Weekly Technology Improvement Series:

Pricing Granularity

Published 9/10/2021

MCT Marketplace features recent improvements on both the buy side and the sell side.

One of the primary functionality enhancements is in the Autobid software, which has new features for granularity on pricing and margins on bids.

For certain types of loans, investors can now easily manage pricing for sellers via new margining features on loans with specified value payups that allow the user to define in either bps or as a % of the total payup.

For example, maybe you want 50 bps and 50% of the spec payup on a particular loan.

Specs for Fannie, Freddie, and GNMA are handled in different ways and the new functionality in MCTlive! provides users the ability to load their own spec payup grid or use the derived payups to margin off of.

You can now build out your own programming rules. So, for example, on a Freddie cash retained loan, you can now choose from all applicable spec values and get as granular as you want on the filters.

It will recalculate daily pickup as the spec values get updated. It will also display a hit to price on a global level, such as for a low loan amount, and can adjust on a client level for loan attributes.

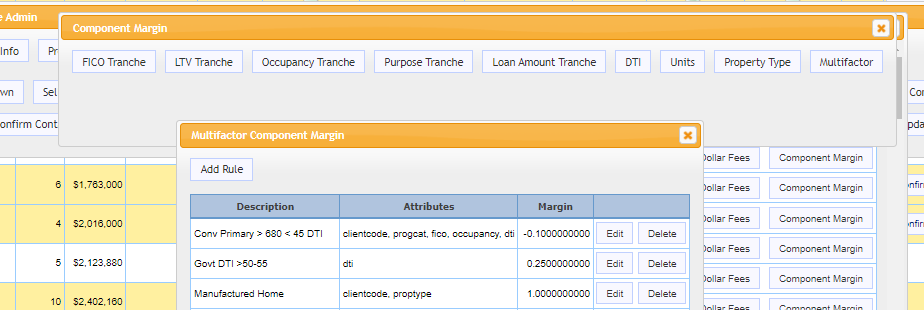

Our new multifactor rule builder for margins and overlays really drives home your point of being a self-managed, very sharp pricing tool for buyers.

This tool allows you to combine any attribute to define when a rule should apply. So, if you want a 5pt hit on loans with a PIW, TX, < 640 FICO, > 80% LTV, MH, for 5 of your sellers. You can do that!

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

Patented Technology Allows Mortgage Buyers to Transact with Any Seller on MCT Marketplace

MCT Marketplace’s Patented Security Spread Commitment boosts execution, liquidity, and approval times in the secondary market, transforming loan auctions with executable prices.

Scale Your Correspondent Market Share with MCT Marketplace

Watch the video to hear what MCT’s Justin Grant, Senior Director, Head of Investor Services, has to say about MCT Marketplace.

MSR Market Monthly Update – August 2024

Click to read the most recent MSR Market Update! – The Fed’s recent announcement indicated no changes to the current Fed Funds rate, hence opening the possibility for a rate decline during their next meeting in September. It appears that the market has already built a 25 basis points decline in the mortgage offerings as we observe continuous easing in the 10 Year Treasury rate and the entire yield curve. As of July 31, 2024, the 30-year primary mortgage rate has retreated by 15 basis points while float income rates have declined by an average of about 45 basis points.

MCT Client Webinar – Major Rally Management

In this webinar, MCT’s Andrew Rhodes, Natalie Arshakian, and Paul Yarbrough provide information and guidance related to this week’s market rally.

MCT Reports a 6% Mortgage Lock Volume Decrease in Latest Report

Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced today a decrease of 5.67% in mortgage lock volume compared to the previous month. Industry professionals and enthusiasts are invited to download the complete report for comprehensive insights into the market dynamics.

MCT’s Andrew Rhodes Honored with HousingWire Insider Award for 2024

MCT is proud to announce that Andrew Rhodes, Senior Director, Head of Trading, has been designated to HousingWire’s 2024 Insider Awards list.

MCT’s Client Success Group – Going Above and Beyond

In this video, MCT’s Paul Yarbrough, Sr. Director, Head of Client Success Group and Jessica Visniskie, Sr. Capital Markets Technology Advisor, discuss how MCT’s Client Success Group goes above and beyond to create the most memorable and valuable experience possible for clients.

MSR 101: Reviewing MSR Principles, Advantages & Disadvantages, & Key Portfolio Valuation Drivers [MCT Industry Webinar]

In this webinar, MCT’s MSR experts, Bill Shirreffs, Azad Rafat, David Burruss, and Natalie Martinez will provide MSR insights, elaborate on their advantages and disadvantages, describe the difference between fair, market, and economic value, and give a current market update.

MSR Market Monthly Update – July 2024

Click to read the most recent MSR Market Update! – Mortgage rates and other rate indices have managed to remain at relatively about the same level as they were at the closing in the month of May. Mortgage rates managed to end the month of June with a marginal increase of about three (3) basis points, while float income rates decreased by about eight (8) basis points during the same period. MSR portfolio holders should expect values to remain about the same level as they were at the end of May results. However, those levels could vary depending on portfolio vintages and other portfolio characteristics such as agency and GNMA mix. The downrate risk and its potential impact on MSR values continue to persist as we navigate through the balance of 2024.

MCTlive! Quarterly Release Notes in Q2 2024

Welcome to MCT’s Quarterly Release Notes! Described within relevant tabs, you’ll find a listing of our Q2 2024 technology developments. This update also includes technology release notes for MCT’s MSRlive! and Business Intelligence tools. Improvements span general platform maintenance, feature and function enhancements, and entirely new development. Should you have questions or comments about our latest releases, please reach out to your MCT representative.

![MSR 101: Reviewing MSR Principles, Advantages & Disadvantages, & Key Portfolio Valuation Drivers [MCT Industry Webinar]](https://mct-trading.com/wp-content/uploads/2024/12/MCT-Lender-Price-MSR-Webinar-Title-Slide-400x250.png)