Weekly Technology Improvement Series:

Pricing Granularity

Published 9/10/2021

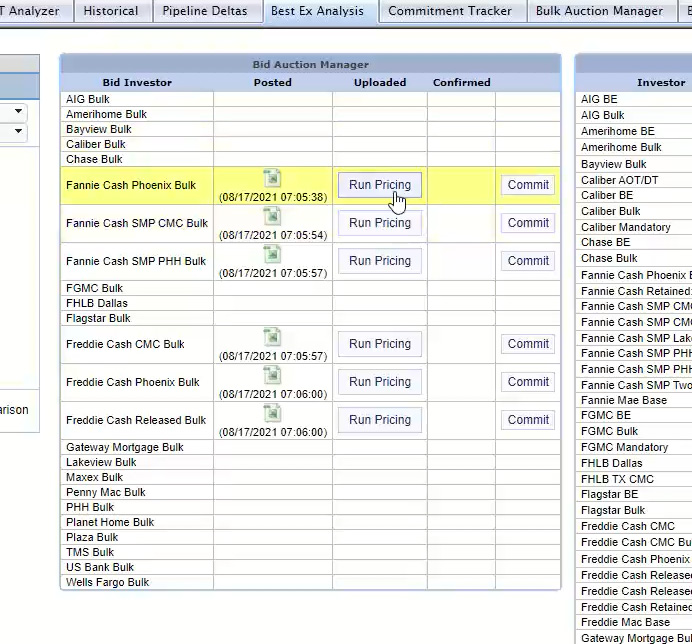

MCT Marketplace features recent improvements on both the buy side and the sell side.

One of the primary functionality enhancements is in the Autobid software, which has new features for granularity on pricing and margins on bids.

For certain types of loans, investors can now easily manage pricing for sellers via new margining features on loans with specified value payups that allow the user to define in either bps or as a % of the total payup.

For example, maybe you want 50 bps and 50% of the spec payup on a particular loan.

Specs for Fannie, Freddie, and GNMA are handled in different ways and the new functionality in MCTlive! provides users the ability to load their own spec payup grid or use the derived payups to margin off of.

You can now build out your own programming rules. So, for example, on a Freddie cash retained loan, you can now choose from all applicable spec values and get as granular as you want on the filters.

It will recalculate daily pickup as the spec values get updated. It will also display a hit to price on a global level, such as for a low loan amount, and can adjust on a client level for loan attributes.

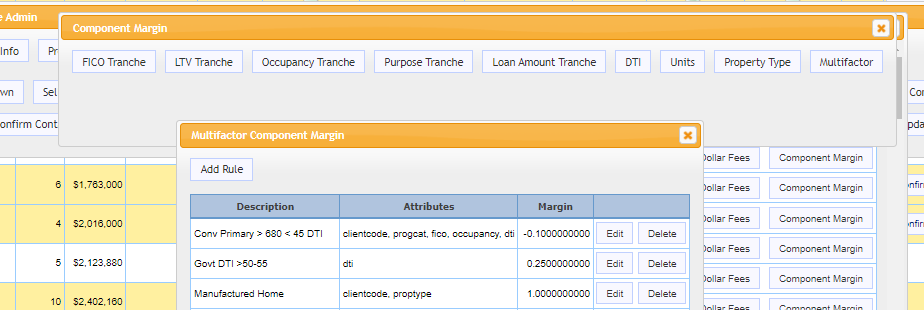

Our new multifactor rule builder for margins and overlays really drives home your point of being a self-managed, very sharp pricing tool for buyers.

This tool allows you to combine any attribute to define when a rule should apply. So, if you want a 5pt hit on loans with a PIW, TX, < 640 FICO, > 80% LTV, MH, for 5 of your sellers. You can do that!

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

MCT Whitepaper: The Links Between MBS Markets and Loan Pricing

In this whitepaper, we will explore the relationship between consumer loan pricing and capital market conditions to address common misconceptions and illustrate the processes involved in generating consumer loan offerings and intermediate loan prices.

Taper Tantrum 2? Comparing 2013 to 2022 & What Lenders Can Do | MCT Industry Webinar

In this webinar recording, MCT’s Phil Rasori, Justin Grant, and Andrew Rhodes will compare 2013 to 2022 in terms of the deteriorating market, market liquidity in specific coupons, loan sale execution liquidity, and investor pricing performance. They also share actionable recommendations to protect your business and pipeline.

Ben Itkin Assumes Sales Leadership Position at MCT as Sales Team Grows

MCT® announced that Ben Itkin has been appointed the new National Sales Director. Mr Itkin will leverage his hands-on experience from his previous senior role as Managing Director to now lead a larger overall investment in the MCT sales team.

Case Study: Atlantic Coast Mortgage Creates Seamless Selling Experience With Rapid Commit

In this case study, MCT sits down with John Collins to hear how the Rapid Commit integration has added efficiency to their loan selling process. Rapid Commit has also reduced the element of human error in putting together the commitments, saving them time, money, and headaches.

MCT Client Exclusive Webinar – Current Market Recommendations

Please view the recording from this client-exclusive webinar from Tuesday, March 29th at 11am PT as we discussed current market recommendations.

MCTlive! Pool Optimizer – Rasori’s Relentless Releases Episode 8

The unique interface between the MCTlive! Pool Optimizer and the Agile MBS pool bidding tool. Similarities and differences that exist between agency cash window commitment optimization and pooling optimizations

MCT Integrates with the Fannie Mae Connect Whole Loan Purchase Advice Seller API

MCT’s award-winning capital markets platform, MCTlive!, is now integrated with the Fannie Mae Connect™ Whole Loan Purchase Advice Seller API. This API connection allows MCT Mark-to-Market and Hedge Accounting Reports to be updated with Fannie Mae purchase data instantly, instead of waiting to run reports through a Loan Origination System (LOS).

The MCT Review: Market Commentary Week of March 7

FNCL 3.0s opened the day at 101-03, hit a high of 101-12+ just prior to 12 noon, and then we drifted lower in the afternoon to close at 101-04. We saw some intraday reprices for the better in the late morning and then some in the other direction later in the afternoon. We are now about 6 ticks lower vs. the Friday close of 101-04 but do not expect much from TBA hedge flows today. March issuance is about ~2.0bln behind the pace of February when you compare the first four business day of March to those of February. The big drop occurred in February and I would now expect the attrition to be a few billion/month.

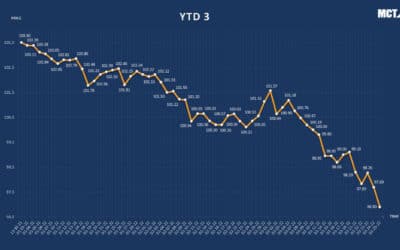

How An Investor Can Offset Declining Volumes in a Rising Rate Environment

Buying in a rising rate environment can be difficult to maneuver, especially when volumes are declining and margins remain pressured. Strategy is of the utmost importance so ensuring you are leveraging the newest technologies available is key to bidding in a smart and efficient way so as to maximize your potential. In this post, we will review strategies for how investors can maximize their market share in a rising rate environment.

The MCT Review: Market Commentary Week of February 22

We’ve seen lighter supply thanks to the Russia/Ukraine headlines. The market has ultimately gained ground with FNCL 3.0s starting at 100-06+ and closing at 100-15. We did see some negative reprices, then the Russia/Ukraine headlines moved the bond market higher into lower yields and that brought better reprices. We currently have FNCL 3.0s at a lower closing level so don’t expect much.