Weekly Technology Improvement Series:

Cash-Window APIs

Published 8/18/2021

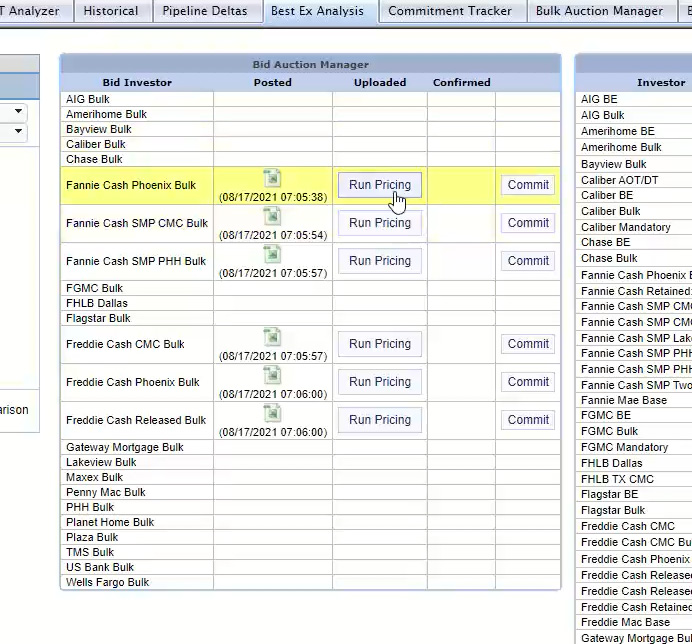

With MCTlive!, all your bids are tied directly to the cash window through our live, on demand, APIs with Fannie Mae and Freddie Mac. Once posted, live pricing from Fannie/Freddie is available with the click of a button.

Even if the market moves between pricing and hitting the bid, you don’t have to worry about delayed rate sheet updates or a dislocation between TBAs and cash window price changes.

A full browse price integration to ALL cash window executions provides assurance that you are receiving the most up to date pricing for your best execution and front-end pricing.

This live browse with the agencies feature allows you to pull in a base price, SRP, spec, and LLPAs, for an accurate all in price, to make retained or released decisions, with SMP (Fannie), CRX (Freddie), and CTOS (Freddie).

Once a best ex analysis is completed (fee adjusted and eligibility included), a lender can easily commit to all of the cash window iterations available.

The ability to select commitment pricing directly from the cash window helps maximize profit and save time in the process of selling loans. MCT® is continually optimizing our capital markets software to keep up with the current market space.

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

A Story of MSR Retain-Release Decisions in a Volatile Market

In this blog post and story, view recommendations from MCT's MSR team on how to make speedy and informed retain-release decisions during periods of market volatility.In these times of low but volatile interest rates, mortgage companies are thrilled with the greater...

MCT Client Webinar: Market Strategies for Hedging, Pull-Through Rates & Pricing

Join us Monday, March 9th at 10am PT for this client-exclusive webinar as we discuss recent market changes.

Rate Renegotiation: Policies that Protect Profit

View recommendations on how to employ rate renegotiation policies to guide your staff in mitigating profit loss using three example best practices.

MCT Client Webinar: MarketFlash Rate Renegotiations

This client-exclusive webinar focused on recent market volatility, as well as tools to help manage your pipeline and ongoing market movements. MCT’s Chief Operating Officer, Phil Rasori, will also review pull-through management and new functionality.

MCT’s Response to the FHFA’s Proposed Changes, Jan. 2020

Read MCT’s Response to the FHFA’s Proposed Changes, January 2020 to learn how elements of the proposal would be detrimental to the mortgage lending community and MBS market participants.

UPDATE: MCT® Integrates its MCTlive!® Secondary Marketing Software with Fannie Mae’s Pricing & Execution – Whole Loan® Application

UPDATE Jan. 23, 2020 – MCT is proud to announce that on December 18th they became the first organization to connect lenders to Fannie Mae’s Loan Pricing API via its Bid Auction Manager (BAM) loan trading platform for live Servicing Marketplace® (SMP) pricing.

MCT® Bolsters Growing Sales Team with Addition of Industry Veteran Bill Shirreffs as Senior Director of Sales Operations

Bill Shirreffs joins MCT as Senior Director of Sales Operations to help manage the expansion of MCT’s entire sales team along with operations, sales leadership and overall strategy.

Market Summary & Outlook 2020

In this report, we review a few recent developments and explore trends in the mortgage and capital markets that have the greatest potential to impact mortgage lending in 2020.

15 Strategies for Improving Profitability in the Current Market

Our latest white paper outlines 15 actionable strategies mortgage lenders use to improve profitability. These include secondary marketing strategies, business operations and technology.

National Mortgage Professional Magazine Designates MCT’s CMO Ian Miller to 2019 Most Connected Mortgage Professionals List

MCT announced that its Chief Marketing Officer (CMO) Ian Miller, has been honored by National Mortgage Professional (NMP) magazine with its 2019 Most Connected Mortgage Professionals award.