Weekly Technology Improvement Series:

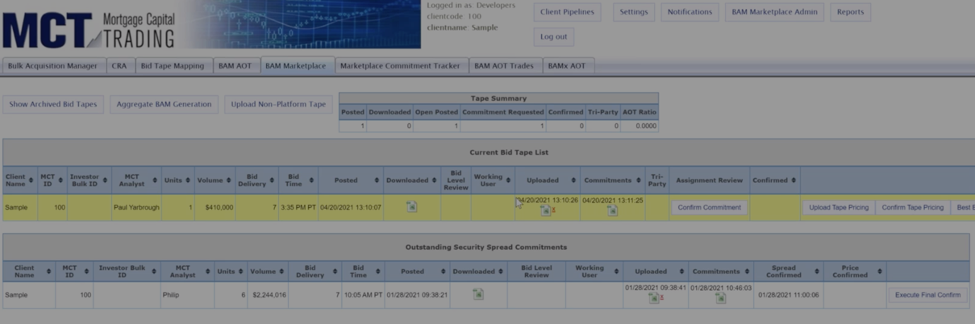

Bid Tape Mapping for Non-Platform Tapes

Published 9/17/2021

We aren’t naïve. Sellers use other services than ours, such as Resitrader, to sell loans.

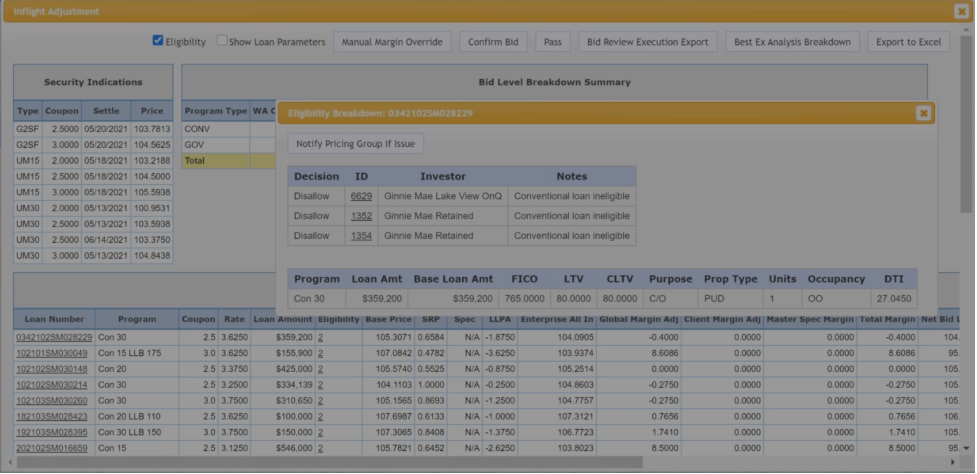

With our easy and robust tape mapping tool that includes eligibility breakdown, we map and normalize tapes for you.

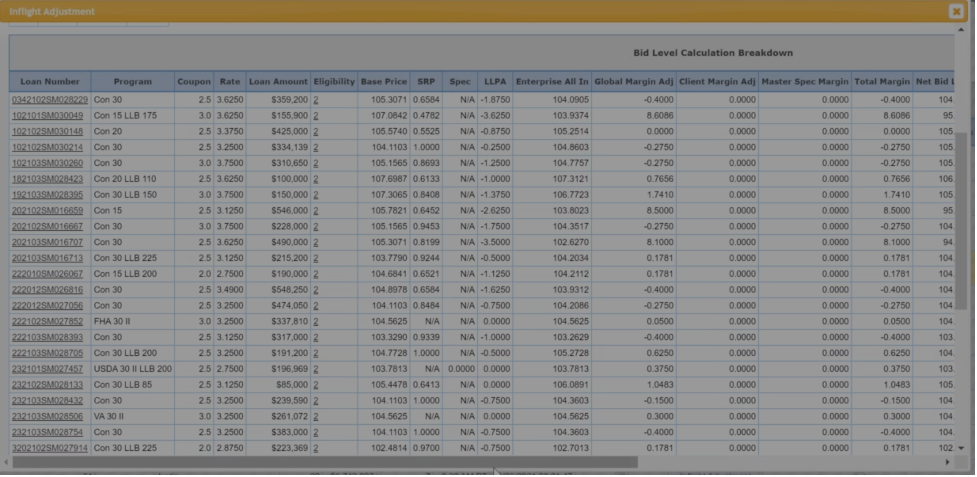

Pull rules that make a loan ineligible for a particular pricing institution. It is a quick and easy way to see eligibility that lets you get as granular as you like.

We also provide a pricing breakdown, which tells you exactly what you need to pay for a loan.

Autobid generates pricing once you hit a button, but you don’t actually need to hit a button.

You can employ Autoprice, which also has controls surrounding tape size, etc.

Price every loan without extra work, providing you with a massive time savings.

Have confidence in the ability to turn tapes without a secondary employee watching it all day.

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

MCT Reports a 2% Lock Volume Increase Despite Rising Rates

Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, today reported a 1.87% increase in mortgage lock volume compared to the previous month. To gain comprehensive insights into the market dynamics, industry professionals and enthusiasts are invited to download the complete report.

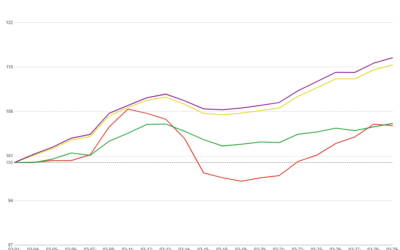

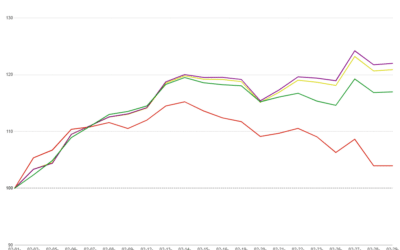

MSR Market Monthly Update – May 2024

Click to read the most recent MSR Market Update! – Mortgage rates and some rate indices have experienced a healthy recovery from their lows recorded at the end of February, closing the month of April with robust gains over their end of the year levels. Mortgage rates managed to end the month of April with an increase of about fifty-two (52) basis points, while float income rates have increased by an average of thirty (30) basis points since the end of March. MSR portfolio holders should expect a moderate value recovery in the range of two to six (2-6) basis points from the end of March. However, those increases will vary depending on portfolio vintages and other portfolio characteristics such as Agency and GNMA mix. The downrate risk and its potential impact on MSR values will persist as we navigate through 2024.

MCT Whitepaper: Duration and Convexity in Mortgage Pipeline Hedging

The intricate world of mortgage pipeline hedging demands a nuanced understanding of key concepts such as duration, convexity, and the interplay between various market dynamics. In this whitepaper, we dive into the importance of grasping these concepts to effectively navigate the complexities of mortgage markets.

MCT Launches Complete Best Execution, Now Including Fully Integrated Retain VS. Release MSR Decisioning

Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, proudly introduces a game-changing advancement. With this groundbreaking development, MCT’s Enhanced Best Execution (EBX) solution emerges as a real-time bridge between MCTlive! (live whole loan/SRP execution) and MSRlive! (loan level MSR valuation), revolutionizing the landscape of best execution strategies in the mortgage industry.

MCT Industry Webinar: Complete Best Execution – Now Including Fully Integrated Retain/Release MSR Decisioning

In this webinar, MCT will review the current state of the MSR market and discuss more comprehensive retain vs. release strategies, in addition to our recently introduced fully integrated Enhanced Best Execution (EBX) solution. MCT’s Paul Yarbrough will provide insights from a trader’s perspective regarding MSR best execution strategies at time of loan sale. He will also be highlighting MCT’s Rapid Commit technology and assignment of trade processes. This session will include a live demo of the EBX (MCTlive! and MSRlive!) integration, showcasing how EBX can effectively optimize your flow MSR trading process and decisions.

MCT Reports a 15% Lock Volume Increase Heading into Buying Season

Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced today an increase of 15.36% in mortgage lock volume compared to the previous month. To gain comprehensive insights into the market dynamics, industry professionals and enthusiasts are invited to download the complete report.

MCT’s Jennifer Kennelly, CMB®, AMP, Named 2024 Mortgage Lending Women of Inspiration by NMP

SAN DIEGO, CA, March 13, 2024– Jennifer Kennelly, CMB®, AMP, Senior Director of Investor Services, has been honored as one of the Mortgage Lending Women of Inspiration for 2024 by National Mortgage Professional magazine.

MCT Reports a 20.9% Increase in Mortgage Lock Volume Amidst Rising Rates

Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, has reported a 20.9% increase in mortgage lock volume in February compared to the previous month. To gain comprehensive insights into the market dynamics, industry professionals and enthusiasts are invited to download the complete report.

MCT Webinar – Moving to Mandatory Loan Sale Delivery – Part 2

In this webinar, MCT will discuss how lenders are leveraging mandatory loan sale delivery to improve profitability and manage risk with pipeline hedging. MCT will also review operational changes needed to move from best efforts to mandatory loan sales. Complete the form to join us on Thursday, April 4th at 11AM PT.

MCT Releases Custom TBA Indications to Provide Price Discovery for Illiquid Coupons

SAN DIEGO, Calif., Feb. 28, 2024 – Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, today announced the release of pricing indications for the to-be-announced mortgage-backed securities (TBAs) used by mortgage lenders to hedge their open mortgage pipelines.