MCT’s custom MSRlive! API considers loan-level characteristics for granular MSR pricing.

In a volatile and uncertain market, every basis point counts. Fierce competition and margin compression necessitate a thoughtful, strategic approach. Achieving acceptable returns is more challenging than ever. One of the critical factors that warrants additional scrutiny is the servicing asset, to ensure that accurate MSR values for pricing are established. This has proven to be essential to the sustained profitability for mortgage companies of all sizes.

That is why MCT has created an API in conjunction with MSRlive! that allows direct integration to your systems for more efficient, strategic, and accurate loan-level pricing.

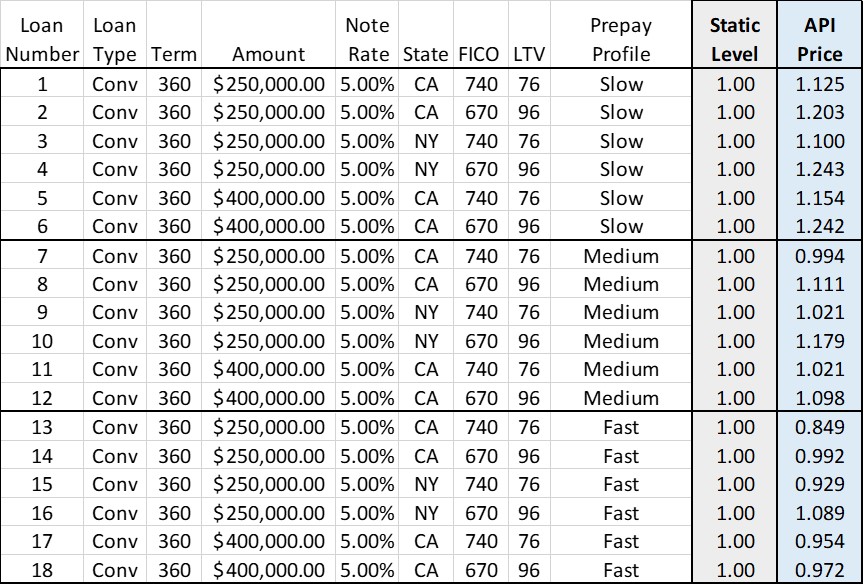

Loan-Level Characteristics Considered for Accurate MSR Pricing

With the new MSRlive! API, you can develop pricing that includes key loan-level characteristics such as location, FICO, loan-to-value (LTV), and more in real time. By factoring in these elements, there is an opportunity which allows avoiding overpaying for potentially underperforming assets.

Sample Grid Level comparing static pricing vs. custom API

To illustrate the importance of loan-level characteristics in your pricing, consider the example above comprised of 18 loans with varying attributes. If a purchaser applied a four-to-one multiple to each loan, that would ultimately result in less than overall favorable returns.

With MSRlive! API, loan-level characteristics like location, FICO, LTV and prepay scenarios are factored in to produce granular pricing for each loan. By mathematically factoring in key characteristics, the MSR buyer ensures they’re not overpaying for these assets while improving the potential for favorable long-term-profitability. No more waiting days or weeks to get the data you’re looking for, MSRlive! API gets you more granular data in real time at your fingertips.

“The competitive landscape has exposed the challenges with applying static multiples across all LTVs and FICOs, and has heightened the importance of a more strategic pricing strategy. MCT’s MSRlive! API is specifically designed to provide granular, loan level, MSR pricing based on your cost assumptions and return expectations. Ultimately, giving you more confidence.”

Setting Up Your Custom MSRlive! API

Getting started setting up your custom MSRlive! API is easy in four simple steps. Follow the steps below or contact us today to learn how you can take advantage of this new functionality.

Step 1

Sign up for API Service to get credentials.

Step 2

Map fields to MSRlive!’s data fields provided in the API Specification.

Step 3

Conduct a call with MCT’s integration team to execute a PostMan test.

Step 4

Start calling the API!

About MSRlive! – Mortgage Servicing Rights Software

Our mortgage servicing rights software helps MSR Portfolio Managers and mortgage banking professionals more efficiently build, optimize and manage their MSR portfolio.

Features like portfolio valuation, custom grid pricing, rate shock analysis and detailed reporting allow you to account for every market scenario.

Learn More About MCT’s Custom MSRlive! API

This new MSRlive! API can provide you with pricing that includes loan-level characteristics like location, FICO, loan-to-value (LTV), and more. By factoring in these characteristics, MSR purchasers can produce granular bids that help spotlight more profitable MSR assets, while ensuring you’re not overpaying for potentially underperforming assets.

For more information on this API integration, please contact us today.