Weekly Technology Improvement Series:

Pricing Granularity

Published 9/10/2021

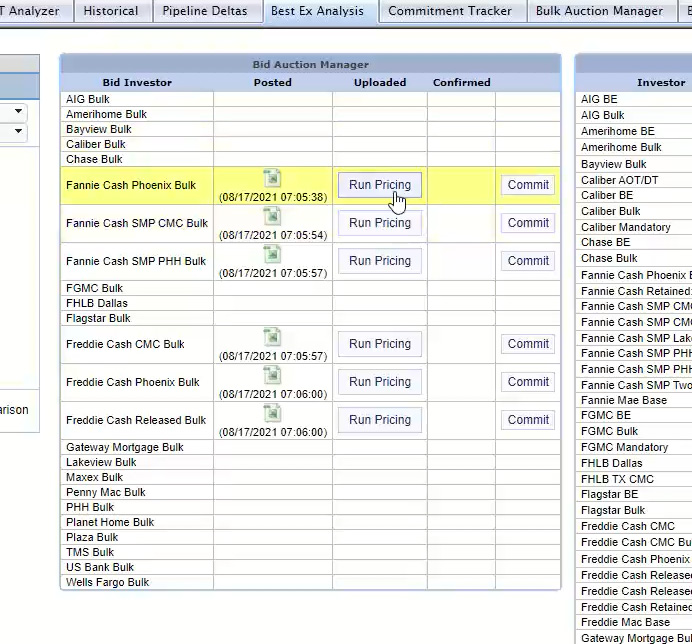

MCT Marketplace features recent improvements on both the buy side and the sell side.

One of the primary functionality enhancements is in the Autobid software, which has new features for granularity on pricing and margins on bids.

For certain types of loans, investors can now easily manage pricing for sellers via new margining features on loans with specified value payups that allow the user to define in either bps or as a % of the total payup.

For example, maybe you want 50 bps and 50% of the spec payup on a particular loan.

Specs for Fannie, Freddie, and GNMA are handled in different ways and the new functionality in MCTlive! provides users the ability to load their own spec payup grid or use the derived payups to margin off of.

You can now build out your own programming rules. So, for example, on a Freddie cash retained loan, you can now choose from all applicable spec values and get as granular as you want on the filters.

It will recalculate daily pickup as the spec values get updated. It will also display a hit to price on a global level, such as for a low loan amount, and can adjust on a client level for loan attributes.

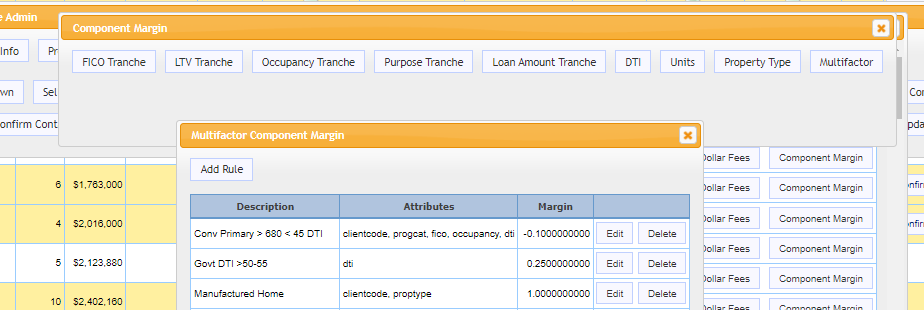

Our new multifactor rule builder for margins and overlays really drives home your point of being a self-managed, very sharp pricing tool for buyers.

This tool allows you to combine any attribute to define when a rule should apply. So, if you want a 5pt hit on loans with a PIW, TX, < 640 FICO, > 80% LTV, MH, for 5 of your sellers. You can do that!

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

NAMMBA Announces Partnership with MCT

MCT increases commitment to diversity to better serve today’s rapidly changing housing landscape.

NAMMBA & MCT Webinar – Leveraging Diversity as a Competitive Advantage

In NAMMBA’s and MCT’s “Leveraging Diversity as a Competitive Advantage” industry webinar, Tony Thompson, CMB, NAMMBA Founder and CEO, speaks on the power of diversity and inclusion in the mortgage industry.

MCT Whitepaper: How Credit Unions Can Benefit Members Through Investor Set Optimization

As a credit union, you have deep community roots, loyal membership, and are always looking to grow market share. One way to help your members get the best rate or price is by optimizing your investor set. Download our whitepaper to learn more.

Reviewing and Optimizing Your Investor Set

In this article, we will discuss how to quantify where to deliver your production, the process for auditing your investor base, and how to optimize your investor set.

HousingWire Announces Ian Miller as 2021 Marketing Leader

MCT®’s CMO Ian Miller, was announced as a 2021 HousingWire Marketing Leader Award Recipient. Mr. Miller was selected for the Marketing Leader Award by a panel of industry leaders that viewed and voted on submissions before the final list was reviewed and confirmed by a committee of HousingWire editors.

MCT Whitepaper: Why Your Loan Sale Process is Holding You Back

In this whitepaper, we will explain the main features and functionalities of BAM Marketplace, giving an in-detail comparison between the standard loan sale process and the upgraded workflow of an open loan exchange. We hope that this paper will effectively highlight the opportunity costs a lender offsets by utilizing this revolutionary secondary market technology.

Case Study: On Q Financial Grows Correspondent Channel Through MCT Marketplace

In this case study, On Q Financial’s VP of Margin Management, Angela Wooldridge, documents how the company used MCT’s newly-released BAM Marketplace loan exchange to launch and grow its correspondent channel. On Q also utilizes MCT’s Security Spread Commitment and AutoBid technology which has helped to give buyers on the platform unparalleled access to new sellers.

Case Study: Homestar Financial Corporation Improves Performance With Business Intelligence Platform

In this case study, Mr. Miles explains how he is leveraging MCT’s Business Intelligence Platform software to glean impactful insights into rates, pricing, and the industry.

Case Study: Alpha Mortgage Gains a Competitive Edge with MCT Marketplace

In this case study, Mr. Collins describes how MCT’s BAM Marketplace enabled him to decrease his average approval times with buyers and achieve an impressive pickup on committed loan volume while delivering via mandatory executions.

HousingWire & MCT Webinar – Unlocking Profitability: How To Navigate Secondary Marketing Challenges

The loan sale process has contributed to recent challenges in the secondary market. An open loan exchange mitigates risk and unlocks profitability. In this webinar, MCT’s Phil Rasori and Justin Grant, as well as OnQ Financial’s Angela Wooldridge and Alpha Mortgage’s Genesis Collins reviewed bidding regardless of approval status, mitigating risk, and increasing profitability.