Weekly Technology Improvement Series:

Pricing Granularity

Published 9/10/2021

MCT Marketplace features recent improvements on both the buy side and the sell side.

One of the primary functionality enhancements is in the Autobid software, which has new features for granularity on pricing and margins on bids.

For certain types of loans, investors can now easily manage pricing for sellers via new margining features on loans with specified value payups that allow the user to define in either bps or as a % of the total payup.

For example, maybe you want 50 bps and 50% of the spec payup on a particular loan.

Specs for Fannie, Freddie, and GNMA are handled in different ways and the new functionality in MCTlive! provides users the ability to load their own spec payup grid or use the derived payups to margin off of.

You can now build out your own programming rules. So, for example, on a Freddie cash retained loan, you can now choose from all applicable spec values and get as granular as you want on the filters.

It will recalculate daily pickup as the spec values get updated. It will also display a hit to price on a global level, such as for a low loan amount, and can adjust on a client level for loan attributes.

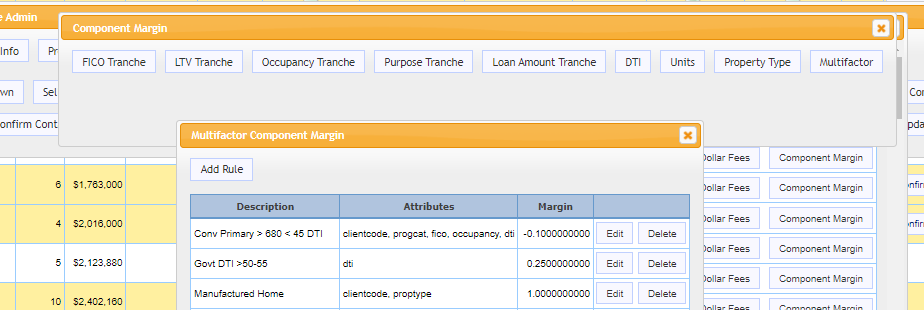

Our new multifactor rule builder for margins and overlays really drives home your point of being a self-managed, very sharp pricing tool for buyers.

This tool allows you to combine any attribute to define when a rule should apply. So, if you want a 5pt hit on loans with a PIW, TX, < 640 FICO, > 80% LTV, MH, for 5 of your sellers. You can do that!

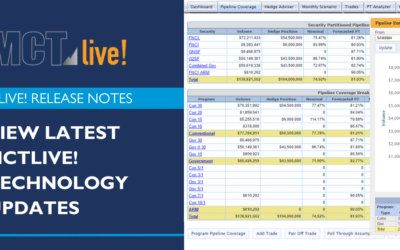

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

MCT Reports a 15% Decrease in Mortgage Lock Volume Amid Higher Rates

Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, reported a 15% decrease in mortgage lock volume compared to the previous month.

Case Study: Lincoln Federal Boosts Accuracy Despite 288% Volume Fluctuation with MCT’s Lock Desk

Lincoln Federal achieved 99.9% accuracy despite 288% volume fluctuation, saving $12K annually with MCT’s full-service Lock Desk.

MCT Announces 2.5% Increase in Mortgage Lock Volume Despite October Market Volatility

San Diego, CA – November 15, 2024 – Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, reported a 2.5% increase in mortgage lock volume compared to the previous month.

What is MSR Valuation? Mortgage Servicing Rights 101

Discover the fundamentals of Mortgage Servicing Rights, their benefits, risks, accounting methods, and key valuation drivers for long-term profitability.

CRA Acquisition & Correspondent Channel Tools from MCT Marketplace

In this webinar, MCT’s Justin Grant, Head of Investor Services, will discuss MCT Marketplace, an open loan exchange software that optimizes whole loan and co-issue mortgage transactions in the secondary market, offering clear investor benefits. Key tools to improve acquisition strategies include AutoBid for automating live bids, AOT automation for tri-party agreements, the Open Pipeline Viewer & CRA Marketplace for sourcing investor CRA and product needs, and AutoShadow for automated shadow bidding, along with analytics and rate sheet support.

MSR Market Monthly Update – November 2024

Click to read the most recent MSR Market Update! – Here we go again! Mortgage rates and all other rate indices continue their roller-coaster ride quarter after quarter. After so much anticipation of lower mortgage rates to remain throughout the rest of 2024, rates took a sharp U-turn and are back up about 68 basis points from their lows on September 30, 2024. The current rates reversal is significant since it took such a short time to get to back up to the same point where market rates were just three months ago. Click to read the full market update!

MCT Client Webinar – MCT Empowers Mortgage Hedging Performance with Customized Spec Durations

In this client-excusive webinar, MCT’s Phil Rasori and Andrew Rhodes provide an exclusive look into customizable duration analysis for specified loan products on MCTlive!

MCT Empowers Mortgage Hedging Performance with Customized Spec Durations

Mortgage lenders using the comprehensive capital markets platform MCTlive! now have the ability to increase, review, and refine the granularity of their spec durations.

MCTlive! Quarterly Release Notes in Q3 2024

Described below within relevant tabs, you’ll find a listing of our Q3 2024 technology developments. This update also includes technology release notes for MCT’s MSRlive! and Business Intelligence tools.

MCT Expands MSR Valuation Options with AD&Co Prepayment Model

MCT announced the integration of the LoanDynamics Model (LDM) from Andrew Davidson & Co. (AD&Co) into their mortgage servicing rights (MSR) valuation software.