Weekly Technology Improvement Series:

Bid Tape Mapping for Non-Platform Tapes

Published 9/17/2021

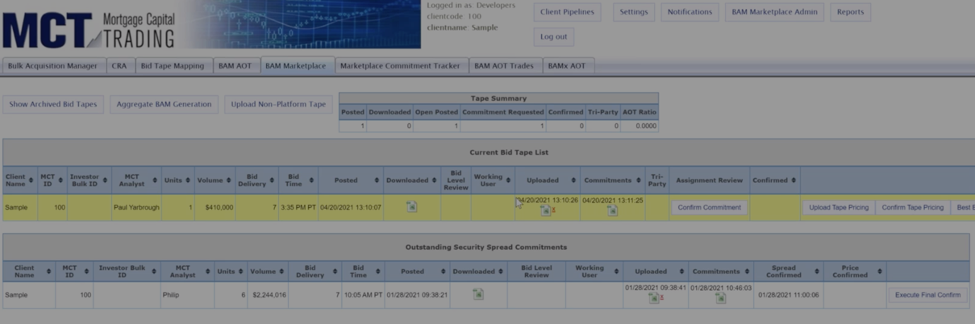

We aren’t naïve. Sellers use other services than ours, such as Resitrader, to sell loans.

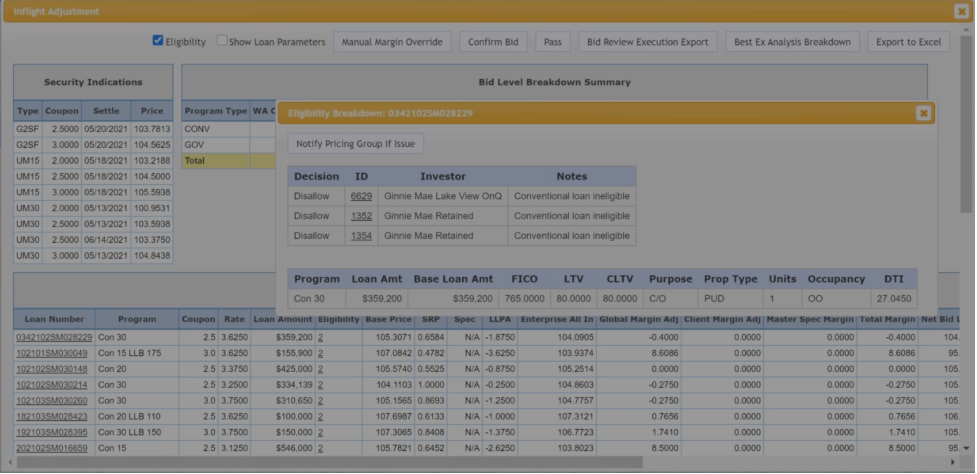

With our easy and robust tape mapping tool that includes eligibility breakdown, we map and normalize tapes for you.

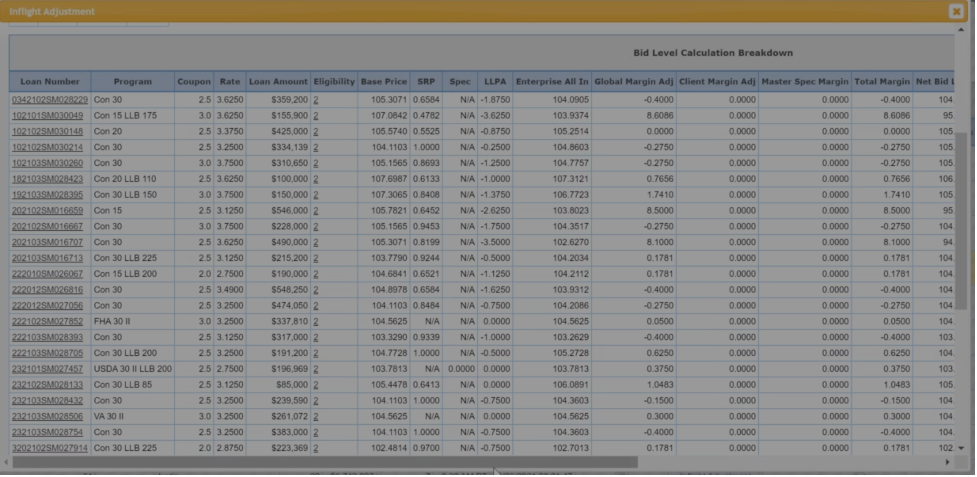

Pull rules that make a loan ineligible for a particular pricing institution. It is a quick and easy way to see eligibility that lets you get as granular as you like.

We also provide a pricing breakdown, which tells you exactly what you need to pay for a loan.

Autobid generates pricing once you hit a button, but you don’t actually need to hit a button.

You can employ Autoprice, which also has controls surrounding tape size, etc.

Price every loan without extra work, providing you with a massive time savings.

Have confidence in the ability to turn tapes without a secondary employee watching it all day.

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

MCT’s Chris Anderson Distinguished as a HousingWire 2024 Vanguard Award Recipient

MCT is proud to announce that its Chief Administrative Officer, Chris Anderson, has been selected as a recipient of HousingWire’s Vanguard Award for 2024.

MCT Reports a 3% Increase in Mortgage Lock Volume Backed by Increasing Refinance Activity

Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced today a 3.33% increase in mortgage lock volume compared to the previous month. Despite a larger increase in rate/term volume, total mortgage volume remains relatively flat.

MCT & Verity Webinar | Offshore Outsourcing, Is It Right for You?

In this webinar, MCT’s Ben Itkin is joined by Verity’s CEO, Sam Mehta, to discuss how mortgage lenders can successfully optimize margins while maintaining quality service and employee morale through strategic outsourcing, automation, and labor optimization.

Enhanced Retain-Release Extension for Best Ex. Analysis

We asked Natalie Martinez, MCT’s Manager of the MSR Services Department & Client Success, to sit down and provide insight into MCT’s enhanced retain-release analysis tool, Enhanced Best Execution (EBX). Watch the video below to see what Ms. Martinez has to say about EBX.

Patented Technology Allows Mortgage Buyers to Transact with Any Seller on MCT Marketplace

MCT Marketplace’s Patented Security Spread Commitment boosts execution, liquidity, and approval times in the secondary market, transforming loan auctions with executable prices.

Scale Your Correspondent Market Share with MCT Marketplace

Watch the video to hear what MCT’s Justin Grant, Senior Director, Head of Investor Services, has to say about MCT Marketplace.

MSR Market Monthly Update – August 2024

Click to read the most recent MSR Market Update! – The Fed’s recent announcement indicated no changes to the current Fed Funds rate, hence opening the possibility for a rate decline during their next meeting in September. It appears that the market has already built a 25 basis points decline in the mortgage offerings as we observe continuous easing in the 10 Year Treasury rate and the entire yield curve. As of July 31, 2024, the 30-year primary mortgage rate has retreated by 15 basis points while float income rates have declined by an average of about 45 basis points.

MCT Client Webinar – Major Rally Management

In this webinar, MCT’s Andrew Rhodes, Natalie Arshakian, and Paul Yarbrough provide information and guidance related to this week’s market rally.

MCT Reports a 6% Mortgage Lock Volume Decrease in Latest Report

Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced today a decrease of 5.67% in mortgage lock volume compared to the previous month. Industry professionals and enthusiasts are invited to download the complete report for comprehensive insights into the market dynamics.

MCT’s Andrew Rhodes Honored with HousingWire Insider Award for 2024

MCT is proud to announce that Andrew Rhodes, Senior Director, Head of Trading, has been designated to HousingWire’s 2024 Insider Awards list.