In this detailed article, we’ll discuss the benefits of using best execution with loan trading platforms and why they are now the standard for secondary marketing staff to achieve their goals while reducing risk for the company.

As the old saying goes “there are a lot of ways to skin a cat,” and the same can be said about execution for lenders in the secondary market. There is a lot of education and knowledge to be gained as the industry evolves. For example:

Some lenders will not engage in mandatory loan sales and “best execution” is not on their radar, and while others do best execution loan sales, but without a loan trading platform. Some are fully hedged, others are not.

Some lenders do not take out TBA commitments, and others don’t know about mandatory pickup, or what a short side position is and how to manage it. Using a loan trading platform is not just for the advanced user.

Our clients have found that, while execution varies greatly for a lender, best execution loan trading platforms can help with any scenario. It can truly be the differentiator of a lender who succeeds in capital markets, versus one that merely survives.

Related Articles on Best Execution:

- What is Best Execution in Loan Sales and Secondary Mortgage Market?

- What is the History of Best Execution?

From seamless data transfer, to greater information security, there are 7 main reasons why using a whole loan trading platform is beneficial to your business. It is not just the profitability, but the efficiency at scale that can make a huge difference on your bottom line.

Read through our top 7 benefits and the benefits only achievable with MCT Marketplace.

7 Benefits of Best Execution on Trading Platforms

For those of you who are not yet utilizing a best execution loan trading platform, you may be wondering how you are leaving profit on the table. Let’s review the functionality and benefits of best execution loan trading platforms including retrieving pricing data, prioritizing execution, security, and ease of use.

1. Seamless Pricing Data Retrieval

In best execution loan trading platforms, pricing data is retrieved through two-way LOS integrations, making it accurate and easy to set up, and all investors participating in the bulk bid tape channel have adopted the technology, with some investors even managing all their seller bid tapes and associated pricing through MCT Marketplace.

Bid tapes are managed by our clients through one-click secure distribution, collection, and analysis of bid tapes with approved bid tape investors. Additionally, anonymized shadow bidding functionality, dubbed AutoShadow, helps lenders explore potential pickup with unapproved investors, and determine whether to start a conversation.

2. Prioritizing Execution for Increased Pickup

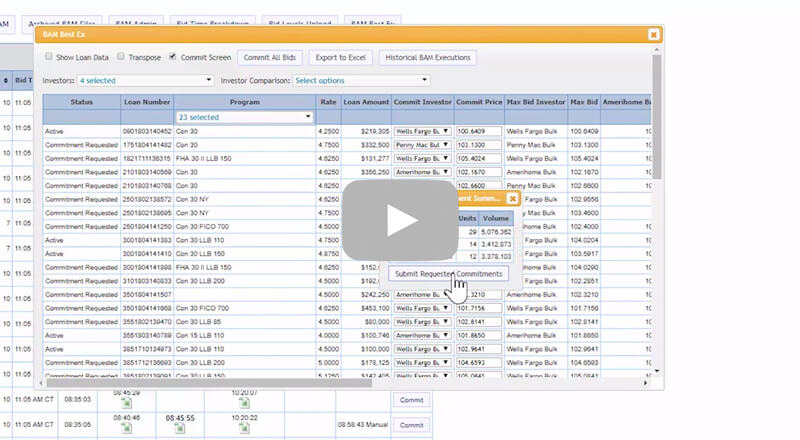

Best execution loan trading platforms allow secondary staff to review or export a prioritized list of possible executions, commit to investors, and receive confirmations. Most importantly, rapid market-adjusted pricing increases speed and organization of the entire pricing process, especially for large bulk bid tapes.

Market timed data means there is no delay in information, and both the position and the pipeline are live. Every spec payup is captured thanks to CRA eligibility scrubbing and the trade desk’s watchful eye. Once the loan is committed, commitment data write-back automates commitment information back into your LOS, saving time and avoiding data entry errors.

3. Greater Information Security

Nonpublic Personal Information (NPI) found in bid tapes is secured in transit and at rest, and never transmitted via email. Communication is centralized and bid tapes are encrypted so that they can be securely, seamlessly, and efficiently passed to investors for pricing and received back.

To ensure data integrity, the best execution loan trading platform accesses lender data via integrations that were developed with their loan origination systems (LOS), the core system of record for lending entities. Each of the transfer methods are data encrypted to ensure security at all times.

A historical repository exists in a central, organized location for counterparties to access bid tapes so there is no discrepancy in price upon delivery. The amount of time saved more than pays for the cost of the service or software, not to mention the protection of margins and the possibility to identify valuable new investors.

The result is a much quicker pricing process for bulk bid tapes, greater data security, better communication between counterparties, process consistency for investors within their existing platform, and newfound efficiencies for traders.

4. Ease of Use Saves Time

Bid tapes can be generated by lenders with the click of a button, sent to multiple investors with another, compared apples-to-apples upon submission, committed and recorded in the system of record automatically, all with up-to-the-minute pricing and an encyclopedia of live reports providing color for the pricing and execution of the files and the overall position to go with it.

Live pricing means lenders can see bids coming in the moment an investor submits, can see their position, and can add coverage or sell loans accordingly right in the system with instant feedback.

In addition, bid tape mark-to-markets (aka, AutoMark) allow MCT to obtain live bid tape pricing from key investors to improve the accuracy of MTM’s. Without this, there has been an increasing divergence between the rate sheet pricing typically used for MTM and the more granular bid tape execution lenders actually achieve, often causing accounting issues.

5. Empowering Staff for Greater Performance

While the speed of execution has drastically increased, best execution trading platforms enable a small secondary staff to do more, freeing up team members for more impactful analysis and strategy. The platform provides a “soup to nuts” solution on the secondary side with short position and long position, adding a lot of transparency and increasing the speed of the selling process.

Turning over routine tasks to a trading platform allows existing staff to be utilized in other areas such as analyzing new investors, working with originators, further improving capital markets functions and/or improving inter-department communication by creating customized management reports. Additionally, special, executive-tailored reporting allows owners or executives to easily track interest areas without digging through a myriad of reports.

6. Secondary Managers Love the Technology

Secondary Marketing Managers using whole loan trading technology love it because they are now able to send bid tapes to dozens of places easily, truly creating a best execution marketplace instead of dealing with the usual four or five investors. By connecting lenders and investors in real-time, and automating what used to be a manual, email-based trading process, the operation becomes incredibly scalable while also increasing transparency.

Originators can connect with new investors almost instantly and accelerate the traditionally protracted, difficult shadow bidding process, so what used to take weeks is now accomplished in seconds by clicking on someone’s name to view their pricing, and all latency that occurs with the manual process is eliminated. Lenders can now work around multiple inconvenient investor formats and processes.

7. Investors Love the Technology

Investors love the technology because tape formats are homogeneous and friction from miscommunication or data entry errors is eliminated. They can parse out data and price loans quickly, and loans are delivered with ease as the solution automates the process of packaging and transferring bulk loan bids.

Data is also more accurate, benefiting everyone because it saves time and also prevents “no bids” coming back. In some cases, automating the commitment process allows post-closers to pull the report and ship files faster, allowing lenders to bid out on a 7-day delivery instead of a 15-day delivery.

Best Execution Features Unique to MCT Marketplace

When searching for a competitive edge in the digitized secondary market, it’s important to realize that there are features that are unique to MCT Marketplace not offered by other competitors. This is due to MCT’s role as the innovator of the whole loan trading process. The following characteristics make all the difference in a best execution loan trading platform.

MCT Marketplace Only Offers:

- New executions quickly and conveniently (including bid tape AOT’s)

- Automated tri-party agreements for AOT transactions

- All agency API’s as soon as they are available

- Accurate MTM’s through bid tape indicative pricing through AutoMark program

- AutoShadow automated investor pricing exploration tool

- Investor set optimization via iMarket Monthly Reviews

- Peer benchmarking through the iMarket report set

- Geocoding of borrower addresses in bid tapes for increased security

- No external/email NPI data transfer

Lenders using MCT Marketplace find that bid tapes are more easily sent to a full set of investors more often rather than just the top tier, resulting in a surprising pickup in some cases. 2+ hours are saved by lenders on average per loan sale.

5 bps Savings on the Bid-ask Spread

With the automation of bid tape AOT, it is more about efficiency gains, making these formerly cumbersome executions more practical, allowing lenders to achieve the approximate 5 bps savings on the bid-ask spread. MCT assigned over 26,000 trades in 2019 resulting in an average savings of $80k per client!

Watch MCT Marketplace Demo Video

As the secondary market continues the pathway to complete automation, it’s clear to see that MCT’s trailblazing team will continue to lead the conversation about what is to be expected in the next stage of our industry’s advancement.

“Using MCT Marketplace saves us 2 to 4 hours every time we do loan sales. The convenience of communication and analysis has encouraged us to send bid tapes to our full set of investors more often rather than just the top-tier, resulting in a surprising pickup in some cases. We used to bid out on a 15-day delivery, but now we’ve reduced that to 7-days. Working with MCT, I feel like we’re in this together —reducing risk and achieving best execution.” – Timothy Ieyoub, SVP of Capital Markets at Eustis Mortgage.

Get Ahead of the Competition with MCT Marketplace!

For both lenders and investors, a best execution trading platform is a win for all involved. Accuracy and reliability are increased with less time spent, pricing and execution are more timely, and the staff can dedicate their resources to strategy and analysis. Contact us below or learn more about MCT Marketplace.

As the digitization of the mortgage marketplace continues, the case for making the transition to a digital whole loan trading platform has intensified. The increased efficiency, autonomy, reduction of risk, and pickup to the bottom line all justify making the switch.

As you continue your exploration of whole loan trading, remember that only MCT Marketplace can offer the seamlessness of agency API’s, geocoding, AutoMark, and Autoshadow which achieve better execution without sacrificing efficiency, as bid-ask savings and cash flow advantages are provided while preserving the pricing granularity and accuracy.

Interested in reaping the benefits of our platform? Contact us for a demonstration of MCT Marketplace.

Lenders seeking to learn more can view the following related articles:

- Case Study: Mountain West Financial Increases Efficiency & Improves Margins with MCTlive!

- Case Study: Eustis Mortgage Upgrades Loan Sales Process with MCT Marketplace

- MCT Marketplace Webinar

- New Bid Tape AOT Executions Explained (Webinar Recap)

- MCT Wins PROGRESS in Lending Association’s 2018 Innovation Award for its New MCT Marketplace Whole Loan Trading Technology

- MCT Whitepaper: 15 Strategies for Lenders to Improve Profitability