact us to discover how MCT can increase your profitability!

2. Maximizing Loan Sale Profit

Preparing, sending, receiving, and managing bid tapes by hand was a full-time job. Now? No more manually entering data points or babysitting spreadsheets instead of working on more valuable projects. Accomplish tasks with a small team in a time sensitive manner. Automation allows for data integrity, which drives profitability.

What would take 20 minutes on three or four commitments now takes seconds. Settlement tracking, which used to be a laborious manual process, has also been made easy with one click. Reducing cycle times while reducing data errors reduces costs to you, which in turn reduces rates for your members. Mandatory deliveries allow for a broader range of execution options over best efforts. You become the interim investor by setting your own lock policies, renegotiations, and extensions. No more being beholden to investors who pass on cost of their hedge to you.

Best efforts delivery only allows for 30-day to 60-day locks. Mandatory can be as short as five days, allowing you to shorten your delivery period and opening up a number of different ways to trade loans. A Best Execution analysis that incorporates all fees into the considerations for where to deliver the loan will maximize profitability.

A live trading platform provides several benefits that increase execution. It prevents stale information from earlier in the day that could make inefficient secondary departments shut down operations to reprice. The live environment also helps to build and optimize coverage throughout the day. Simply go into your product and pricing engine, increase margin as appropriate and move on with your day.

You always want the best price for your members. A basis point here and a basis point there all go toward your bottom line! Moving to mandatory on average provides a pickup of about 25 bps versus best efforts (investor choice, current spreads, and how efficient you are on the backside all influence that figure). Credit union cost of funds aren’t reliant on warehouse lines of credit, which can help you earn more spread on current cost of funds versus where the loan is originated.

3. Improving Operations for Mandatory Delivery

The good news is your operations are not going to change a lot, but there are a few changes you need to consider.

Lock Desk/Secondary: Agree to a process to identify loans to hedge, make post-lock adjustments, produce LOS pipeline reporting and mark-to-market tracking to accurately hedge your pipeline

Underwriting: Identify all “eligible” investors rather than underwriting to a “single” investor

- Broker/Dealer approvals for TBA settlements

- Additional investor relationships: bolstering your stable is key to maximizing member benefits (see our article)

Accounting: New cash flows (TBA settlements each month with broker/dealers) and implementation of fair-value accounting (if needed, should be part of onboarding process)

More Tips to Maximize Mandatory Success

- Centralize your lock desk

- Reliably and continuously update pipeline data

- Focus on in-house (delegated) underwriting

- Get mandatory approvals from investors and broker/dealers (should have two investors for all of your product)

Mortgage Capital Trading (MCT) is Here to Help

MCT is the industry leader in helping lenders move from best efforts to mandatory loan delivery. Mandatory delivery is more than additional pickup over best efforts. It gives you more flexibility to manage risk and deliver loans. Decrease per loan operational expense and provide more value to your members.

- MCT’s daily mark-to-market reporting provides added visibility into pipelines.

- MCT helps clients integrate the API for Rapid Commit to the GSEs.

- MCTlive!, MCT Marketplace saves time, generates better returns, and improves efficiency.

Contact us to learn more about mandatory loan delivery for credit unions.

MCT Technology Adds Value When Moving to Mandatory

MCT Technology Adds Value When Moving to Mandatory