Weekly Technology Improvement Series:

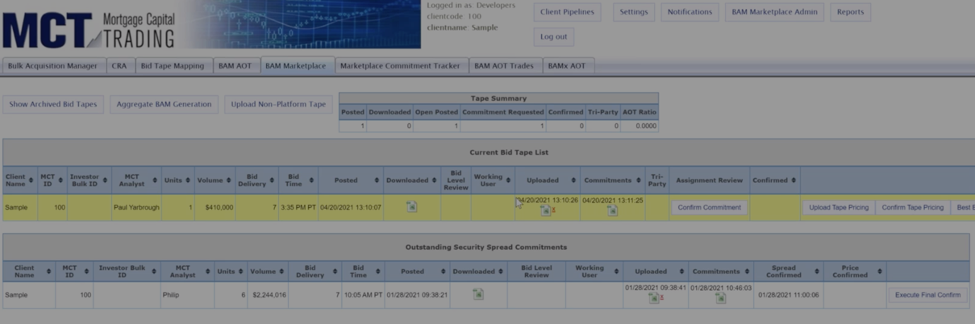

Bid Tape Mapping for Non-Platform Tapes

Published 9/17/2021

We aren’t naïve. Sellers use other services than ours, such as Resitrader, to sell loans.

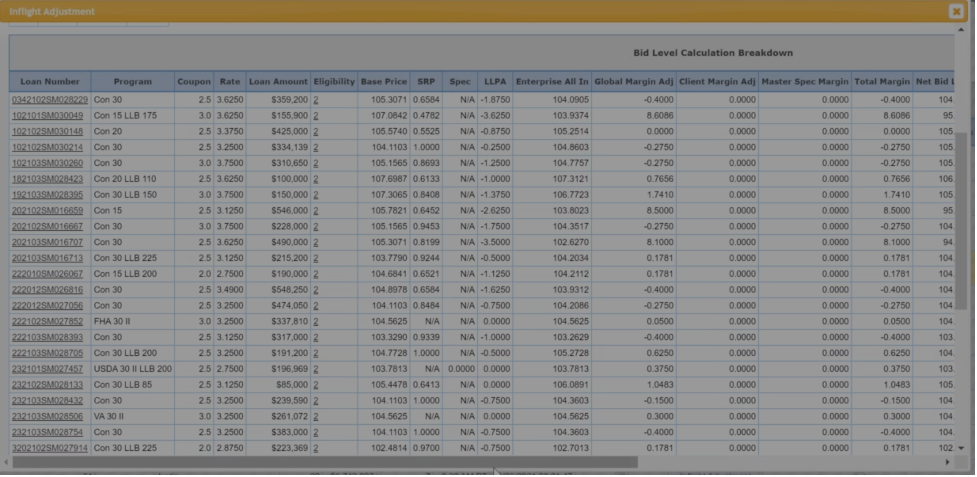

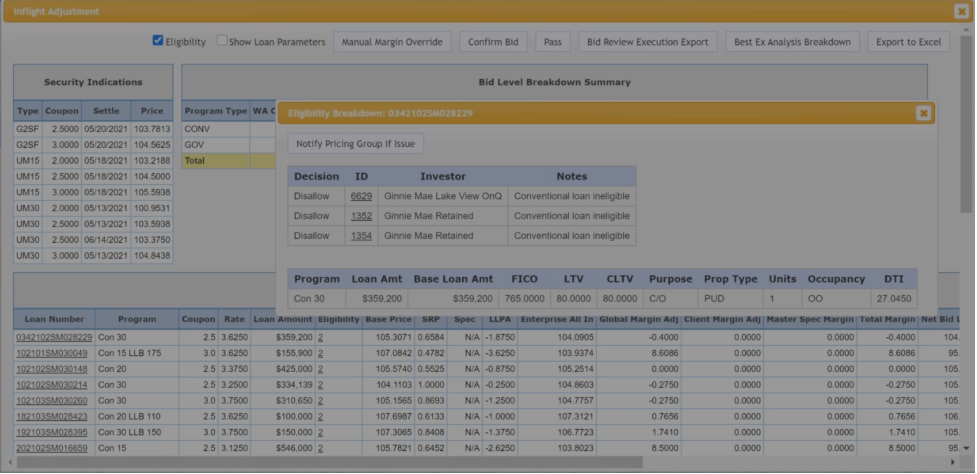

With our easy and robust tape mapping tool that includes eligibility breakdown, we map and normalize tapes for you.

Pull rules that make a loan ineligible for a particular pricing institution. It is a quick and easy way to see eligibility that lets you get as granular as you like.

We also provide a pricing breakdown, which tells you exactly what you need to pay for a loan.

Autobid generates pricing once you hit a button, but you don’t actually need to hit a button.

You can employ Autoprice, which also has controls surrounding tape size, etc.

Price every loan without extra work, providing you with a massive time savings.

Have confidence in the ability to turn tapes without a secondary employee watching it all day.

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

HousingWire Announces Ian Miller as 2021 Marketing Leader

MCT®’s CMO Ian Miller, was announced as a 2021 HousingWire Marketing Leader Award Recipient. Mr. Miller was selected for the Marketing Leader Award by a panel of industry leaders that viewed and voted on submissions before the final list was reviewed and confirmed by a committee of HousingWire editors.

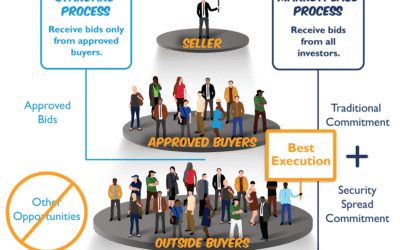

MCT Whitepaper: Why Your Loan Sale Process is Holding You Back

In this whitepaper, we will explain the main features and functionalities of BAM Marketplace, giving an in-detail comparison between the standard loan sale process and the upgraded workflow of an open loan exchange. We hope that this paper will effectively highlight the opportunity costs a lender offsets by utilizing this revolutionary secondary market technology.

Case Study: On Q Financial Grows Correspondent Channel Through MCT Marketplace

In this case study, On Q Financial’s VP of Margin Management, Angela Wooldridge, documents how the company used MCT’s newly-released BAM Marketplace loan exchange to launch and grow its correspondent channel. On Q also utilizes MCT’s Security Spread Commitment and AutoBid technology which has helped to give buyers on the platform unparalleled access to new sellers.

Case Study: Homestar Financial Corporation Improves Performance With Business Intelligence Platform

In this case study, Mr. Miles explains how he is leveraging MCT’s Business Intelligence Platform software to glean impactful insights into rates, pricing, and the industry.

Case Study: Alpha Mortgage Gains a Competitive Edge with MCT Marketplace

In this case study, Mr. Collins describes how MCT’s BAM Marketplace enabled him to decrease his average approval times with buyers and achieve an impressive pickup on committed loan volume while delivering via mandatory executions.

HousingWire & MCT Webinar – Unlocking Profitability: How To Navigate Secondary Marketing Challenges

The loan sale process has contributed to recent challenges in the secondary market. An open loan exchange mitigates risk and unlocks profitability. In this webinar, MCT’s Phil Rasori and Justin Grant, as well as OnQ Financial’s Angela Wooldridge and Alpha Mortgage’s Genesis Collins reviewed bidding regardless of approval status, mitigating risk, and increasing profitability.

MCT Webinar: Building a Correspondent Channel with MCT Marketplace

View the recording from Wednesday, June 23rd at 10AM PT as we conduct an in-depth review of buyer features and benefits of the platform, including a demonstration of MCT’s AutoBidTM.

MCT Introduces MCT Marketplace, the First Truly Open Mortgage Loan Exchange

Mortgage Capital Trading®, Inc. (MCT), announced the public introduction of BAM MarketplaceTM. Originally launched to support existing MCT sellers during the 2020 pandemic liquidity crisis, BAM Marketplace now welcomes new buyers and sellers as the world’s first truly open loan exchange between unapproved counterparties.

MCT Industry Webinar: Introducing MCT Marketplace

Join us on June 9th at 10AM PT for a formal introduction to the platform, where we will discuss the process, features, and competitive benefits of the world’s first truly open loan exchange platform.

How Mortgage Loan Prices Are Determined by Lenders

In this article, we will provide a detailed explanation for how mortgage prices are determined, reviewing all the factors that influence mortgage lenders’ pricing decisions in the secondary mortgage market.