Weekly Technology Improvement Series:

Data “Writeback” in MCTlive!

Published 9/24/2021

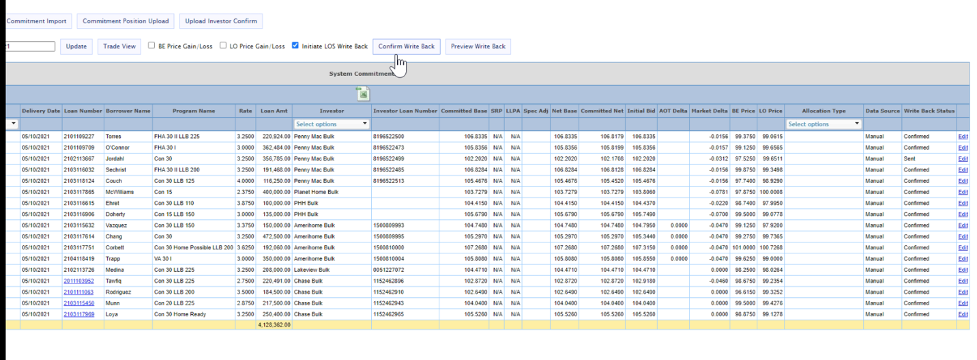

Looking to conduct your “write backs” from the MCTlive! platform?

Our Commitment Tracker Tab confirms come in via API or are uploaded by investors.

All that information is organized and displayed on a loan level in the commitment tracker.

You can initiate, preview, and confirm data write back to your LOS.

We conduct error checking to catch things such as duplicate sends or missing data to prevent mistakes.

Differentiators MCTlive! has that others may not include: populating custom fields, doing custom calculation and doing write backs at the loan-level rather than the trade-level.

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

Carry Opportunity: Strategy for Banks and Depositories

Current conditions in the MBS market have created an opportunity for depositories to take advantage of their low funding costs to pick up investment income. We encourage our bank and depository clients to consider using the approach outlined in this summary to take advantage of these current unusual conditions in mid-2019.

MCT Bolsters Executive Management Team with Addition of Leslie Winick as Chief Strategy Officer

SAN DIEGO, Calif., April 30, 2019 – MCT announced that Leslie Winick has joined the company as Chief Strategy Officer (CSO). In this newly created position, Ms. Winick will play an integral role in helping MCT hone its strategic direction, further increase market share, manage rapid growth, and delight clients.

MCT Reorganizes Sales Processes, Expands National Sales Team, and Forms Client Success Group

SAN DIEGO, Calif., April 16, 2019 – MCT today announced it has restructured the company’s internal sales processes, bolstered the sales team, and launched a Client Success Group (CSG).

Aggregated Structural Equations (ASE) Model: An Alternative View of Value and Risk – Part 2

In this issue we will determine the value and examine some risk scenarios with an actual MSR portfolio utilizing the ASE, consider some of the implications to managing MSR risk through hedging, and discuss how ASE can be used to gain a more precise and nuanced understanding of a portfolio’s underlying risks.

Aggregated Structural Equations (ASE) Model: An Alternative View of Value and Risk – Part 1

In this issue of Servicing Insights, we will describe our methodology of determining MSR values and quantifying and monitoring MSR risk. Our approach to modeling the different market interest rates is to statistically model a set of structural relationships between the interest rates, as well as other variables which cause them to change.

MCT’s CMO Ian Miller Designated a 2019 ‘Top 40 Most Influential Mortgage Professionals Under 40’ by NMP

SAN DIEGO, Calif., March 15, 2019 – Mortgage Capital Trading, Inc. (MCT) a leading mortgage hedge advisory and secondary marketing software firm, announced that its Chief Marketing Officer, Ian Miller, was recognized by National Mortgage Professional...

Webinar: Navigating the Waters of MSR Sales

Join webinar to learn how to determine which MSRs to sell, how to evaluate bids you receive, and tips for negotiating a contract. Topics will also include expected challenges, purchase terms, and timing of the sale.

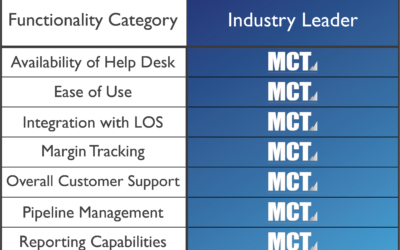

MCT Scores High Marks in Overall Satisfaction, Lender Loyalty, and Functionality Effectiveness According to Recent Study

SAN DIEGO, Calif., February 18, 2019 – Mortgage Capital Trading (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, announced that the 2018 STRATMOR Technology Insight Study rated MCT as the leader in overall satisfaction, lender loyalty,...

5 Strategies for Improving Profitability in the Current Market

Register and attend on February 20, 2019 at 11AM Pacific for actionable tactics that address both short and long-term profitability. The webinar will be moderated by Chris Anderson, CAO of MCT, and feature panelists James Deitch, CEO and Co-Founder of TeraVerde, and Bill Berliner, Director of Analytics at MCT.

First Bank Realizes Increased Profitability by Moving to Mandatory Loan Sales

Learn the details of how Andrew Stringer at First Bank leveraged MCTlive!, Bid Auction Manager (BAM), and Rapid Commit to improve loan sale pickup and operational efficiencies.