In this article we interviewed MCT’s Director of Analytics, Bill Berliner, to explore how industry trends have contributed to shrinking margins. We’ll discuss lender competition, decreasing volumes, increased interest rates, and weakening of relative pricing of mortgage-backed securities (MBS) as contributors.

We are proud to introduce our latest whitepaper, What Caused the Lender Profit Margin Compression? by Bill Berliner, for those who are interested in taking a deeper dive into detailed MCT® client and market data.

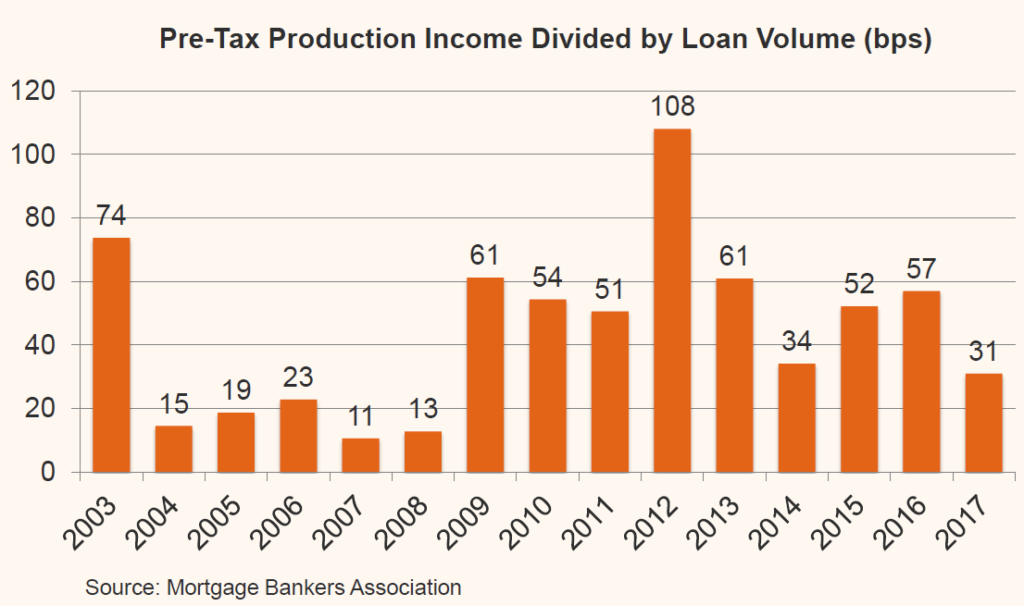

The “Mortgage Industry Profitability Trends” graph below reminds us of what our industry has been observing since Q4 2016 – profit margins are at their lowest level since 2008.

Now more than ever is the time to rise to the challenge and maximize every basis point of execution!

Whitepaper: What Caused Margin Compression?

In our latest whitepaper, What Caused Lender Profit Margin Compression in 2018, Bill Berliner uses MCT client and market data to narrate the steps leading to shrinking margins in 2018 and what may be in store for the future.

Mr. Berliner offers his expertise in this explorative analysis by using illustrative charts and historical data to contextualize the top level trends that lenders have been experiencing all year.

Dive deeper into the data in this comprehensive whitepaper.

“Even as rates rose in the first half of 2018, the prices that lenders were receiving were under pressure; as an example, the spread over par for conventional loans declined from a high of 3.48 points in December of 2017 to 2.95 points in May of 2018.”

Industry Trend: Lender Competition Driving Down Profits

In the Q1 2018, Fannie Mae Mortgage Lender Sentiment Survey, most business owners credit lender competition as the major driver for reduced profit margins. We asked MCT’s Director of Analytics, Bill Berliner, to explain why lenders are so concerned about competition in the context of today’s market climate.

In this section, we will explain how rising mortgage rates cause loan volume decreases, which, in turn, cause increased competition and declining profitability.

Later, we will explain advantages that give some lenders the edge over their competition so they can protect their profit margin despite the challenging market environment.

Fannie Mae Mortgage Lender Sentiment Survey

The following commentary was initiated by the data found in the Fannie Mae Mortgage Lender Sentiment Survey, a lender survey that tracks performance and predictions of the market. Combining research of market trends drawn from the MBA and commentary from Business Insider from as early as 2016, we also tapped our MCT expert to offer his explanation and perspective on this topic.

Industry Trend: Raising Mortgage Rates Driving Down Loan Volume

Mortgage rates are related to lender competition because increased rates drive down loan sales volumes.

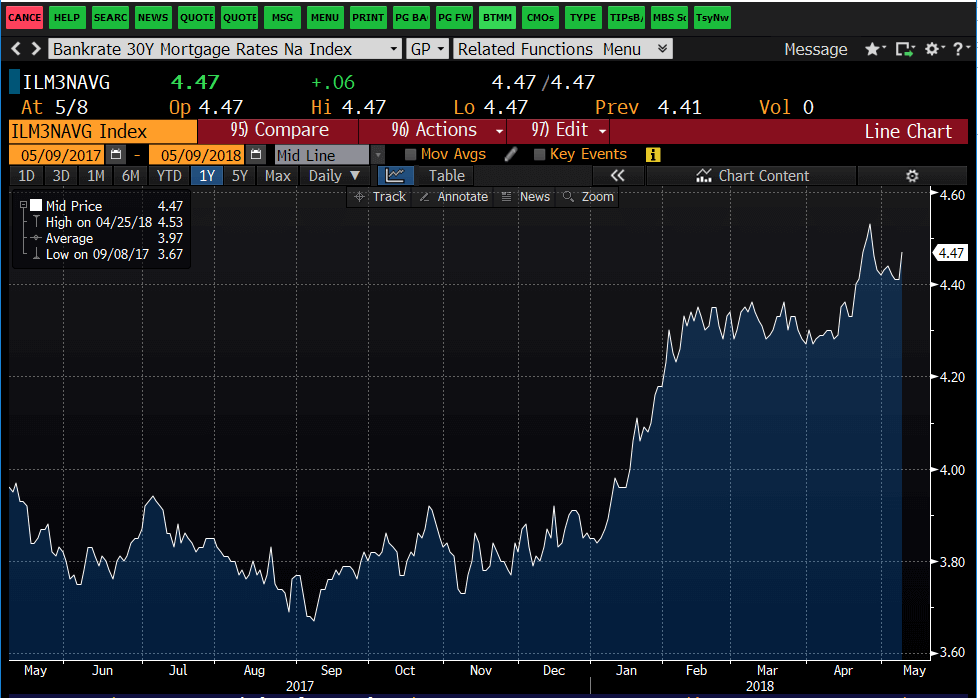

Since the beginning of 2018, mortgage rates are up, as is shown in the chart below depicting the national average rate for 30-year conventional (non-government) mortgages.

Source: Bankrate.com via Bloomberg

The Bank Rate national average has been rising significantly, totaling an increase of 58 basis points from January until early May.

“Usually when consumers refinance, it’s because they are refinancing to lower their rates, but when rates are high, then refinancing volumes are reduced significantly,” shared Bill Berliner, Director of Analytics.

This leaves mortgage lenders with mainly new purchases to look to for profits when the refinances are reduced. When loan volume is reduced in this way, lenders are forced to price more competitively, causing them to see a decline in profitability.

Basis Point Increase from Jan - May 2018

Industry Trend: Lowest Loan Refinance Volumes Since Financial Crisis

The current market is reaching all-time lows in regards to refinance loan volumes.

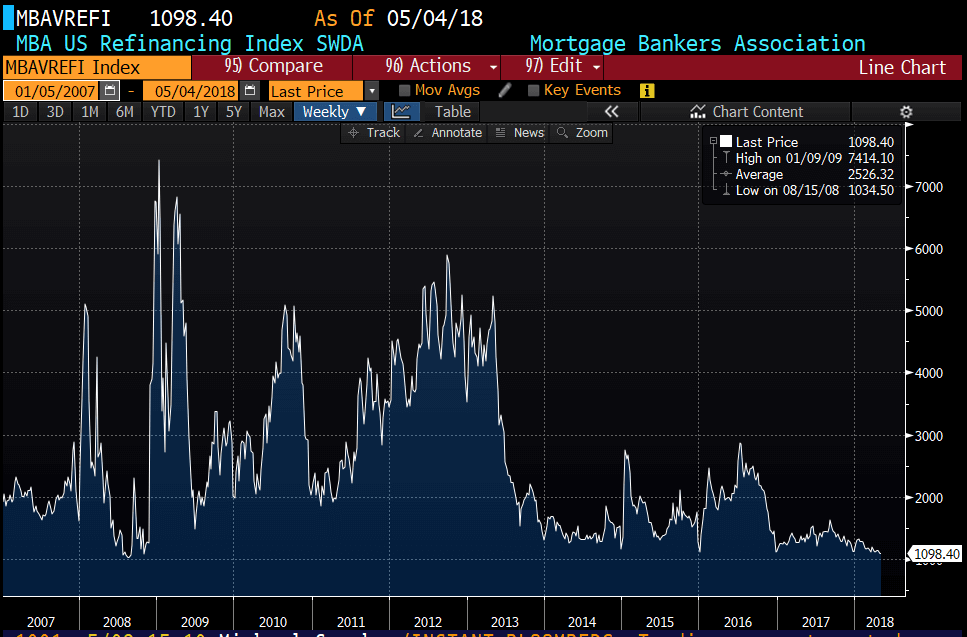

When loan volumes are low (this includes new purchases as well as refinances) lenders find themselves fighting for less business available. Citing the MBA Refinance Index, which began in 1990, Mr. Berliner gave us some insight about how the current loan volumes measure up to previous years.

“At a level below 1100, we reached our lowest mid-year levels (in refi volume) since the height of the financial crisis in the summer of 2008.” said Berliner.

“The last time it was below this level in the middle of year (with the exception of the holiday lull), was August 2008 with an index of 1034.5.”

May 4, 2018 Refinancing Index

This decline can be observed in the following chart image from the MBA App survey.

Source: MBA’s Application Survey via Bloomberg

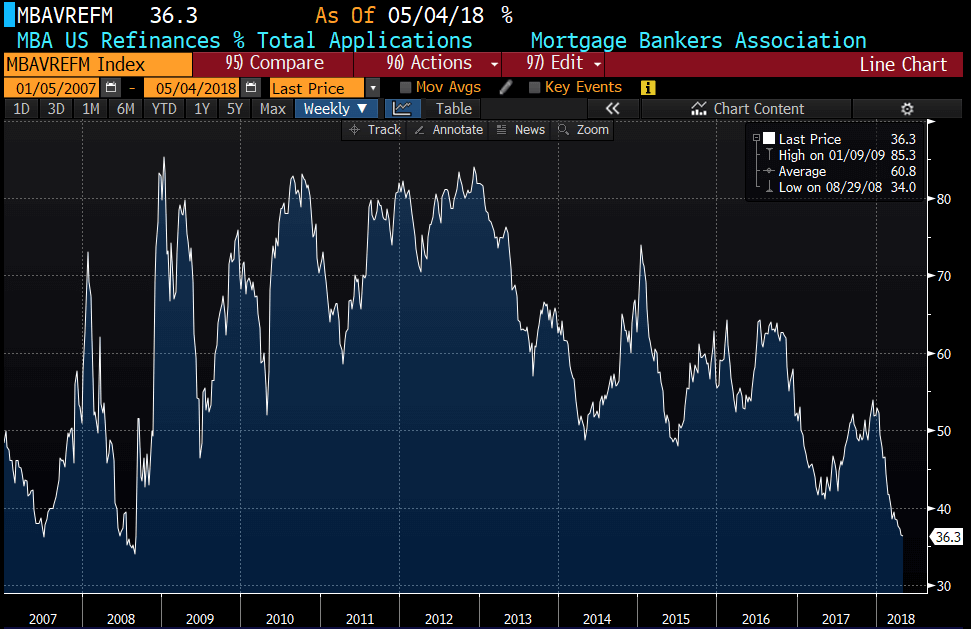

Additionally, the current refi percentage of 36.5 also hasn’t been this low since the fall of 2008 (see chart below from MBA App Survey).

Source: MBA’s Application Survey via Bloomberg

The reason that lenders are citing competition as their number one driver for reduced profitability is because there is so little refi volume that everyone is fighting over what is left over – which is mainly purchases.

For example, refis on a percentage basis are currently at their lowest level in a long time. Refi volume has fallen off a great deal and now lenders are fighting for purchase volumes.

Even though the percentage is higher, the overall applications activity (excluding the holidays and seasonally adjusted) hasn’t been this low in years. Clearly, people are fighting for diminished volumes.

Therefore, this is the biggest source of lender competition.

%

Refi Percentage May 2018

Industry Trend: Weakness in Relative Pricing of Agency MBS

The last industry trend that contributed to shrinking margins in 2018 was the weakness in the relative pricing of agency mortgage-backed securities.

MBS prices have softened relative to their historical levels due to reduced Federal Reserve purchases and the flatter yield curve. From the recession in 2008 until the end of 2017, the Federal Reserve continued to buy MBS to boost the economy, which has since been tapering off. Due to this trend mortgage-backed securities are in greater supply which is driving down the demand for purchasing.

The second contributing factor is that the spread between 2 yr and 10 yr yields narrowed causing mortgage-backed securities to decrease in value. Buyers of MBS are decreasing as the yield curve flattens because they cannot make as much money on MBS and are therefore seeking alternative investments.

What Tactics Are Giving Lenders the Competitive Edge?

According to our team of capital markets experts, there are a few main distinguishing factors between a successful mortgage lender and a company that may be swallowed by lending competitors. Learn these tactics to stay ahead of, or at least keep pace with, the heavily competitive marketplace.

- Tactic 1: Lenders that are executing their loan sales on a mandatory basis have greater profitability and operational benefits compared to those who are executing on a best efforts basis. While hedging with best execution loan sales has incremental costs, it is vastly outweighed by the increase in loan sale profits and greater control over rates, extensions, and more.

- Tactic 2: Efficient processes must be in place in order to reap gains over best effort shops. If a lender is doing best execution but they have inefficient processes, then they may be dragged back down toward what they could make on best efforts pricing.

- Tactic 3: Secondary marketing technologies are making processes more efficient for lenders who adopt them, giving them a significant advantage. For example, Eustis Mortgage implemented MCT Marketplace, a technology within MCTlive! to improve bid tape management and achieve best execution. This technology has saved them several hours on every loan sale, decreased their delivery window from 15-day to 7-day, and earned them an extra 60 bps in pickup on certain loans. Read a case study about their before and after experience with MCT Marketplace.

To be competitive in this market: begin executing on a mandatory basis, audit your processes to eliminate inefficiencies, and join the wave of automation that is leading the digitization of the mortgage industry.

Manage Margin Compression by Leveraging MCT Expertise

It’s a tough market out there right now, with loan profitability under pressure.

Even while increasing competition over decreasing loan volume is causing a decline in profitability for lenders, you can still maximize your margins through best execution with the help of a hedge advisory firm.

At MCT we have many strategies to increase profitability and take advantage of the margin that still exists. Start achieving the competitive advantage today, by tapping into the tactics of an industry leading mortgage hedging advisory and secondary marketing software firm.

Contact us to learn how best execution loan sales help mortgage lenders to make the most of declining profits.