Weekly Technology Improvement Series:

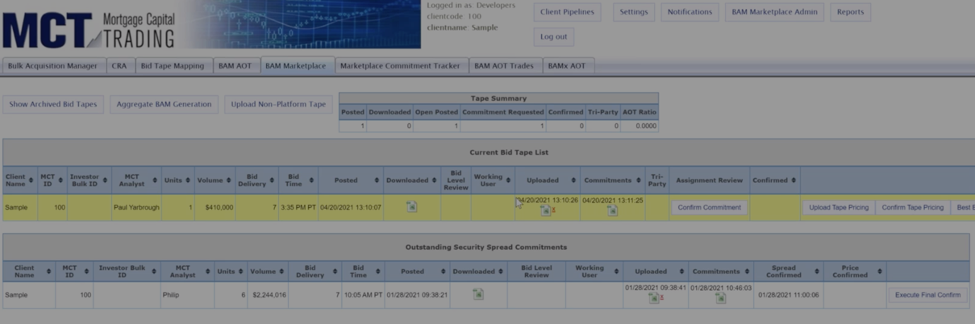

Bid Tape Mapping for Non-Platform Tapes

Published 9/17/2021

We aren’t naïve. Sellers use other services than ours, such as Resitrader, to sell loans.

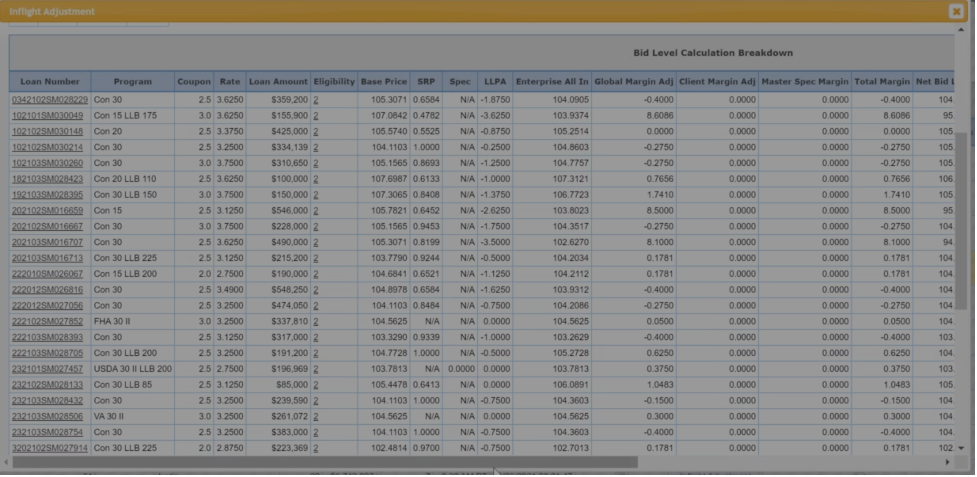

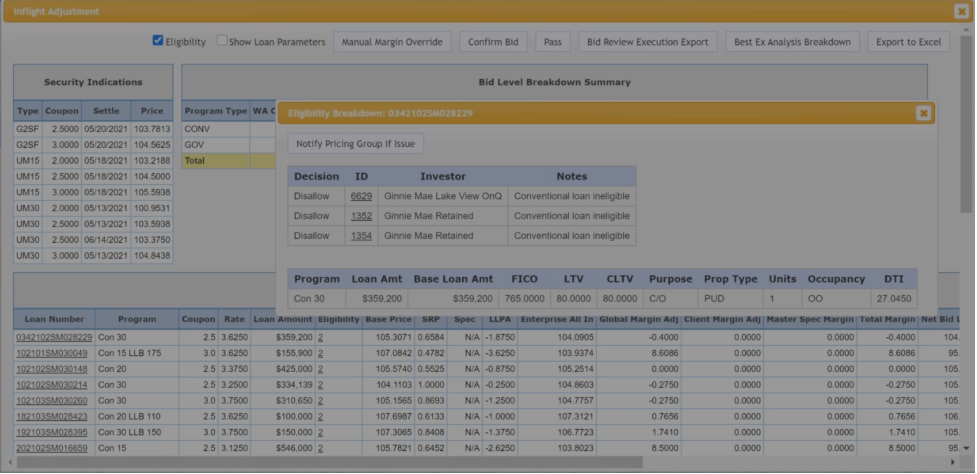

With our easy and robust tape mapping tool that includes eligibility breakdown, we map and normalize tapes for you.

Pull rules that make a loan ineligible for a particular pricing institution. It is a quick and easy way to see eligibility that lets you get as granular as you like.

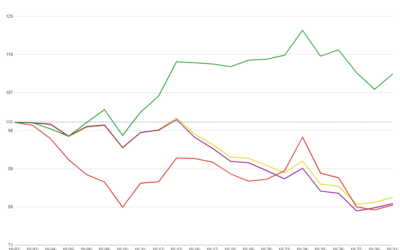

We also provide a pricing breakdown, which tells you exactly what you need to pay for a loan.

Autobid generates pricing once you hit a button, but you don’t actually need to hit a button.

You can employ Autoprice, which also has controls surrounding tape size, etc.

Price every loan without extra work, providing you with a massive time savings.

Have confidence in the ability to turn tapes without a secondary employee watching it all day.

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

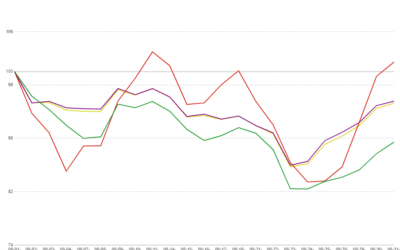

MCT Webinar: The Great Inflation vs. 2024: Analysis & New Tools for the Current Market

In this webinar, Phil Rasori and Andrew Rhodes will share analysis on the current market, comparison to relevant historical precedent, and new MCT software functionality to equip lenders in this challenging market.

Mortgage Volume Continues Downward Trend in Latest MCT November Indices Report

Mortgage Capital Trading, Inc. (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, reported today a drop of 17.76% in mortgage lock volume over the prior month. Complete the form to download the full report.

MCT’s Cara Krause Honored with the Powerful Women of Mortgage Banking Award by Mortgage Banker Magazine

– Mortgage Capital Trading, Inc. (MCT), the de facto leader in innovative mortgage capital markets technology, announced that Cara Krause, VP, Northeast Regional Sales, has been selected as one of the Powerful Women of Mortgage Banking 2023 by Mortgage Banker Magazine. The annual awards recognize successful women who are shattering the glass ceiling and making significant impact in the industry.

MCT Mortgage Industry Perspectives

What Gets You Through Down Cycles in the Mortgage Market? In this new MCT series, we are asking secondary market professionals topical questions you’re also probably pondering as well.

MCT Industry Webinar: Maximize Loan Trading Profits with MCT Marketplace

With limited mortgage volume, you need to make the most of every loan trade. MCT Marketplace is the largest mortgage asset exchange for the U.S. secondary market that is pushing the industry forward with new efficiencies and executions. View this webinar featuring MCT’s Phil Rasori, Paul Yarbrough, and Justin Grant for a practical guide to maximizing your loan trading profits.

High Rates & Low Supply Drag Down Mortgage Volume in MCT October Indices Report

MCTlive! Mortgage Lock Volume Indices covers the period from September 1 to September 30, 2023, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.

Mortgage Capital Trading Named Best Place to Work 2023 by SDBJ

Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced that it has been named one of the Best Places to Work 2023 by the San Diego Business Journal (SDBJ).

MCT and Freddie Mac Webinar: Current Economic and Housing Outlook, Affordable Lending Strategies and Technology Solutions

Complete the form to join Freddie Mac’s Ajita Atreya and Mia Jones, along with MCT’s Paul Yarbrough for this webinar on Thursday, October 5th, 10-11a.m. PT.

Mortgage Lock Volume Dips Slightly in Response to Rising Rates in September MCT Indices Report

MCTlive! Mortgage Lock Volume Indices covers the period from August 1 to August 31, 2023, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.

MCT Whitepaper: Optimizing Your Best Execution Loan Sale Analysis

Determining what execution is most efficient and profitable will have a big impact on the bottom line. This whitepaper reviews several key considerations to apply a strategic best execution analysis.