Weekly Technology Improvement Series:

Data “Writeback” in MCTlive!

Published 9/24/2021

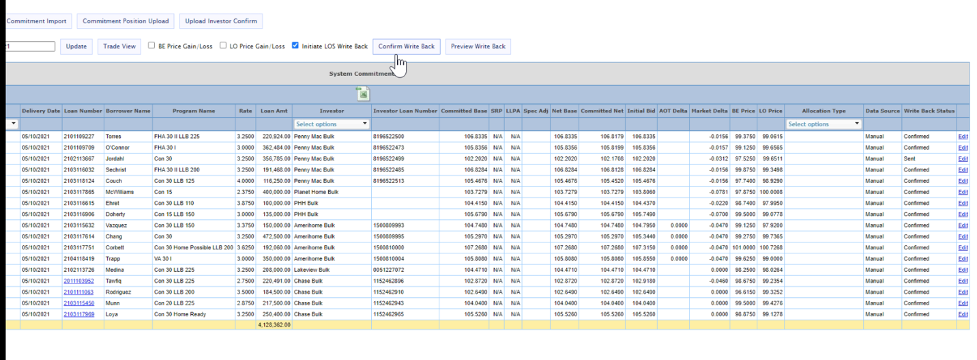

Looking to conduct your “write backs” from the MCTlive! platform?

Our Commitment Tracker Tab confirms come in via API or are uploaded by investors.

All that information is organized and displayed on a loan level in the commitment tracker.

You can initiate, preview, and confirm data write back to your LOS.

We conduct error checking to catch things such as duplicate sends or missing data to prevent mistakes.

Differentiators MCTlive! has that others may not include: populating custom fields, doing custom calculation and doing write backs at the loan-level rather than the trade-level.

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

Taper Tantrum 2: Mortgage Market Selloff Deja Vu?

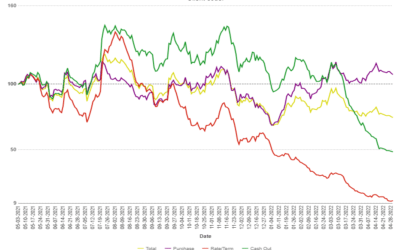

In this article, we will discuss the similarities and differences between the market selloffs in 2013 and 2022. 2022 has had the benefit of a much more orderly move and a healthier marketplace.

MCT Client Exclusive Webinar – Current Market Roll Costs and Their Effect on Loan Sale Execution

In this webinar, MCT’s Phil Rasori, Justin Grant and Andrew Rhodes discussed increased roll costs, the importance of a short commitment period at the time of loan sale, and both front and back end implications.

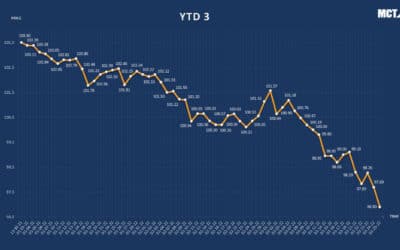

MCTlive! Lock Volume Indices: April 2022 Data

MCTlive! Mortgage Lock Volume Indices covers the period from April 1 through April 30, 2022, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.

Fannie Mae Purchase Advice API – Paul’s Tip of the Week

In Paul’s Tip of the Week, we look at how MCT completed the first integration to Fannie Mae’s new API for loan sale purchase advices.

Improve Profitability to Counter Market Headwinds | MCT Industry Webinar

In this webinar, MCT’s Phil Rasori, Justin Grant, and Andrew Rhodes explain how MCT is helping clients Bring BPS Back and improve profitability to counter market headwinds.

2022 HW Tech100 Mortgage Award Announces MCT as Leader in Innovation

MCT® was announced as a 2022 HousingWire Tech100 Mortgage Winner. The Tech100 Mortgage Award recognized the most innovative and impactful technology companies serving the mortgage industry and forever changing the home sales process.

MCT Whitepaper: The Links Between MBS Markets and Loan Pricing

In this whitepaper, we will explore the relationship between consumer loan pricing and capital market conditions to address common misconceptions and illustrate the processes involved in generating consumer loan offerings and intermediate loan prices.

Taper Tantrum 2? Comparing 2013 to 2022 & What Lenders Can Do | MCT Industry Webinar

In this webinar recording, MCT’s Phil Rasori, Justin Grant, and Andrew Rhodes will compare 2013 to 2022 in terms of the deteriorating market, market liquidity in specific coupons, loan sale execution liquidity, and investor pricing performance. They also share actionable recommendations to protect your business and pipeline.

Ben Itkin Assumes Sales Leadership Position at MCT as Sales Team Grows

MCT® announced that Ben Itkin has been appointed the new National Sales Director. Mr Itkin will leverage his hands-on experience from his previous senior role as Managing Director to now lead a larger overall investment in the MCT sales team.

Case Study: Atlantic Coast Mortgage Creates Seamless Selling Experience With Rapid Commit

In this case study, MCT sits down with John Collins to hear how the Rapid Commit integration has added efficiency to their loan selling process. Rapid Commit has also reduced the element of human error in putting together the commitments, saving them time, money, and headaches.