Weekly Technology Improvement Series:

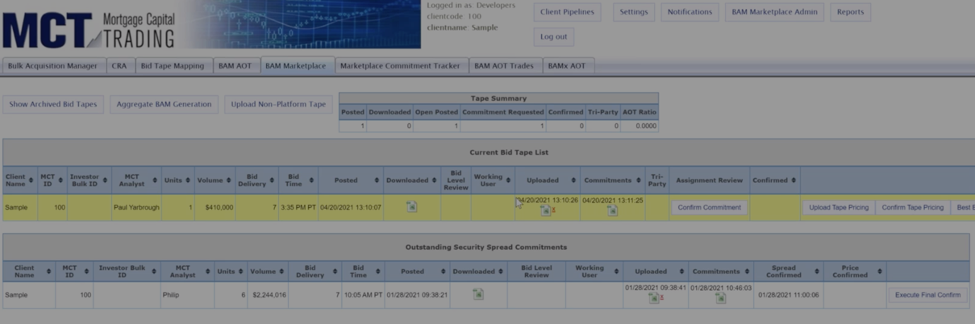

Bid Tape Mapping for Non-Platform Tapes

Published 9/17/2021

We aren’t naïve. Sellers use other services than ours, such as Resitrader, to sell loans.

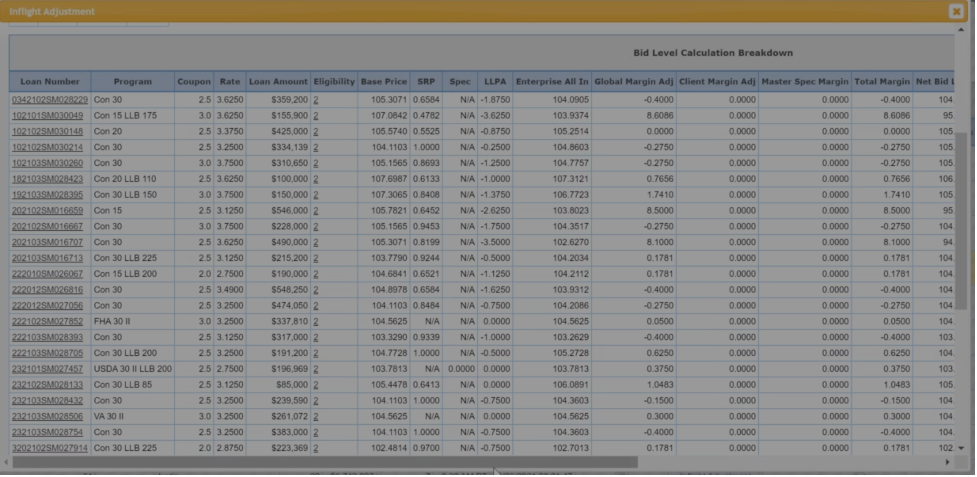

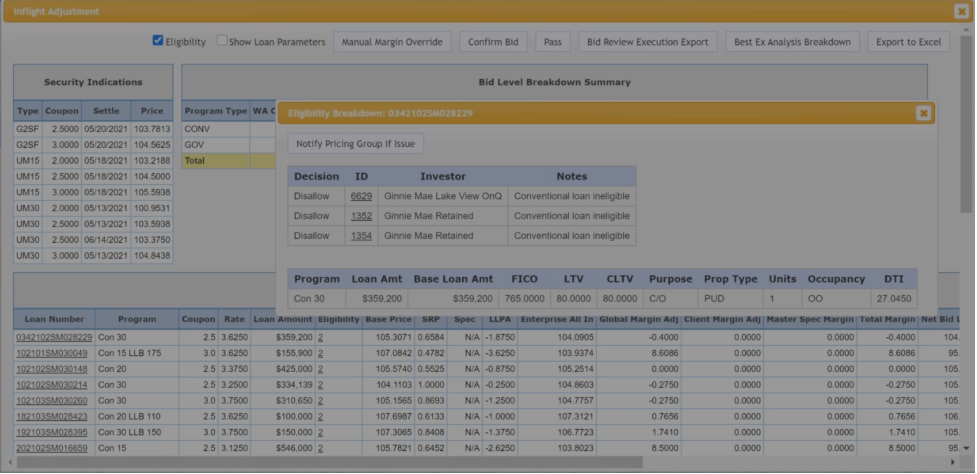

With our easy and robust tape mapping tool that includes eligibility breakdown, we map and normalize tapes for you.

Pull rules that make a loan ineligible for a particular pricing institution. It is a quick and easy way to see eligibility that lets you get as granular as you like.

We also provide a pricing breakdown, which tells you exactly what you need to pay for a loan.

Autobid generates pricing once you hit a button, but you don’t actually need to hit a button.

You can employ Autoprice, which also has controls surrounding tape size, etc.

Price every loan without extra work, providing you with a massive time savings.

Have confidence in the ability to turn tapes without a secondary employee watching it all day.

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

How An Investor Can Offset Declining Volumes in a Rising Rate Environment

Buying in a rising rate environment can be difficult to maneuver, especially when volumes are declining and margins remain pressured. Strategy is of the utmost importance so ensuring you are leveraging the newest technologies available is key to bidding in a smart and efficient way so as to maximize your potential. In this post, we will review strategies for how investors can maximize their market share in a rising rate environment.

The MCT Review: Market Commentary Week of February 22

We’ve seen lighter supply thanks to the Russia/Ukraine headlines. The market has ultimately gained ground with FNCL 3.0s starting at 100-06+ and closing at 100-15. We did see some negative reprices, then the Russia/Ukraine headlines moved the bond market higher into lower yields and that brought better reprices. We currently have FNCL 3.0s at a lower closing level so don’t expect much.

“Can’t Go” and “Must Go” Investors – Paul’s Tip of the Week

In Paul’s Tip of the Week, we look at how through custom eligibility and ready for sale identification a user can streamline their best ex in MCTlive!

MCT Whitepaper: Understanding and Preparing for Changes in the Mortgage Market

The mortgage origination space is one of the most cyclical industries in the U.S. economy. Interest rates, origination volume, and profit margins are constantly shifting based on a variety of factors, and it takes an efficient and intelligent operation to stay on top of it all. Most lenders react, rather than act, to week by week or month by month changes in the environment. We advocate acting decisively and in a calculated fashion. This paper will outline a simplified model illustrating mortgage market stages and how lenders can set a foundation of resilience to changing markets.

Top Metrics Every Investor Should Know

During times of rising rates and dropping loan originations, investors must consider additional strategies to ensure they’re reaching their market share goals. To do this, MCT’s InvestorMatic Analytics reporting tool is helping investors dissect their purchasing strategies to find hidden opportunities. In this post, we review top metrics from a sample report available to our clients. To receive the full sample report! please contact us today!

MCT Webinar – Staying Prepared in a Changing Mortgage Market

In this webinar, MCT’s COO, Phil Rasori, will team up with MBA’s Chief Economist, Mike Fratantoni, to discuss how lenders can stay on top of changing market cycles in 2022.

MCT Client Webinar – MSR Asset Overview

In this webinar, MCT’s Azad Rafat and David Burruss will discuss key MSR value drivers, MSR accounting methods and how the MSR life cycle effects your balance sheet.

Dealer Exposure and Volume Limits – Paul’s Tip of the Week

In Paul’s Tip of the Week, we look at MTM and Volume limits for clients working with dealers in MCTlive!

MCT Client Exclusive Webinar – Market Volatility & FHFA Announcements

In this webinar, MCT’s Phil Rasori and Andrew Rhodes discuss recent FHFA announcements, front-end pricing, monetary policy expectations and recent market volatility.

MPA Magazine Names Danyel Shipley on List of Elite Women for 2021

Danyel Shipley has been designated to Mortgage Professional America (MPA) magazine’s list of Elite Women in Mortgage for 2021. The annual awards recognize successful women who are raising the bar on gender equality within the industry, making significant contributions, advancing their companies, and are consummate experts in their respective fields.