Weekly Technology Improvement Series:

Cash-Window APIs

Published 8/18/2021

With MCTlive!, all your bids are tied directly to the cash window through our live, on demand, APIs with Fannie Mae and Freddie Mac. Once posted, live pricing from Fannie/Freddie is available with the click of a button.

Even if the market moves between pricing and hitting the bid, you don’t have to worry about delayed rate sheet updates or a dislocation between TBAs and cash window price changes.

A full browse price integration to ALL cash window executions provides assurance that you are receiving the most up to date pricing for your best execution and front-end pricing.

This live browse with the agencies feature allows you to pull in a base price, SRP, spec, and LLPAs, for an accurate all in price, to make retained or released decisions, with SMP (Fannie), CRX (Freddie), and CTOS (Freddie).

Once a best ex analysis is completed (fee adjusted and eligibility included), a lender can easily commit to all of the cash window iterations available.

The ability to select commitment pricing directly from the cash window helps maximize profit and save time in the process of selling loans. MCT® is continually optimizing our capital markets software to keep up with the current market space.

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

What is MSR Valuation? Mortgage Servicing Rights 101

Discover the fundamentals of Mortgage Servicing Rights, their benefits, risks, accounting methods, and key valuation drivers for long-term profitability.

CRA Acquisition & Correspondent Channel Tools from MCT Marketplace

In this webinar, MCT’s Justin Grant, Head of Investor Services, will discuss MCT Marketplace, an open loan exchange software that optimizes whole loan and co-issue mortgage transactions in the secondary market, offering clear investor benefits. Key tools to improve acquisition strategies include AutoBid for automating live bids, AOT automation for tri-party agreements, the Open Pipeline Viewer & CRA Marketplace for sourcing investor CRA and product needs, and AutoShadow for automated shadow bidding, along with analytics and rate sheet support.

MSR Market Monthly Update – November 2024

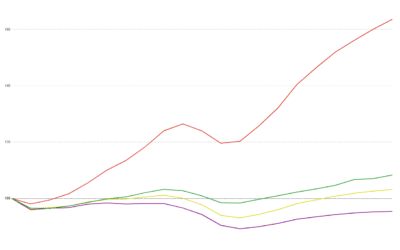

Click to read the most recent MSR Market Update! – Here we go again! Mortgage rates and all other rate indices continue their roller-coaster ride quarter after quarter. After so much anticipation of lower mortgage rates to remain throughout the rest of 2024, rates took a sharp U-turn and are back up about 68 basis points from their lows on September 30, 2024. The current rates reversal is significant since it took such a short time to get to back up to the same point where market rates were just three months ago. Click to read the full market update!

MCT Client Webinar – MCT Empowers Mortgage Hedging Performance with Customized Spec Durations

In this client-excusive webinar, MCT’s Phil Rasori and Andrew Rhodes provide an exclusive look into customizable duration analysis for specified loan products on MCTlive!

MCT Empowers Mortgage Hedging Performance with Customized Spec Durations

Mortgage lenders using the comprehensive capital markets platform MCTlive! now have the ability to increase, review, and refine the granularity of their spec durations.

MCTlive! Quarterly Release Notes in Q3 2024

Described below within relevant tabs, you’ll find a listing of our Q3 2024 technology developments. This update also includes technology release notes for MCT’s MSRlive! and Business Intelligence tools.

MCT Expands MSR Valuation Options with AD&Co Prepayment Model

MCT announced the integration of the LoanDynamics Model (LDM) from Andrew Davidson & Co. (AD&Co) into their mortgage servicing rights (MSR) valuation software.

MSR Market Monthly Update – October 2024

The Fed has finally cut the overnight rate by 50 basis points, a larger cut than what was anticipated. The mortgage market had already built in the rate cut in their offerings; Mortgage rates continued their downward trend during the month of September;

MCT Reports 3% Increase in Mortgage Lock Volume, Refinance Activity Buoys Market

San Diego, CA – October 2, 2024 – Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced today a 3.17% increase in mortgage lock volume compared to the previous month. The report highlights key market dynamics, offering industry professionals valuable insights.

Case Study: Gateway Mortgage Group Improves Buyer Efficiency with MCT Marketplace

In this case study, Tom Bradley, Trader & Senior Correspondent Product & Pricing Analyst at Gateway Mortgage Group, LLC speaks to the benefits of time savings, targeting specific loan characteristics, reporting, and the ability to find new sellers as an investor on MCT Marketplace.