Weekly Technology Improvement Series:

Pricing Granularity

Published 9/10/2021

MCT Marketplace features recent improvements on both the buy side and the sell side.

One of the primary functionality enhancements is in the Autobid software, which has new features for granularity on pricing and margins on bids.

For certain types of loans, investors can now easily manage pricing for sellers via new margining features on loans with specified value payups that allow the user to define in either bps or as a % of the total payup.

For example, maybe you want 50 bps and 50% of the spec payup on a particular loan.

Specs for Fannie, Freddie, and GNMA are handled in different ways and the new functionality in MCTlive! provides users the ability to load their own spec payup grid or use the derived payups to margin off of.

You can now build out your own programming rules. So, for example, on a Freddie cash retained loan, you can now choose from all applicable spec values and get as granular as you want on the filters.

It will recalculate daily pickup as the spec values get updated. It will also display a hit to price on a global level, such as for a low loan amount, and can adjust on a client level for loan attributes.

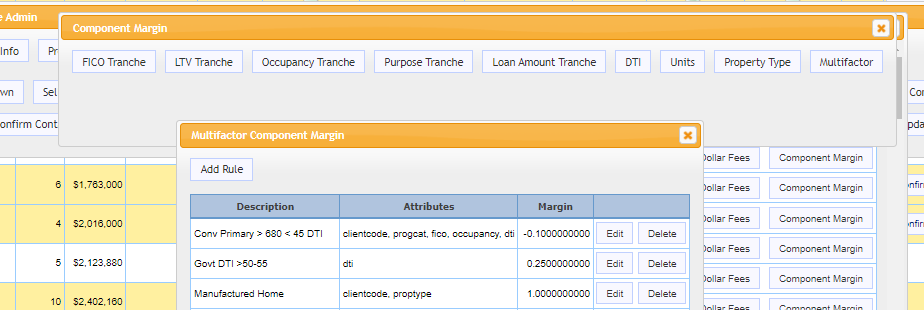

Our new multifactor rule builder for margins and overlays really drives home your point of being a self-managed, very sharp pricing tool for buyers.

This tool allows you to combine any attribute to define when a rule should apply. So, if you want a 5pt hit on loans with a PIW, TX, < 640 FICO, > 80% LTV, MH, for 5 of your sellers. You can do that!

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

Justin Grant Named to NMP’s 2022 40 Under 40

Justin Grant, was recognized by National Mortgage Professional Magazine’s (NMP) for his industry accomplishments, landing him on the 2022 ‘Top 40 Most Influential Mortgage Professionals Under 40’ list.

Employee Spotlight: Decades of Dedication

Voted for Best Work Place year after year, MCT has a long-standing history of team members staying with the company for 10 or more years.

MCT’s Azad Rafat Named 2022 Tech Trendsetter by HousingWire Magazine

Azad Rafat, MCT’s Senior Director of MSR Services, has been selected as a 2022 HW Tech Trendsetter. Azad is credited with driving innovation in the housing market specifically with his work on MCTlive! 2.0, a new software update to the original MSRlive! MSR software trading platform and portfolio system.

MCTlive! Lock Volume Indices: November 2022 Data

MCTlive! Mortgage Lock Volume Indices covers the period from November 1 through November 30, 2022, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.

San Diego Business Journal Names Natalie Martinez Finalist for 2022 Business Women of the Year

Natalie Martinez, Manager of the MSR Services Department & Client Success, was selected as one of the finalists for San Diego Business Journal’s 2022 Business Women of the Year.

MCT & Mr. Cooper Whitepaper: Getting Started with Co-Issue Transactions

In this whitepaper, we’ll review the basics of co-issue transactions, how to get started and how to easily incorporate this strategy in your plan to achieve your business objectives.

MCT Launches BAMCO: Co-issue Loan Sale Marketplace for Shadow Pricing and Unique Executions

MCT announced the release of BAMCO, a new marketplace for co-issue loan sales. Co-issue loan sales, also known as flow-based mortgage servicing rights (MSR) sales, are a three-way transaction involving the sale of loans to one of the agencies with a simultaneous sale of the MSRs to a separate third party. BAMCO brings co-issue transactions directly into MCT’s whole loan trading platform and improves price transparency by connecting unapproved sellers to live executions from potential buyers.

[MCT Webinar] Introducing BAMCO: New Co-Issue Marketplace

In this webinar, MCT’s Phil Rasori and Justin Grant will introduce BAMCO. BAMCO brings co-issue loan sale transactions directly into MCT’s whole loan trading platform, making the process of selling co-issue more convenient and transparent.

MCT Expands Investor Services Team by Appointing Jennifer Kennelly as Senior Director

MCT announced that Jennifer Kennelly has been appointed as the new Senior Director of MCT’s quickly expanding Investor Services team. Jennifer will leverage her unique background to grow MCT’s Bid Auction Manager (BAM) MarketplaceTM, the nation’s first open mortgage loan exchange where buyers can bid regardless of approval status, and sellers receive automated live pricing from every buyer on the platform.

MCTlive! Lock Volume Indices: October 2022 Data

MCTlive! Mortgage Lock Volume Indices covers the period from October 1 through October 31, 2022, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.

![[MCT Webinar] Introducing BAMCO: New Co-Issue Marketplace](https://mct-trading.com/wp-content/uploads/2022/11/BAMCO-Webinar-400x250.jpg)