Weekly Technology Improvement Series:

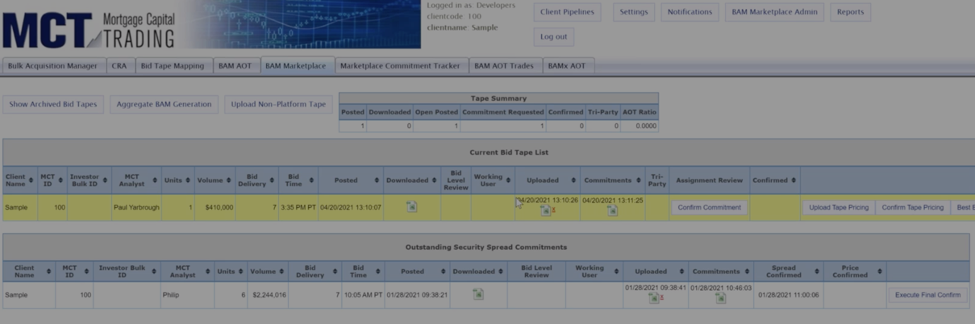

Bid Tape Mapping for Non-Platform Tapes

Published 9/17/2021

We aren’t naïve. Sellers use other services than ours, such as Resitrader, to sell loans.

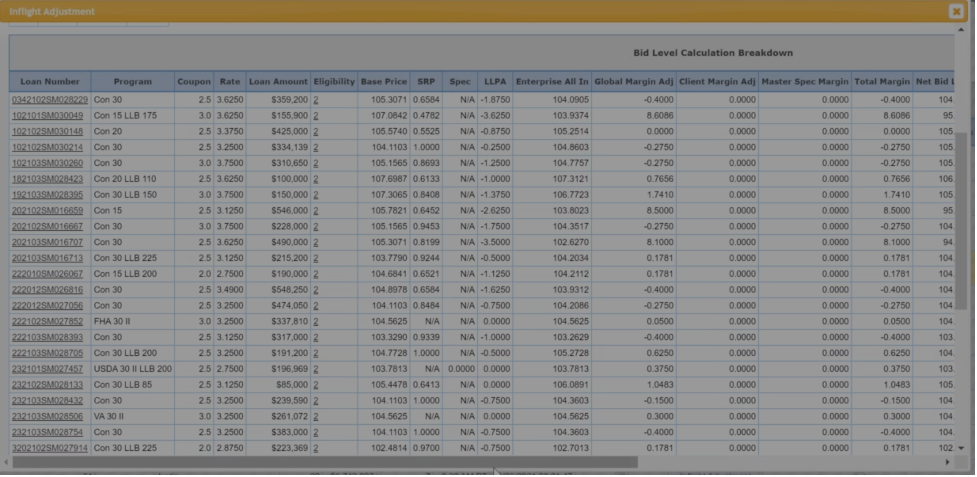

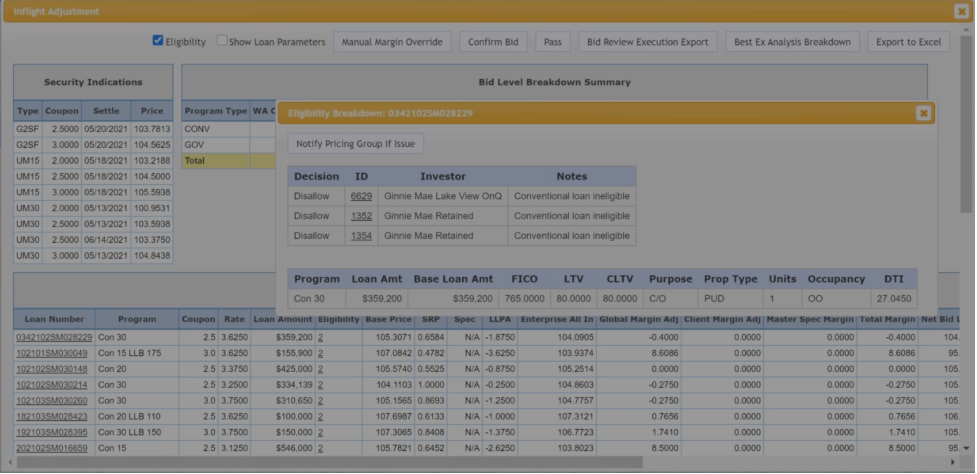

With our easy and robust tape mapping tool that includes eligibility breakdown, we map and normalize tapes for you.

Pull rules that make a loan ineligible for a particular pricing institution. It is a quick and easy way to see eligibility that lets you get as granular as you like.

We also provide a pricing breakdown, which tells you exactly what you need to pay for a loan.

Autobid generates pricing once you hit a button, but you don’t actually need to hit a button.

You can employ Autoprice, which also has controls surrounding tape size, etc.

Price every loan without extra work, providing you with a massive time savings.

Have confidence in the ability to turn tapes without a secondary employee watching it all day.

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

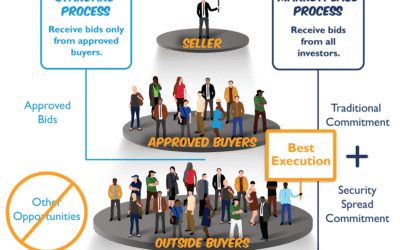

MCT Introduces MCT Marketplace, the First Truly Open Mortgage Loan Exchange

Mortgage Capital Trading®, Inc. (MCT), announced the public introduction of BAM MarketplaceTM. Originally launched to support existing MCT sellers during the 2020 pandemic liquidity crisis, BAM Marketplace now welcomes new buyers and sellers as the world’s first truly open loan exchange between unapproved counterparties.

MCT Industry Webinar: Introducing MCT Marketplace

Join us on June 9th at 10AM PT for a formal introduction to the platform, where we will discuss the process, features, and competitive benefits of the world’s first truly open loan exchange platform.

How Mortgage Loan Prices Are Determined by Lenders

In this article, we will provide a detailed explanation for how mortgage prices are determined, reviewing all the factors that influence mortgage lenders’ pricing decisions in the secondary mortgage market.

MCT Webinar: Strategies for Credit Unions to Add Value to Members

In collaboration with CUREN and MGIC, MCT will examine credit union’s process flow to identify potential improvements in areas such as secondary marketing, technology, automation, and business processes. The strategies explored in this webinar amount to over 50 basis points of potential improvement to margins based on the experiences of Credit Unions who have put them to use….

Case Study: Ruoff Mortgage Adds Efficiency with Rapid Commit & Fannie Mae

In this case study, Mr. Cassetta describes how MCT’s Rapid Commit enables him to sell loans to Fannie Mae five times faster than his previous manual process. His use of the tool also helps Ruoff keep up with periods of increased volume like increases seen during the Spring of 2020.

MCT’s Enhanced Best Execution (EBX) Technology Automates MSR Retain-Release Decisions

Mortgage Capital Trading®, Inc. (MCT), the leading mortgage hedge advisory and secondary marketing software firm, announced today their Enhanced Best-Execution (EBX) tool used for MSR retain-release decisions has now automated the function of pulling comprehensive data from MCTlive!® and MSRlive!.

How to Grow from a Mortgage Broker to Mortgage Banker

In this article, we will discuss the role of a broker versus banker and how a secondary market professional can make the transition from broker to banker most successfully.

Top 5 Takeaways for Bulk MSR Market: Q1 2021

With the first quarter over in 2021, the market for MSR sales is beginning to shift. Take a look below and review our Top 5 Takeaways for Bulk MSR Market.

How Does the Federal Reserve Affect Mortgage Rates?

In this article, we will discuss the structure of the Federal Reserve, how the Federal reserve supports the economy, and how it influences the demand of the three monetary policy tools.

2021 HW Tech100 Mortgage Award Announces MCT as Leader in Innovation

MCT® was announced as a 2021 HousingWire Tech100 Mortgage Winner. The Tech100 Mortgage Award recognized the most innovative and impactful technology companies serving the mortgage industry and forever changing the home sales process.