Join us as we recap the most important information from this webinar on valuing your MSR portfolio in today’s market climate.

MCT specializes in delivering award-winning technology with industry leading expertise to educate our clients and partners.

This is a recap of the MSR webinar which occurred on Nov. 15, 2018.

As part of this initiative, we have recently released MSRlive! – mortgage servicing rights software to help MSR Portfolio Managers and mortgage banking professionals more efficiently build, optimize and manage their MSR portfolio.

To understand the features within MSRlive!, we outlined three market scenarios to analyze the effect on a sample portfolio.

Three market scenarios and their effect on an MSR portfolio:

- Base Case Scenario – Our base case scenario uses the current market with a relatively healthy economy and housing market, current rate levels and a sample portfolio.

- Market Scenario #1 – This scenario uses assumptions similar to the recession from 2008 – 2011.

- Market Scenario #2 – The second scenario analyzes the effect of an increase in disruption technology and the effects on your servicing portfolio.

About the Webinar – MSR Portfolio Valuation in Today’s Market

MSR portfolio valuation tools have evolved dramatically even in the last five years. As tools like MSRlive! continue to evolve, they can analyze bigger portfolios in a fraction of the time. These tools also make it easy to review detailed and accurate analysis of ‘what-if’ scenarios on your portfolio.

In this webinar recording and recap, you will see the effects of three market scenarios on a sample portfolio. These market scenarios include a base case scenario, a recession, and the effects of disruptive technology on your portfolio.

Speaker:

Phil Laren, Director of MSR Services at Mortgage Capital Trading

- Phil Laren has over 30 years of capital markets experience from top 5 originators and servicers. He also holds advanced degrees in statistics and econometrics.

Susi Schlenk, VP of MSR Services at Mortgage Capital Trading

- Susi Schlenk works with Phil on MSRlive! and has been vital in the development of the MSR Services team.

Host:

David Ring, Marketing Manager at Mortgage Capital Trading

- David Ring has an extensive marketing background and enjoys creative problem solving in a team environment.

View the Webinar Video Recording & Slide Deck

We hope you enjoy viewing the full webinar. You can also download the slide deck used in this presentation. For a summary of the questions answered in this webinar, please read on below this recording.

Learn More in Webinar Recap Below

Questions answered by this webinar:

- What assumptions will you use in the Base Case Scenario?

- How would the Base Case Scenario be input into MSRlive!?

- What is the result of the Base Case Scenario on Cash Flow?

- What assumptions will be used in the Market Recession Scenario?

- How detailed are assumptions in the Market Recession Scenario?

- What is the result of the Market Recession Scenario on cash flows?

- What assumptions will be used in the Disruptor Technology Scenario?

- What is the effect of Disruptor Technology on the sample portfolio?

- How does the recapture rate affect the sample portfolio?

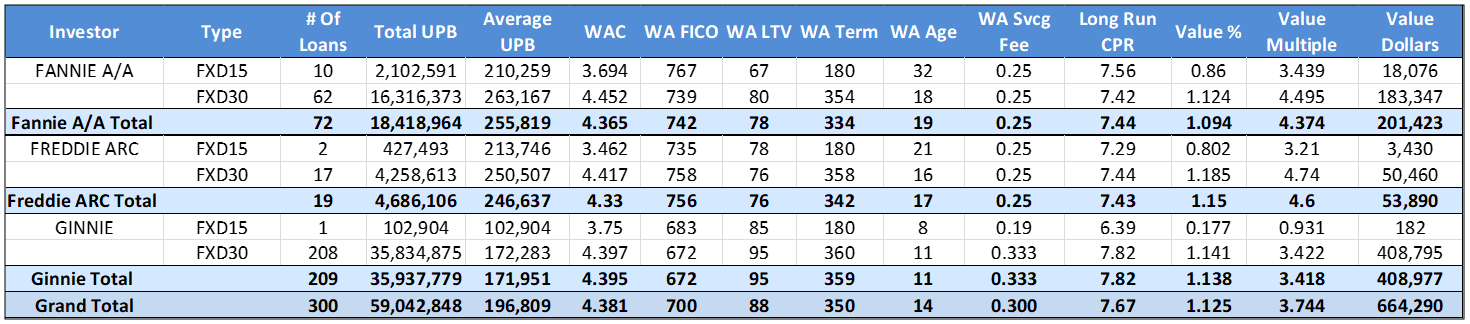

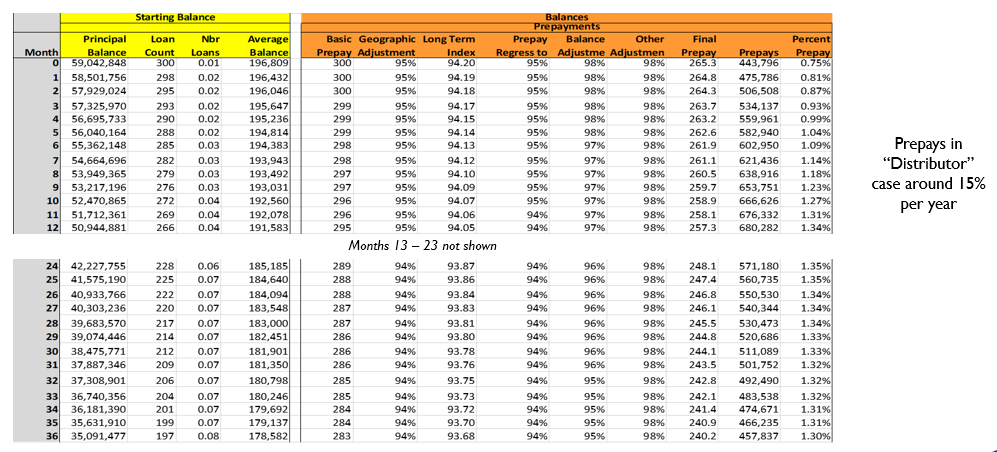

For our base case scenario we will look at a $60 million portfolio with an average balance of about $200,000. The coupon interest rate for this portfolio is 4.381% with a current market rate of 5%. Based on those numbers this portfolio is not at risk for refinancing. This sample portfolio also has a strong FICO score and loan-to-value (LTV). Our internal prepayment model is estimating a 7.67 prepayment rate with a value of 1.125%.

%

base case valuation

To value a portfolio, click ‘Value a Portfolio’ and then click Start. Choose the sample data, default prepay speeds and balances then click Run. The valuation then begins and will take roughly 15 seconds for this portfolio of 300 loans.

If you’re running 100,000 loans it will take roughly 45 minutes and 2 million loans can be run overnight. MSRlive! values loans at roughly 30 loans per second. The valuation for our 300 loans has come back at a value of 1.125 basis points. You can view all loan level results, create summary reports, as well as view cash flows. MSRlive! will also show you all 360 months with roughly 80 columns of cash flows including prepay speeds, advances, delinquencies, income and costs.

For extra large portfolios, which may need rapid results during a volatile market, MSRlive! has a tranching tool where the loans can easily be grouped into tranches with similar characteristics.

loans valued per second using MSRlive!

What is the result of the Base Case Scenario on Cash Flow?

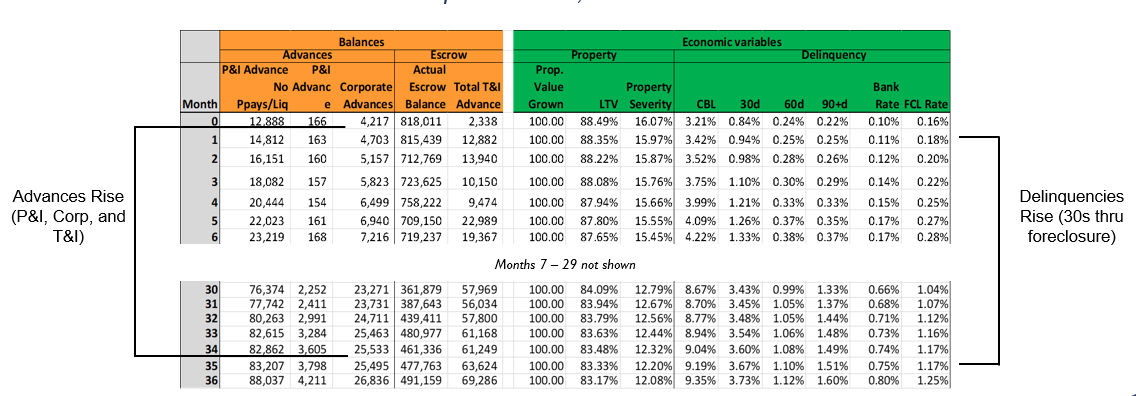

Now that MSRlive! has completed the valuation, we can view our cash flows. In the balances column you’ll find corporate advances that you don’t recover until you submit your claim. You’ll find that as delinquencies rise, so do advances. This model also includes P&I and T&I advances. For example, if this loan is in California and it’s December, half the taxes are due on the loan. You can now see how much money you’ll need to cover the taxes and if you’ll need an advance.

MSRlive! will update to reflect the recovery of the payment advance. Our tool also reflects a change in delinquencies over time. For example, borrowers will normally pay their first few payments but are more likely to be delinquent as time goes on.

What assumptions will be used in the Market Recession Scenario?

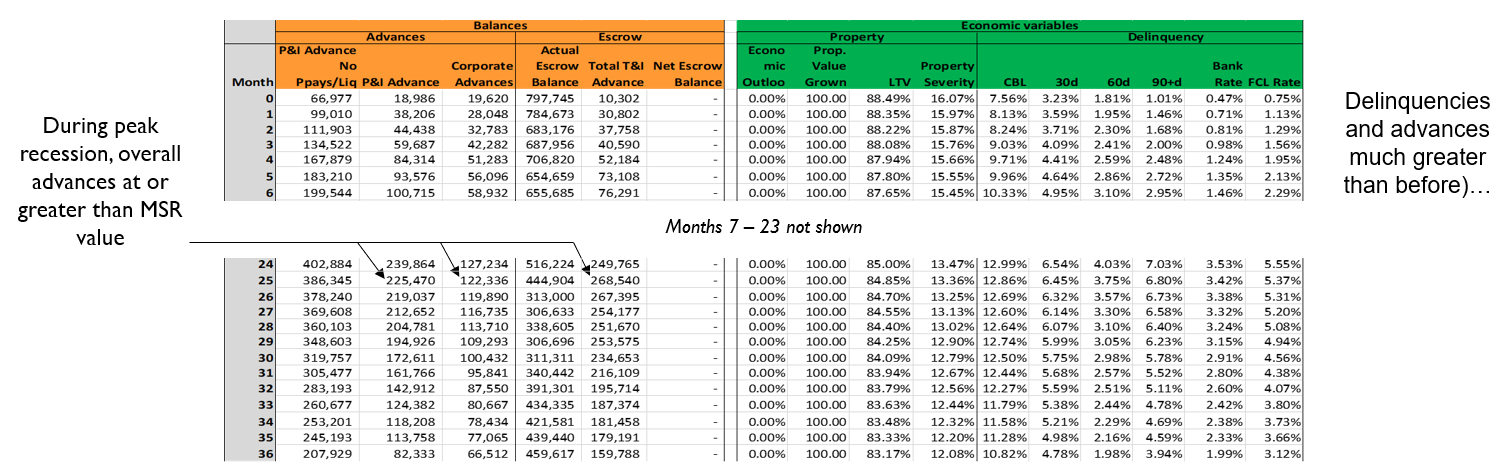

In this scenario we will look at a recession as bad as 2008 – 2011. We’re going to have more delinquencies and loss of equity. We’ll use assumptions where Ginnie Mae’s delinquencies were similar to those in 2008 – 2009. Fannie Mae’s delinquencies will be around half as much as the government delinquency rates.

High delinquencies, foreclosure costs, and advance costs bring the value down from 1.125% to 0.941% basis points.

Higher delinquencies also result in P&I advances of over $200,000, corporate advances of over $100,000, and T&I advances over $200,000. The sum is over $500,000 which is more than the value of the servicing itself. These calculations also reveal you’ll need a line of credit to assist with the advances.

Property Value Changes

As delinquency and foreclosure rates increase, property values decline and the federal easing is a likely response. From a servicing standpoint this is the worst of both worlds. Good loans will refinance and the bad loans will go to foreclosure. When considering these assumptions in addition to the delinquencies, we found the value went down from 1.125% to .415%.

Foreclosure Calculations

MSRlive! uses detailed foreclosure metrics when valuing a portfolio. When computing FHA foreclosure, for example, our model will calculate severity of each loan using note rate, status, projected foreclosure timeline by state, pass through cost, and debenture rate. We also recently added curtailment rate, which measures a servicers’ ability to meet claim deadlines in a timely manner.

Current But Late (CBL)

Another feature not usually reflected in other models is the current but late percentage (CBL). These are borrowers that would pay after the 15th but before the 30th. They do not show up in your 30 day delinquencies but they do exist. In the portfolios we’ve studied, the majority of late fees come out of the CBL group and not the 30s and 60s.

What is the result of the Market Recession Scenario on cash flows?

A severe recession will cause the economic value of this MSR portfolio (heavily government) to decline by more than 50%. The temporary advances will be greater than the value of your servicing, so you’ll need the ability to do advancing.

If you’re a bank you’ll have the escrow accounts sitting in there so you’ll be able to use those demand deposits to offset advances. If you’re not a bank, you will need a line of credit. You may also consider selling some of the riskier servicing early and devote resources to loss mitigation prior to the recession. However, you’ll need a tool to identify which loans are worth selling.

You can work with our MSR advisory team to identify pre-emptive steps to make it easier to reduce your cash exposure.

What assumptions will be used in the Disruptor Technology Scenario?

Technology is making it easier to buy anything online. In this scenario, we will look at the effect of borrowers utilizing technology to complete their loan process.

We would expect prepays on mortgage loans to speed up when origination is made simpler. A borrower is also more likely to apply for a new loan, especially if there is an opportunity to refinance at a lower rate mortgage. Several mortgage companies have developed their origination tech and consumer direct channels to the point where they are able to simplify the process of closing a loan. We have looked at the data of those originators and their portfolios run off at a more rapid pace. For this scenario, we have separated out the prepay rates of the “fast guys” and the “slowpokes” over different interest rate scenarios and can model their behavior separately.

What is the effect of Disruptor Technology on the sample portfolio?

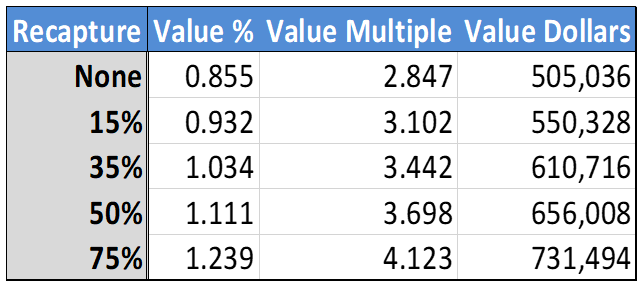

When we input the effect of disruptor technology we find that our base value of 1.125% fell to .855%. Speedy technology has led to a higher runoff and prepays moved from .7% (base case) to around 1.5% (disruptor). Does that mean no one should hold servicing? Actually no, the ease of recapture means the servicer has an inside track on getting the first contact with the borrower when rates are falling. This is especially true when considering roughly 36% of borrowers only get one rate quote. This makes it easier to recapture loans.(Note: graph below describes “distributor, not disruptor”)

MSRlive! can incorporate the recapture rate in its valuation. For example, our base case scenario shows the value of our portfolio at 1.125%. If we do not recapture any of those loans the value drops to .855%. However, if we can recapture at least 50% of our loans then we will be back at base level. If we recapture 75% of loans, our portfolio value increases to 1.239%.

During a refinancing boom, recapture rates increase due to the convenience of refinancing with a servicer. In general, margins are greater and origination costs are lower during a refi boom using a consumer direct channel. MSRlive! can be adjusted to reflect higher margins and different recapture rates for a full analysis of the “value add” when developing new origination technology.

Final Summary

MSR portfolio valuations can change dramatically as the fed continues to change rates and markets continue to shift. New technology is also becoming more advanced and readily available.

These market scenarios will affect how you manage your portfolio, cash flows, and retain release strategy. MSRlive! can keep you one step ahead and prepare you for any market scenario. Our MSR advisors will also work with you to identify risks in your portfolio and develop strategies to increase the profitability of your portfolio.

About MCT’s MSRlive! – Mortgage Servicing Rights Software

MSRlive! is MCT’s mortgage servicing rights software which helps MSR Portfolio Managers and mortgage banking professionals more efficiently build, optimize, manage, and value their MSR portfolio.

MSRlive! is MCT’s mortgage servicing rights software which helps MSR Portfolio Managers and mortgage banking professionals more efficiently build, optimize, manage, and value their MSR portfolio.

Features like portfolio valuation, custom grid pricing, rate shock analysis and detailed reporting allow you to account for every market scenario. The ability to view and edit more than 400 inputs ensures your valuation is extremely accurate, easy to review, and customizable for unique analysis.

Contact Our Team to Learn More

Interested in learning more about how MSRlive! can help you manage your MSR portfolio? Contact us today for a one-on-one consultation with a MSR expert.