Weekly Technology Improvement Series:

Data “Writeback” in MCTlive!

Published 9/24/2021

Looking to conduct your “write backs” from the MCTlive! platform?

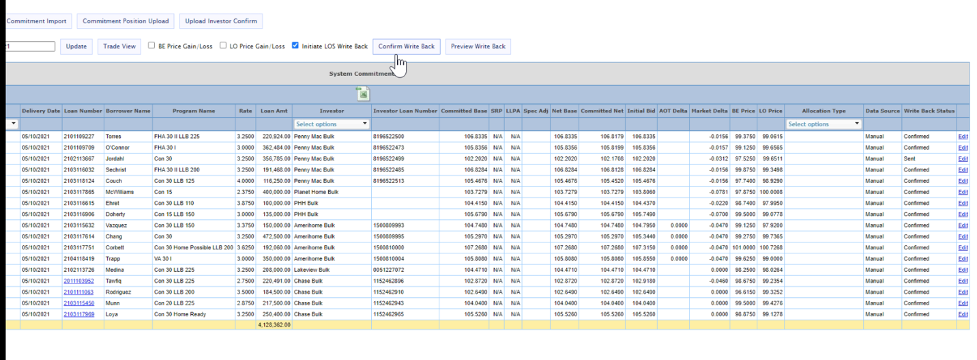

Our Commitment Tracker Tab confirms come in via API or are uploaded by investors.

All that information is organized and displayed on a loan level in the commitment tracker.

You can initiate, preview, and confirm data write back to your LOS.

We conduct error checking to catch things such as duplicate sends or missing data to prevent mistakes.

Differentiators MCTlive! has that others may not include: populating custom fields, doing custom calculation and doing write backs at the loan-level rather than the trade-level.

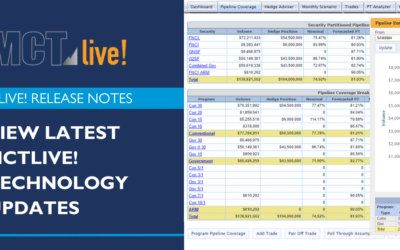

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

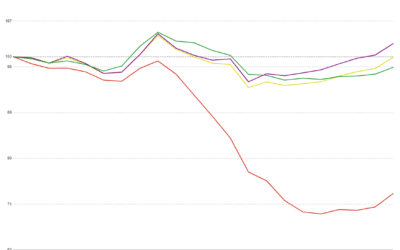

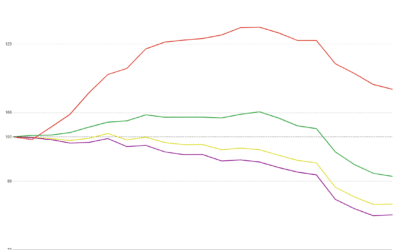

Spec Durations in MCTlive! Explained

In this video, MCT’s Andrew Rhodes, Senior Director, Head of Trading, discusses spec duration within MCTlive!, why it is important to mortgage lenders, and how spec duration helps lenders hedge their position with various spec stories.

Mortgage Lock Volume Stays Flat in Latest MCT February Indices

Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced today a 0.12% decrease in mortgage lock volume compared to the previous month.

MSR Market Monthly Update – February 2025

The Fed has decided not to cut the overnight rate in its recent FOMC meeting and has announced that it will pause further rate changes until the new administration presents its economic policies. Such measure was expected by the financial markets. The 10 Years Treasury rate has remained around its highest level in over a year at around 4.50% since the Fed’s December FOMC meeting.

MCT Receives HousingWire Tech100 Honors for 2025

MCT earns spot on HW Tech100 list, recognized for capital markets technology that generated $136M in additional lender earnings through advanced analytics and automation.

MCT’s AI Blueprint for the Future of Mortgage Capital Markets Technology

Learn how MCT is extending its legacy of innovation and technology stewardship by sharing its assessment of both the promise and the perils of this new revolutionary technology for the capital markets.

MCT Strengthens Integration with MeridianLink to Improve Secondary Marketing Processes for Mortgage Lenders

MCT and MeridianLink announce enhanced API integration for mortgage lenders, improving data flow speed and control while reducing origination costs through automated processes.

MCTlive! Quarterly Release Notes in Q4 2024

Described below within relevant tabs, you’ll find a listing of our Q4 2024 technology developments. This update also includes technology release notes for MCT’s MSRlive! and Business Intelligence tools.

MCT Client Webinar – Implementing AI in the MCTlive! Platform

Discover MCT’s strategic AI implementation journey and learn how they’re enhancing the MCTlive! platform while prioritizing data security and user experience.

MCT® Unveils MSRlive!® 4.0 — Offering Ground-Breaking Enhancements to MSR Reporting and Transparency

MCT launches MSRlive! 4.0, enhancing its MSR valuation platform with advanced portfolio analytics and transparency features, giving mortgage servicers deeper insights into valuation drivers and risk exposure.

MCT Reports 16% Decrease in Mortgage Lock Volume Amid Market Dynamics

Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced today a 16.7% decrease in mortgage lock volume compared to the previous month.