Weekly Technology Improvement Series:

Data “Writeback” in MCTlive!

Published 9/24/2021

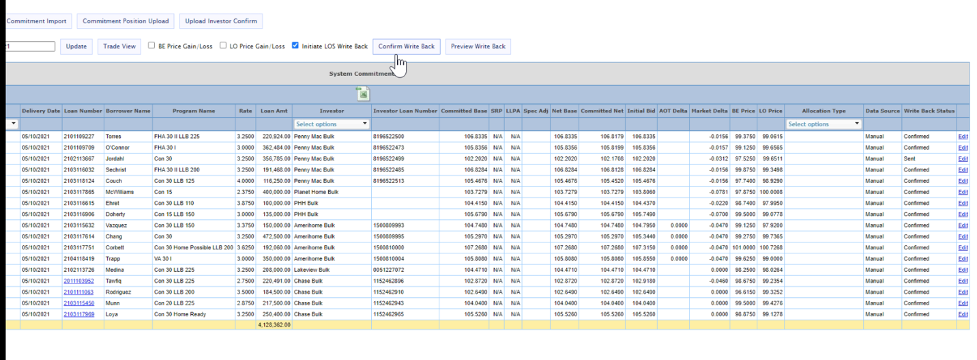

Looking to conduct your “write backs” from the MCTlive! platform?

Our Commitment Tracker Tab confirms come in via API or are uploaded by investors.

All that information is organized and displayed on a loan level in the commitment tracker.

You can initiate, preview, and confirm data write back to your LOS.

We conduct error checking to catch things such as duplicate sends or missing data to prevent mistakes.

Differentiators MCTlive! has that others may not include: populating custom fields, doing custom calculation and doing write backs at the loan-level rather than the trade-level.

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

5 Operational Best Practices for 2020 Market Volatility

COVID-19 has affected more than just people’s health; it has affected people’s ability to work and pay their mortgage. In this blog post, learn five best practices for secondary and operations managers to manage risk and succeed in times of market volatility.

Challenges & Solutions for Correspondent Lending in Crisis

Challenges & Solutions for Correspondent Lending in Crisis Challenges & Solutions for Correspondent Lending in Crisis View Webinar Recordings from April 8th and May 21st View Webinar Recordings from April 8th and May 21st In this post, we have included the...

Considerations for Increasing Best Efforts Lock Production

In this article, we will discuss how to adjust lock desk best practices to transition loan sales to Best Efforts during periods of market volatility. We will also provide some context to explain why switching to Best Efforts loan sales might be a necessity in some cases.

MCT Whitepaper: Lock Desk Centralization 101

Read MCT’s whitepaper Lock Centralization 101 to learn what operational changes to staff, procedures, and technology will need to be made in order to establish a centralized lock desk for your business.

HousingWire Names MCT® to 2020 Tech100 Mortgage List for Secondary Marketing Software Innovations

MCT was designated to HousingWire’s 2020 Mortgage Tech 100 list as one of the most innovative companies in the U.S housing economy as a result of multiple solutions and services it developed and successfully launched in 2019.

MCT Immediate Client Webinar – High Balance Executions

Join us for this immediate client webinar at 10:15AM PT as we discuss high balance executions.

MCT Webinar: Quarter-End Mark-to-Market Strategies for Market Volatility

View the recording from our webinar on March 31st at 11AM PT to learn more about the quarter-end Mark-to-Market reports, recent market events and MCT’s advocacy efforts during market volatility.

MCT Webinar: Coronavirus (COVID-19) Response Update

Join us Monday, March 23rd at 1:00PM PT for this client-exclusive webinar.

MCT Immediate Client Webinar: Reviewing Market Conditions, Coverage & Pull-Through

MCT’s Phil Rasori as he discusses the current market conditions. A review of current market conditions, managing and adjusting coverage, reviewing and anticipating potential fallout.

MCT Client Webinar: Fed Action & The Road Ahead

Join us Tuesday, March 17th at 11am PT for this client-exclusive webinar as we discuss recent market changes.