Effective margin management creates a competitive advantage. As shifts in interest rates, loan volume, and borrower demand reshape the landscape, every basis point can significantly impact profitability.

Successful margin management requires analyzing rate sheet price and origination production, plus an understanding of the relationship between price and volume.

The challenge then, is that many lenders lack the bandwidth and/or expertise to manage margins effectively.

Active margin management is about creating an intentional pricing strategy for different geographies, products, and risk characteristics.

When is Margin Management Important in the Mortgage Market?

A core tenet of secondary marketing is margin management.

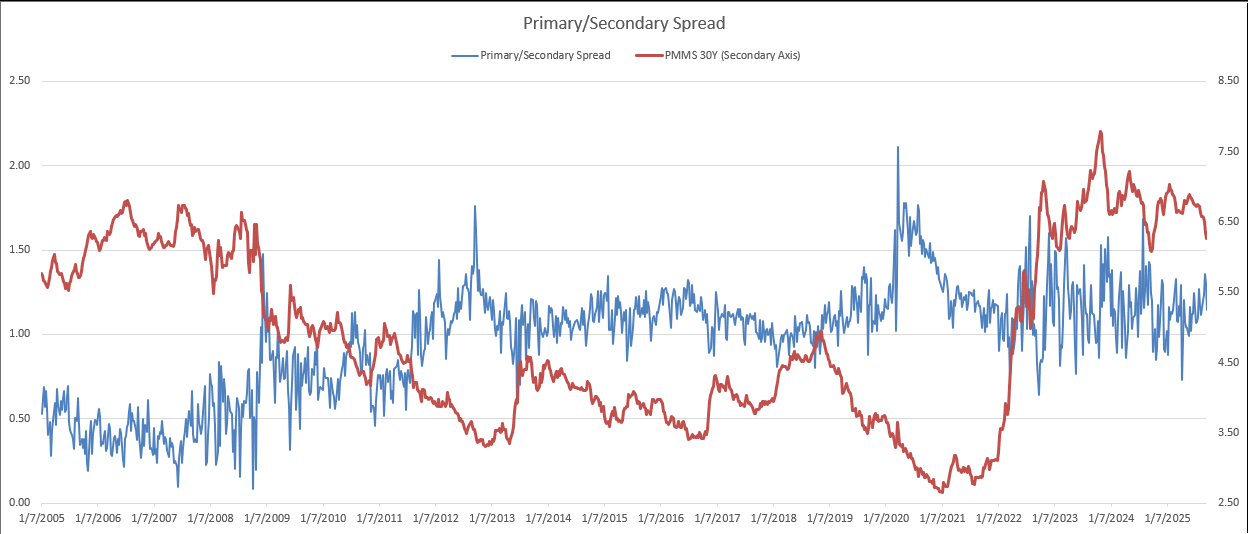

One example of the importance of margin management was what happened in the United States mortgage market from 2020 through the start of 2021.

Due to decreasing rates during the onset of the COVID-19 pandemic, there was a combination of expanding volumes and margins that made it nearly impossible for lenders not to post record profits.

At that time, most lenders were so preoccupied with how they were going to turn over their inadequate warehouse lines or maximize funded loans that the last thing on their mind was margin management.

After the mortgage space emerged from the initial boom, the industry experienced a contraction in mortgage lenders’ pipelines.

The average MCT client as of May 2021 was down 30% from a year earlier and some of the larger refinance shops have fared even worse as rates rose into 2022.

“This pattern has repeated across multiple rate cycles, from the 2008 financial crisis through the 2020 refinance boom and into the 2022 rising-rate environment,” Dukes explains. “Successful lenders must adapt their margin management approach to changing market conditions.”

When each basis point makes an impact on the bottom line, a prudent, well-thought-out, and disciplined margin management strategy is an invaluable pillar of any successful mortgage company that wishes to stand out amongst its peers.

Margin management is about finding those extra basis points that improve the bottom line, and lenders that excel in this discipline have a competitive advantage with all else being equal.

The Revenue Impact of Margin Management in Secondary Mortgage Markets

Margin management involves price testing, measuring outcomes, and adjusting pricing strategies based on the results.

For example, finding five basis points of margin on $1 billion of annual production can earn lenders an additional $500,000 in revenue.

- Scenario: A lender charges the same margin across all risk characteristics for certain products

- Production mix: 10% of production is less than 660 FICO

- Action: Increase margin by 50 basis points on loans with less than 660 FICO

- Result: Yields 5 BPS of additional margin across total production

“It’s critical to understand your price position in the market and your relative market share,” Dukes emphasizes.

The Challenge with Internal Pricing Strategies

Many lenders approach pricing with internally focused pricing strategies that can have certain shortcomings.

“Lenders may not be watching what competitors do, and they may not understand their share of the market, particularly if they’re only looking at internal metrics,” Dukes explains. “These strategies reveal where there is opportunity to find unrealized profits.”

With the advent of the pricing engine and the functionality that allows lenders to institute a spread between the investor’s published price and the lender’s street-facing price, it became easy to simply establish a pass-through strategy that fixed the lender’s anticipated profit margin.

“Managing margins with anecdotal evidence or no concrete strategy can jeopardize the lender’s reputation, put Loan Officer loyalty at risk and create an environment where the lender ‘chases’ the competition. You develop a reputation with your LOs based on gut decisions, and it damages the LOs’ reputation if you’re changing your price strategy all the time.”

– Brandonn Dukes, Director, Margin Management Advisory, MCT

The problem with this “set it and forget it” margin management approach is multifaceted.

First, the unmanaged profit margin fails to optimize that lender’s opportunities for profit gain when the market allows. By constantly testing pricing elasticity through adjusting margins and watching the subsequent following lock volumes, a company can pick up basis points that might otherwise have been unnecessarily passed through.

Second, an unmanaged profit margin ignores the lender’s need to regulate volume against the company’s internal resource capacities. If, for example, resources are being stretched to the point that the service levels are compromised, an increase of the margin can actually solve the problem while making up the revenue lost on the conceded volume with the larger gains of the loans that do fund.

Third, passive margin management subjects the lender to accepting the price position dictated by their competitors rather than strategically positioning themselves in the market.

When a company holds a static margin, it’s essentially tethering its pricing decisions to those of the targeted investor.

Major investors are actively managing their own margin changes based upon their own particular circumstances and a lot of times those margin changes can be significant.

In the scenario of an unmanaged profit margin, the lender’s margin and profit are “along for the ride.” For example, a lender could have tied their margin to price a day before realizing that they were “over the skis” in terms of volume. When the investor throws another 25 basis points into pricing to slow things down, the lender then inadvertently widens their price by 25 basis points due to an unmanaged profit margin.

Establishing a Proactive Margin Management Strategy

So, what should a lender consider in a margin management decision?

First, lenders should note that margin management doesn’t happen in a vacuum. The following recommendations and examples highlight the necessity for regular analysis of the decision-making margin management process.

Strategy 1: Consider How Margins are Affected by Competition

For example, if a lender’s low FICO government production is spiking (it can happen even in a scenario where that lender might not have made any changes to its margin or pricing hits), a competitor could be making an active change to margins and influence the lender’s profitability.

If the lender is not paying attention to their production mix, that lender might become victim to adverse selection in the market and have a problem – even if the lender itself did not make any active changes.

Understanding your competitive price position in the market is foundational to effective margin management. It’s important to recognize that mortgage demand elasticity varies by market conditions and rate environment.

In higher rate environments, borrowers may be more price-sensitive for certain transaction types, potentially limiting homes of certain values.

However, mortgages generally get done regardless of rate levels.

The key differentiator becomes competitive positioning.

If a lender adjusts pricing by 25 basis points but all competitors make the same adjustment, market share levels may remain relatively unchanged because the relative price position hasn’t shifted.

Strategy 2: Use Margin Management to Manage Fulfillment Capacity & Production Mix

Reviewing a P&L to see how a company is faring against financial goals is a good exercise but it is a different exercise than a tactical analysis required to adjust pricing mid-flight toward optimal levels.

In other words, hitting targeted profitability goals does not necessarily equate to achieving maximum profitability or appropriate pricing objectives.

When we say “pricing objectives” outside the context of actual profitability, we mean that mortgage originators should be thinking of pricing not only as a means to bottom-line growth but also as one of its most effective tools to manage other flows in the business.

An obvious example of this strategy in place is that, instead of using pricing to increase volume, you can use price to push volume away. Price and margin management can act as a throttle used to slow the machine down when volumes are compromising the service levels.

Margin management strategy is not just crucial in terms of managing total volume, it can also be used in the context of managing production mix.

For example, a lender could also use margins to steer the production of purchase versus refinance volume or to free up underwriting space for more profitable loans such as non-QM or Jumbo. There are different scenarios where pricing can be adjusted to influence production mix.

Another scenario might be when lenders might try to clean up their performance based on investor or Agency scrutiny. Your production of low FICO might have you on the radar with one of the entities that are buying your loans.

Learn More

Strategy 3: Price Elasticity & Price Testing

Price elasticity testing is a critical component of sophisticated margin management. Rather than making broad assumptions about how borrowers will respond to pricing changes, lenders should implement systematic testing protocols to understand the actual elasticity of their pricing across different products, geographies, and risk characteristics.

“Price testing involves making small, measured adjustments to margins and carefully monitoring the resulting lock volumes and production mix,” Dukes explains. “This empirical approach allows lenders to discover pricing opportunities they might otherwise miss. For instance, certain product types or borrower segments may be less price-sensitive than others, creating opportunities to capture additional margin without material volume loss.”

The key is to test in controlled increments and measure outcomes consistently.

Lenders should establish baseline metrics before making pricing adjustments, then track changes in lock volume, pull-through rates, and market share to determine whether the margin adjustment achieved its intended result.

This data-driven approach removes guesswork from margin management decisions and helps identify the optimal price point for each product segment.

Strategy 4: Managing Loan Officer Behavior

Loan officer (LO) behavior and compensation structure play a significant role in the effectiveness of margin management strategies. Even the most sophisticated pricing strategy can be undermined if loan officers have incentives that misalign with margin management objectives or if they lack confidence in the lender’s pricing consistency.

“Loan officers develop relationships and reputations with their referral partners based on reliability and competitiveness,” Dukes notes. “Frequent, unexplained price strategy changes can damage those relationships and erode LO confidence in the lender’s strategy. The goal is to implement margin management in a way that maintains LO trust while still optimizing profitability.”

Effective loan officer management in the context of margin management involves clear communication about pricing strategy, consistent application of pricing changes, and compensation structures that are conducive in incenting the proper behavior consistent with the selected pricing strategy.

When LOs understand the rationale behind margin adjustments and see that changes are based on data rather than reactive gut decisions, they’re more likely to support the strategy and maintain confidence when competing for business.

6 Suggested Inputs for a Robust Margin Management Analysis

In this section, we will detail various analyses that would be helpful in a robust margin management analysis to inform the two strategies listed above.

1. Volume Versus Capacity Analysis

Any mortgage company should have a grasp of its FDE requirements for producing a loan. Then, they should be measuring that capacity against actual production.

This is done not only to determine the appropriate headcount in the long run, but also for a short-term basis.

As mentioned earlier, in the time that it would take a lender to lay off part of their workforce, they could instead use price to adjust volumes to bring the company back to an off optimal capacity.

2. Competitive Rate Comparisons

There are many well-known rate comparison tools that are useful in margin management, such as the Icon Survey.

At MCT, within our suite of business intelligence offerings, we debuted a competitive rate comparison tool that allows our users to gauge their price against the price of their peers.

A competitive rate comparison tool is important for margin management because you can compare your street price to the street prices of other lenders.

This is not necessarily a margin management tool, though it does inform margin management decisions as discussed in the strategy section above.

When you utilize a competitive rate comparison tool, we recommend that you restrict parameters in the system to give you greater insight such as filtering to your specific geographical market, channels, and products.

As your trusted capital markets partner, MCT has found that it’s much more actionable to look at price rather than margin because when analyzing margins, there’s too much noise when it comes down to comparing one lender’s margin against another.

Whereas margin to margin comparison becomes very challenging, looking at the street price allows each lender to “back into” their implied margin off of the comparison.

3. Market Share Analysis

Within the MCT Business Intelligence Platform, a lender can monitor locked volume versus peers to inform their margin decisions. Market share indicators are more telling than an actual volume analysis in a vacuum.

A market share analysis allows the lender to determine if the increases or decreases in the volume are simply market-driven or if those movements are the result of their price competitiveness or any of the changes they have made in their pricing.

4. Pricing Elasticity Testing

It is recommended that lenders test the elasticity of their pricing in small but regular increments. This is to ensure that margin isn’t just being given away without an appropriate pickup in volume to merit the thinner margin.

By systematically testing price changes and measuring the resulting impact on lock volume and production mix, lenders can identify the optimal margin for each product and risk segment. This approach transforms margin management from guesswork into a data-driven discipline.

5. Day One Versus Final Execution Analysis

A day one versus final execution analysis is a report that is more important for lenders engaging in mandatory rather than best efforts delivery. With mandatory execution, there will be little disparity between the day one assumption on your exit price (which is what you use to establish your price) versus your final execution. Once you run this analysis, you can ask yourself “what action am I going to take with this potential differential or lift?”

The lift between day one and final execution can be much more significant depending on how you establish that day one price. A lot of lenders are using the best efforts price basis to come up with the rate sheet, so this will be less important as the loan pricing is fluctuating less.

MCT’s Lender Analytics Platform contains a feature that allows lenders to compare their up-front pricing basis to their final execution when the loans are committed out of the price. The basis identified by this report is essentially the sell-side price assumption used to come up with the upfront pricing.

A lender can use this analysis to establish front-end pricing by running the upfront price basis as of the time that the loan is actually sold, then capturing the spread of that basis to the committed price. The reporting is dynamic and it can be manipulated for different views, depending on your business needs.

6. Best Effort Execution Max Investor View

One very helpful iteration shown in the day one versus final execution analysis is over a time series that displays that day-over-day spread. There is lots of functionality that this tool provides, but you have to restrict the bid value filters to best effort execution max investor.

When you do that, the tool is comparing the committed price on loans to the max investor as of the day the loan was committed on a best effort basis.

For example, a lender who is using best efforts upfront pricing shows a delta over a recent prior period of time that is 78.4 basis points. This is a pretty good indication of what their lift over best efforts is (and of course you have to take into account your hedge cost).

When you have an accurate analysis of the recent context of that spread you are no longer guessing and it helps the lender become firm in their decisions of what portion of that gain passed through into their pricing.

If the lender is confident in that lift then they can choose to let it bleed back into their pricing if they deem it to be appropriate (after considering all other analyses) in order to drive additional value.

At that point, the lender will want to come back to their pricing elasticity testing and ask themselves “Does it make sense to pass out extra basis points to borrowers or should we be keeping them for ourselves?”

Seeking Rate Sheet and Margin Management Expertise

Margin management is more about oversight and provoking critical thoughts on how to refocus a margin as it passes through your pipeline.

These strategies allow you to manage your business through any market cycle and stay on top.

Manage Margins with MCT

Prepare for market scenarios that require robust margin management. Schedule a strategy conversation today.