Weekly Technology Improvement Series:

Cash-Window APIs

Published 8/18/2021

With MCTlive!, all your bids are tied directly to the cash window through our live, on demand, APIs with Fannie Mae and Freddie Mac. Once posted, live pricing from Fannie/Freddie is available with the click of a button.

Even if the market moves between pricing and hitting the bid, you don’t have to worry about delayed rate sheet updates or a dislocation between TBAs and cash window price changes.

A full browse price integration to ALL cash window executions provides assurance that you are receiving the most up to date pricing for your best execution and front-end pricing.

This live browse with the agencies feature allows you to pull in a base price, SRP, spec, and LLPAs, for an accurate all in price, to make retained or released decisions, with SMP (Fannie), CRX (Freddie), and CTOS (Freddie).

Once a best ex analysis is completed (fee adjusted and eligibility included), a lender can easily commit to all of the cash window iterations available.

The ability to select commitment pricing directly from the cash window helps maximize profit and save time in the process of selling loans. MCT® is continually optimizing our capital markets software to keep up with the current market space.

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

MCT’s Azad Rafat Named 2022 Tech Trendsetter by HousingWire Magazine

Azad Rafat, MCT’s Senior Director of MSR Services, has been selected as a 2022 HW Tech Trendsetter. Azad is credited with driving innovation in the housing market specifically with his work on MCTlive! 2.0, a new software update to the original MSRlive! MSR software trading platform and portfolio system.

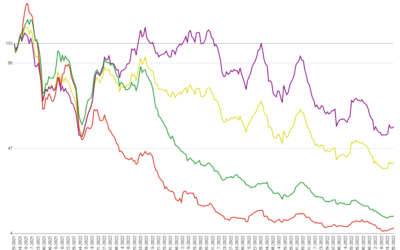

MCTlive! Lock Volume Indices: November 2022 Data

MCTlive! Mortgage Lock Volume Indices covers the period from November 1 through November 30, 2022, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.

San Diego Business Journal Names Natalie Martinez Finalist for 2022 Business Women of the Year

Natalie Martinez, Manager of the MSR Services Department & Client Success, was selected as one of the finalists for San Diego Business Journal’s 2022 Business Women of the Year.

MCT & Mr. Cooper Whitepaper: Getting Started with Co-Issue Transactions

In this whitepaper, we’ll review the basics of co-issue transactions, how to get started and how to easily incorporate this strategy in your plan to achieve your business objectives.

MCT Launches BAMCO: Co-issue Loan Sale Marketplace for Shadow Pricing and Unique Executions

MCT announced the release of BAMCO, a new marketplace for co-issue loan sales. Co-issue loan sales, also known as flow-based mortgage servicing rights (MSR) sales, are a three-way transaction involving the sale of loans to one of the agencies with a simultaneous sale of the MSRs to a separate third party. BAMCO brings co-issue transactions directly into MCT’s whole loan trading platform and improves price transparency by connecting unapproved sellers to live executions from potential buyers.

[MCT Webinar] Introducing BAMCO: New Co-Issue Marketplace

In this webinar, MCT’s Phil Rasori and Justin Grant will introduce BAMCO. BAMCO brings co-issue loan sale transactions directly into MCT’s whole loan trading platform, making the process of selling co-issue more convenient and transparent.

MCT Expands Investor Services Team by Appointing Jennifer Kennelly as Senior Director

MCT announced that Jennifer Kennelly has been appointed as the new Senior Director of MCT’s quickly expanding Investor Services team. Jennifer will leverage her unique background to grow MCT’s Bid Auction Manager (BAM) MarketplaceTM, the nation’s first open mortgage loan exchange where buyers can bid regardless of approval status, and sellers receive automated live pricing from every buyer on the platform.

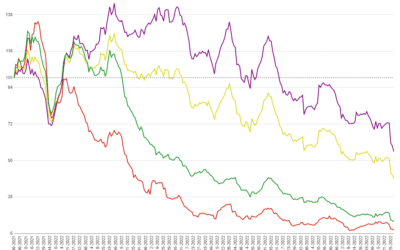

MCTlive! Lock Volume Indices: October 2022 Data

MCTlive! Mortgage Lock Volume Indices covers the period from October 1 through October 31, 2022, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.

Current Housing Market Trends

In this article, we will discuss current market outlook. Even though the headlines say, “Everything is down, down, down,” we have some recommendations.

San Diego Business Journal Again Names MCT as Best Places to Work 2022

MCT announced that it has been named Best Places to Work 2022 by the San Diego Business Journal (SDBJ). MCT was ranked number seven in the medium-sized company category (50 – 249 U.S. employees).

![[MCT Webinar] Introducing BAMCO: New Co-Issue Marketplace](https://mct-trading.com/wp-content/uploads/2022/11/BAMCO-Webinar-400x250.jpg)