When markets began to show increased volatility at the onset of the COVID-19 pandemic, MCT was there to support clients in a myriad of ways. Let’s review, because hindsight is 2020…

From the beginning of the pandemic, MCT committed to providing laser-focused guidance on market changes and their potential impact to businesses, in a way that no other hedge advisory firm could or did. Through the constant communication of Marketflash emails, webinars, and educational content, MCT helped numerous lenders stay in business.

In this article, we reflect back on the period of COVID-19 market volatility from February to May of 2020 to demonstrate all the ways that MCT was the most proactive hedge advisory firm during the crisis, supporting clients and the mortgage industry as a whole during this time of hardship.

Join our newsletter for Marketflash emails in the future!

How MCT Addressed the Challenges of 2020

February 2020 saw a rapid spread of the novel COVID-19 virus, followed by significant economic implications for the global economy. At this time, MCT began providing nearly daily market volatility guidance to support clients. This continued through May 2020, when much of the volatility in the mortgage market occurred.

FUN FACT: Over the course of the COVID-19 pandemic and market volatility, MCT averaged two webinars and three timely MarketFlash updates per week, on top of the daily market commentary and constant stream of support and communication to lender clients.

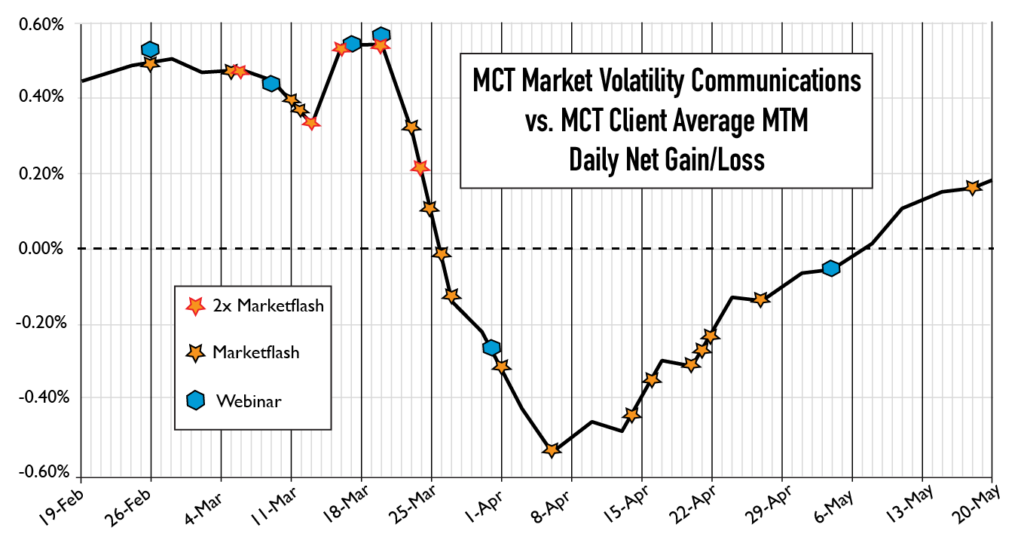

MCT Market Volatility Guidance Frequency Overview

The timeline below illustrates MCT’s consistent commitment to market volatility guidance during the worst times in the bond market last year by showing our webinar and Marketflashes along with our client’s average MTM daily net gain/loss.

What are our Marketflash Email Updates?

A Marketflash is a timely MCT email communication that addresses current events with advisory recommendations on what actions lenders can take to maximize their profitability or avoid common pitfalls.

During the pandemic, there was a need at times for even multiple Marketflash emails per day, to keep clients on the “up and up” with best courses of action to take to protect their margins.

While these communications are exclusive to MCT clients, during the pandemic MCT did open up their advisory recommendations to the benefit of the entire secondary mortgage market.

Join MCT’s newsletter to stay abreast of timely market updates!

How Many Communications Were Sent?

Review this full illustrative timeline below to see more than just top-level volatility events and webinars that MCT hosted in the above graphic. If you take a look at the infographic below, you can take a step back into the 2020 pandemic volatility period to see that MCT was sending out market volatility guidance very consistently and sometimes multiple times per day, depending on need.

Join our newsletter for Marketflash emails in the future!

Infographic: 2020 Market Volatility Events & Education

The infographic shown below is a comprehensive timeline summary of the major market volatility events along with corresponding MCT email communication responses and MCT hosted educational webinars.

Click to expand and zoom in on the graphic or download it here.

In the following narration, we will illustrate in even more detail how granular and timely was the day-to-day guidance provided by MCT staff to keep lenders in business.

What Happened to the Secondary Mortgage Market in 2020?

Due to the effects of the COVID-19 global pandemic, the period from March to April 2020 caused unprecedented volatility in the U.S. residential mortgage market, and subsequently, the secondary mortgage market.

When stay-at-home orders began in March, fears about the downturn of the economy led to changing liquidity conditions, uncertainty, and volatility in the secondary market.

In anticipation of this volatility, MCT provided to clients a top level summary of what to expect. These hedge advisory recommendations included an overview of the implications for pull-through and pipeline management, rate renegotiation best practices, and instructions for how to leverage ongoing market intelligence, encouraging lenders to increase front-end margins. MCT’s accompanying trading strategies for the current market enabled clients to be prepared and confident as the period of volatility approached.

MCT also used this anticipatory moment to remind clients about MCTlive! tools that would assist them through this difficult time, and advocated for lenders to ensure liquidity and capacity, back up margins to protect profitability, avoid long term locks, and practice proactive renegotiation policies.

As a result of impending market volatility, MCT quickly released the new MCTlive! mobile app functionality, including a new Market Intelligence Tool which could be used to review market levels, market commentary, indications and pipeline summaries. The further integration of Siri and Alexa voice activation within the mobile app allowed users to get hands-free pipeline information on-the-go when timeliness was key.

Beginning of March 2020: Onset of Mortgage Market Volatility

By mid-March, the secondary market saw lenders forced to increase margins because they were at maximum mortgage loan pipeline capacities.

As broker-dealers reached capacity, pulled back on pricing, or increased margin calls, MCT called for all clients back up margins to insure against potential downstream price degradation.

It was soon after that the Federal Reserve announced sweeping additional emergency actions to mitigate the effects of the coronavirus (COVID-19) on the economy. The Federal Reserve announced they would increase MBS and Treasury holdings “in the amounts needed to support the smooth functioning of markets for Treasury securities and agency MBS.”

By then, mandatory to best efforts spreads had widened significantly. MCT recommended for clients to extend the lock period, to continue to expand broker-dealer options, and to use margins to control volume.

Towards the end of March, Treasury Secretary Steven Mnuchin formed a task force to confront mortgage firms’ liquidity challenges due to COVID-19 borrower forbearance. Despite this, pricing continued to deteriorate particularly on government products. MCT recommended removing government locks from the pipeline up to FICO’s of 680, for lenders to implement day-of-funding verbal verification of employment (VVOE) and to push locking later into the mortgage process.

As correspondent lender in crisis faced unprecedented aggregator capacity issues, non-depository servicer liquidity concerns, forbearance impacting delivery, and aggregators taking advantage of the situation, MCT’s MCT Marketplace was introduced to help ensure competitive execution during times of market stress and liquidity (such as now on low FICO Gov production).

MCT Marketplace was an extension of the traditional best ex process within MCTlive! That enabled less traditional buyers to bid on closed loan collateral. This timely solution was completely automated at no additional cost to MCT hedge clients to immediately start receiving bids from a growing universe of investors such as other MCT clients, hedge funds, and money managers.

The primary objective of creating MCT Marketplace was to help ensure a competitive execution during times of market stress and illiquidity. Lower-FICO Ginnie loans are a primary example of the type of niche product planned for trading on MCT Marketplace.

End of March and Continued 2020 Volatility Support

Subsequent announcements from FHFA followed towards the end of March 2020. This included a limit on servicer advance obligations to a maximum of four months for agency loans in COVID-19 related forbearance and further support of the mortgage market in light of increasing requests for forbearance from borrowers impacted by the pandemic.

One of the most attended MCT volatility webinars, the “Quarter End Mark-to-Market Strategies for Market Volatility” was hosted on March 31st. Up until this point, there had been increased fallout due to coronavirus, with a widening BE-Mandatory spread.

In this webinar, MCT’s COO Phil Rasori discussed very helpful strategies for lenders on how to address the widening aggregator-agency pricing divergence, execution issues, and tightening on government product. These recommendations allowed lenders to improve their MTM accuracy and, subsequently, their profitability outlook.

Lenders were instructed on how to update their pull-through forecast and associated coverage and widen their margins to mitigate the negative impacts of the quarter-end market. This webinar was certainly a highlight during the pandemic as it greatly helped lenders protect their liquidity and capacity.

Even after the initial surge of volatility in March and April, MCT hosted yet another webinar on April 7th, reflecting on the primary challenges to correspondent lending in crisis, namely the aggregator capacity issues, non-depository servicer liquidity concerns, forbearance impacting delivery, and aggregator pricing divergence from agencies and TBAs that had taken place.

By the end of May, aggregator capacity issues were all but eliminated. At this time, MCT spoke with every top tier investor and all but one were back to within 1 day of pre-covid turn times.

By then, FHFA/agencies had addressed their liquidity and forbearance issues. Forbearance began to show initial signs of plateau and a significant percentage of borrowers were making payments in forbearance. Additionally, forbearance-related aggregator policies and fees became increasingly rare.

Even at this time, MCT made further recommendations to the industry to increase liquidity for funding and trading. This would help lenders protect and manage margins as volatility continued to stabilize. Some of these recommendations were to lock key loans best efforts, create agency relationships that could be leveraged during volatility, include forbearance policies and fees in lenders’ best ex analyses, and leverage MTM strategies for a more accurate valuation.

With MCT’s guidance, lenders updated their pull through assumptions and used MCT Marketplace to find outlets and deals on less liquid product, all the while leveraging MCT’s business intelligence in peer comparison and investor discussions.

Lenders who held the course and followed MCT’s guidance in early 2020 found themselves in a strong and improved position for the end of one of the most turbulent years in the secondary mortgage market.

Lenders that moved to or returned to pipeline hedging and mandatory delivery after volatility were able to benefit from wide spreads. With appropriate precautions, MCT was able to lead lenders to a fundamentally good time for hedging with potential for oversized profits.

How Does Your Hedge Advisor Support You During Periods of Market Volatility?

We know that 2020 was a challenging time for our family, community, industry, and the entire country. As your trusted capital markets partner, MCT will continue to provide laser-focused guidance on market changes and their potential impact to your business at all times. It is our duty to serve your needs as a hedge advisor as we weather challenges together.

MCT stands by you during times of market volatility – even if you are not an MCT client. Contact us for expert guidance.

Interested to learn more about market volatility best practices? Explore our market volatility guidance for lenders to find related articles.

Join Newsletter for Timely Updates from MCT