Weekly Technology Improvement Series:

Pricing Granularity

Published 9/10/2021

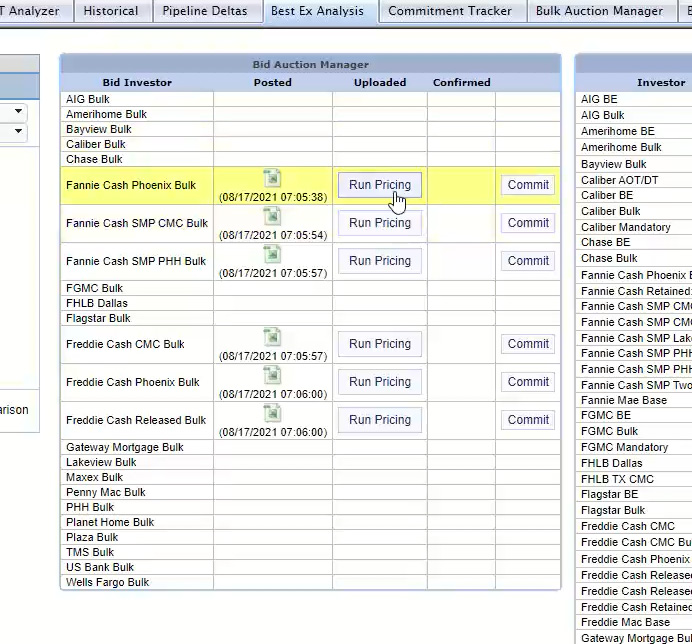

MCT Marketplace features recent improvements on both the buy side and the sell side.

One of the primary functionality enhancements is in the Autobid software, which has new features for granularity on pricing and margins on bids.

For certain types of loans, investors can now easily manage pricing for sellers via new margining features on loans with specified value payups that allow the user to define in either bps or as a % of the total payup.

For example, maybe you want 50 bps and 50% of the spec payup on a particular loan.

Specs for Fannie, Freddie, and GNMA are handled in different ways and the new functionality in MCTlive! provides users the ability to load their own spec payup grid or use the derived payups to margin off of.

You can now build out your own programming rules. So, for example, on a Freddie cash retained loan, you can now choose from all applicable spec values and get as granular as you want on the filters.

It will recalculate daily pickup as the spec values get updated. It will also display a hit to price on a global level, such as for a low loan amount, and can adjust on a client level for loan attributes.

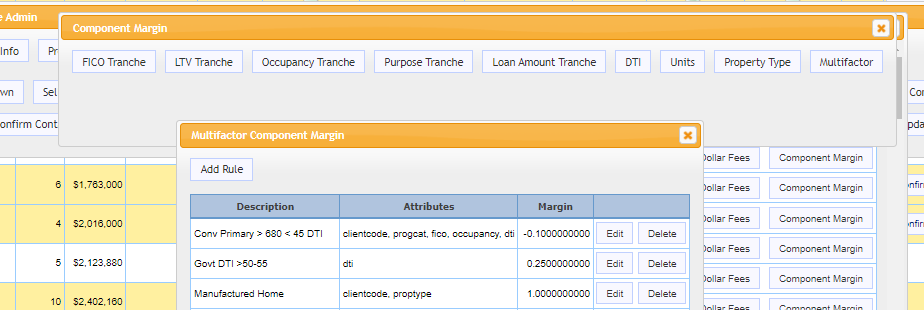

Our new multifactor rule builder for margins and overlays really drives home your point of being a self-managed, very sharp pricing tool for buyers.

This tool allows you to combine any attribute to define when a rule should apply. So, if you want a 5pt hit on loans with a PIW, TX, < 640 FICO, > 80% LTV, MH, for 5 of your sellers. You can do that!

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

MCT Releases Custom TBA Indications to Provide Price Discovery for Illiquid Coupons

SAN DIEGO, Calif., Feb. 28, 2024 – Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, today announced the release of pricing indications for the to-be-announced mortgage-backed securities (TBAs) used by mortgage lenders to hedge their open mortgage pipelines.

Industry Webinar – The New World of Warehouse Lines and Relationships

Last year’s regional banking crisis, pressure from the market downturn on mortgage originators, and recent events have all changed the warehouse lending landscape. Learn to navigate the new environment in our industry webinar featuring Western Alliance, Customers Bank, First Horizon, and Wintrust, with moderation by Chris Anderson, CAO at MCT.

MCT Awarded HW Tech100 Mortgage Award for the 5th Consecutive Year

Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, was announced as a 2024 HousingWire Tech100 Mortgage Winner for the 5th consecutive year. For more than a decade, HousingWire’s Tech100 program has identified and recognized the most innovative technology companies serving the mortgage and real estate industries.

Assignment of Trade (AOT) Executions 101

In this blog post, MCT experts delve into the nature of an AOT execution, the impact of bid tape AOT on TBA positions, how automation has improved the AOT process, and how bid tape AOT affects the best execution strategy. Read on to learn all about the AOT process and why it is a must-have strategy in the current mortgage market climate.

Monthly Mortgage Volume Increases 13.96% in Latest MCT Indices Report

SAN DIEGO, CA – February 2,2024 – Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced today an increase of 13.96% in mortgage lock volume compared to the previous month.

MQMR & MCT Webinar – MSR Risk Management, Compliance & Current Market Strategies

In this webinar, MQMR and MCT review operational and regulatory best practices, tips to avoid common MSR management mistakes, and current MSR pricing trends.

Seasonal Lows Contribute to 13.71% Drop in Mortgage Volume

Mortgage Capital Trading, Inc. (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, revealed today a 13.71% decline in mortgage lock volume compared to the previous month. To gain comprehensive insights into the market dynamics, industry professionals and enthusiasts are invited to download the complete report.

Housing Market Predictions 2024: Will Housing Prices Drop in 2024?

When will mortgage rates drop? Will inflation go down in 2024? Is a recession coming? Read this market predictions for 2024 article to learn our analysis for the future of 2024 and predictions for the 2025 housing market.

Monthly Mortgage Volume Decreases 10.7% in Latest MCT Indices Report

Mortgage Capital Trading, Inc. (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, today announced a 10.7% decrease in mortgage lock volume compared to the previous month. This revelation comes as part of MCT’s monthly Lock Volume Indices report, offering valuable insights into the dynamic landscape of the residential mortgage industry.

MCT Whitepaper: Margin Management Best Practices

This whitepaper reviews the intricate world of margin management, a pivotal driver of success in the ever-transforming mortgage industry. Learn how analyzing market share dynamics and volume trends becomes a strategic compass for effective margin management.