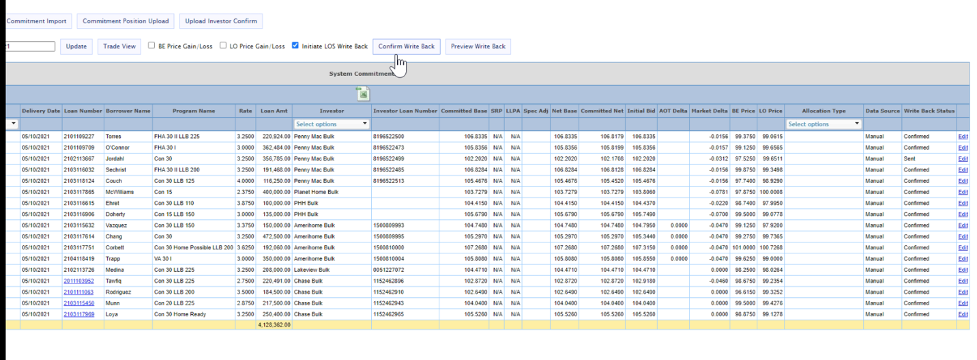

Weekly Technology Improvement Series:

Data “Writeback” in MCTlive!

Published 9/24/2021

Looking to conduct your “write backs” from the MCTlive! platform?

Our Commitment Tracker Tab confirms come in via API or are uploaded by investors.

All that information is organized and displayed on a loan level in the commitment tracker.

You can initiate, preview, and confirm data write back to your LOS.

We conduct error checking to catch things such as duplicate sends or missing data to prevent mistakes.

Differentiators MCTlive! has that others may not include: populating custom fields, doing custom calculation and doing write backs at the loan-level rather than the trade-level.

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

Pricing Granularity – Rasori’s Relentless Releases: Weekly Technology Improvement Series

In MCT’s latest Rasori’s Relentless Releases, we discuss new pricing granularity features in MCTlive!.

HousingWire Designates MCT’s Paul Yarbrough to Insiders Award List

Mortgage Capital Trading, Inc. (MCT®), an industry-leading mortgage hedge advisory firm, announced that Paul Yarbrough, Director of the Client Success Group, has been named to HousingWire’s Insider Awards list. The list is designed to honor an organization’s operational all-stars — those insiders who are the company’s best-kept secret, yet vital to its success.

The Future of Fannie Mae and Freddie Mac – A Conversation with Phil Rasori and Rob Chrisman

In this article, we sit down with Phil Rasori and Rob Chrisman to discuss the future of Fannie Mae and Freddie Mac with the impending appointment of a new FHFA director.

How The 10-Year U.S. Treasury Note Impacts Mortgage Rates

In this article, we examine the relationship between the 10-year U.S. Treasury yield and fixed mortgage rates.

Cash-Window APIs – Rasori’s Relentless Releases: Weekly Technology Improvement Series

In MCT’s sixth episode of Rasori’s Relentless Releases, Phil Rasori covers the January 14th proposal of volume caps on agency cash window deliveries, the features of the MCTlive! Pool Optimizer and also reviews a new comparison tool.

MCT Study of Digital RFQ Implementation

This report measures the change in phone use, productivity and TBA execution associated with the implementation of Agile Trading Technology’s RFQ platform (Agile RFQ). Complete the form to receive a copy of the report summarizing experiences of platform users.

A Credit Union’s Guide to Moving to Mandatory Loan Sale Delivery

Credit unions can leverage mandatory loan sale delivery to improve profitability and manage risk with pipeline hedging. This paper discusses that, as well as all the operational changes needed to move from best efforts to mandatory loan sales.

MCT & Freddie Mac Webinar | Selling Guarantor: Ensuring a Successful Transition

In this webinar, Freddie Mac and MCT explore the execution, operations, and costs lenders should analyze when considering the move from Cash to Guarantor.

Mortgage Banker Announces Natalie Arshakian as 2021 Powerful Women of Mortgage Banking

MCT®’s Natalie Arshakian was announced as one of the 2021 Powerful Women of Mortgage Banking. Ms. Arshakian was selected for the Marketing Leader Award by a panel of industry leaders that viewed and voted on submissions before the final list was reviewed and confirmed by a committee.

NAMMBA Announces Partnership with MCT

MCT increases commitment to diversity to better serve today’s rapidly changing housing landscape.