MSRlive! Client Update – MSRlive! 2.0 Launch

In this webinar, Natalie Martinez along with Bill Shirreffs and Azad Rafat go over all of the new features and exciting transition to MSRlive! 2.0.

In this webinar, Natalie Martinez along with Bill Shirreffs and Azad Rafat go over all of the new features and exciting transition to MSRlive! 2.0.

In this two-part video series, Freddie Mac and MCT’s MSR division team up to discuss strategies for managing a MSR portfolio in a volatile market. Watch Part 1 and Part 2 of the video series below or contact us today for strategic MSR guidance.

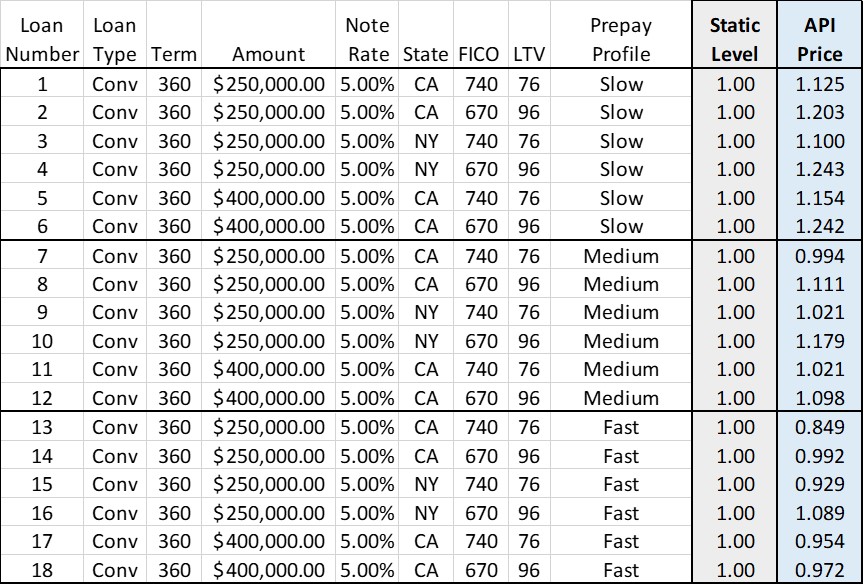

With the new MSRlive! API, you can develop pricing that includes key loan-level characteristics such as location, FICO, loan-to-value (LTV), and more in real time. By factoring in these elements, there is an opportunity which allows avoiding overpaying for potentially underperforming assets.

Mortgage Capital Trading (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, has announced today a new technology for mortgage servicing rights (MSR) buyers to produce more granular pricing for mortgage servicing. The feature leverages an application programming interface (API) to connect MSRlive!, MCT’s state-of-the-art MSR valuation platform to clients’ systems for more precise and accurate loan-level pricing in real time.

In this webinar, MCT’s Azad Rafat and David Burruss will discuss key MSR value drivers, MSR accounting methods and how the MSR life cycle effects your balance sheet.

The economy continues to heal from the pandemic and MSR pricing has seen improvement as a result. Many servicers are still sitting on large portfolios as a result of MSR multiples/prices going to zero in early 2020, but the market is becoming ripe for MSR bulk sales and there is ample capital/liquidity from buyers ready to purchase. Continue reading below for our Top 5 Takeaways for the Bulk MSR Market.

SAN DIEGO, CA, 10-08-2021 – MCT announced today that Azad Rafat has joined the company as the new Senior Director of MSR Services. Mr. Rafat will leverage his hands-on experience designing, building and managing mortgage servicing products to help MCT clients achieve their mortgage servicing goals.

In this case study, Mr. Miles explains how he is leveraging MCT’s Business Intelligence Platform software to glean impactful insights into rates, pricing, and the industry.

The loan sale process has contributed to recent challenges in the secondary market. An open loan exchange mitigates risk and unlocks profitability. In this webinar, MCT’s Phil Rasori and Justin Grant, as well as OnQ Financial’s Angela Wooldridge and Alpha Mortgage’s Genesis Collins reviewed bidding regardless of approval status, mitigating risk, and increasing profitability.

In collaboration with CUREN and MGIC, MCT will examine credit union’s process flow to identify potential improvements in areas such as secondary marketing, technology, automation, and business processes. The strategies explored in this webinar amount to over 50 basis points of potential improvement to margins based on the experiences of Credit Unions who have put them to use….

Mortgage Capital Trading®, Inc. (MCT), the leading mortgage hedge advisory and secondary marketing software firm, announced today their Enhanced Best-Execution (EBX) tool used for MSR retain-release decisions has now automated the function of pulling comprehensive data from MCTlive!® and MSRlive!.

With the first quarter over in 2021, the market for MSR sales is beginning to shift. Take a look below and review our Top 5 Takeaways for Bulk MSR Market.

As MSR pricing and volatility begin to normalize in 2021, many portfolio managers are revisiting their short-term and long-term servicing strategy. In this webinar, MCT’s Phil Laren, David Burruss and several mortgage lenders reviewed current MSR market trends and strategies to optimize your portfolio.

In this case study, Mr. Danilowicz explains how MCT’s MSR team helped Doorway Home Loans successfully facilitated a $1 billion MSR Sale. He also describes how MCT was instrumental in providing critical guidance through the 2020 market uncertainty and volatility.

MCT® announces that David Burress has joined the company in the position of MSR Sales Director, directly addressing the increase in market demand for MCT’s MSR products.

In this servicing insights article, we will provide some guidance on the MCT’s approach to recapture and its impact on servicing. We will define recapture, how to measure it, how to include it in MSR valuation exercises, and whether it should be included in a fair value assessment of MSR.

In this timely article, MCT’s Director of MSR Services, Phil Laren, reviews how market changes have impacted MSR forbearance in 2020. He also outlines common challenges experienced by portfolio managers and MCT’s recommendations for future MSR management.

In this webinar from May 28th at 11AM PT, MCT’s Phil Laren and Bill Berliner discussed current MSR market conditions, cash management and forbearance strategies.

In this issue we will determine the value and examine some risk scenarios with an actual MSR portfolio utilizing the ASE, consider some of the implications to managing MSR risk through hedging, and discuss how ASE can be used to gain a more precise and nuanced understanding of a portfolio’s underlying risks.

In this issue of Servicing Insights, we will describe our methodology of determining MSR values and quantifying and monitoring MSR risk. Our approach to modeling the different market interest rates is to statistically model a set of structural relationships between the interest rates, as well as other variables which cause them to change.

Join webinar to learn how to determine which MSRs to sell, how to evaluate bids you receive, and tips for negotiating a contract. Topics will also include expected challenges, purchase terms, and timing of the sale.

View the webinar on MSR valuations using MSRlive!, a mortgage servicing rights software built to help MSR professionals manage their portfolio.

SAN DIEGO, Calif., Oct. 25, 2018 – MCT announced the upcoming launch of MSRlive!, a powerful web-based platform designed to effectively support lenders’ efforts to build, maintain and optimize their servicing portfolios.