Weekly Technology Improvement Series:

Pricing Granularity

Published 9/10/2021

MCT Marketplace features recent improvements on both the buy side and the sell side.

One of the primary functionality enhancements is in the Autobid software, which has new features for granularity on pricing and margins on bids.

For certain types of loans, investors can now easily manage pricing for sellers via new margining features on loans with specified value payups that allow the user to define in either bps or as a % of the total payup.

For example, maybe you want 50 bps and 50% of the spec payup on a particular loan.

Specs for Fannie, Freddie, and GNMA are handled in different ways and the new functionality in MCTlive! provides users the ability to load their own spec payup grid or use the derived payups to margin off of.

You can now build out your own programming rules. So, for example, on a Freddie cash retained loan, you can now choose from all applicable spec values and get as granular as you want on the filters.

It will recalculate daily pickup as the spec values get updated. It will also display a hit to price on a global level, such as for a low loan amount, and can adjust on a client level for loan attributes.

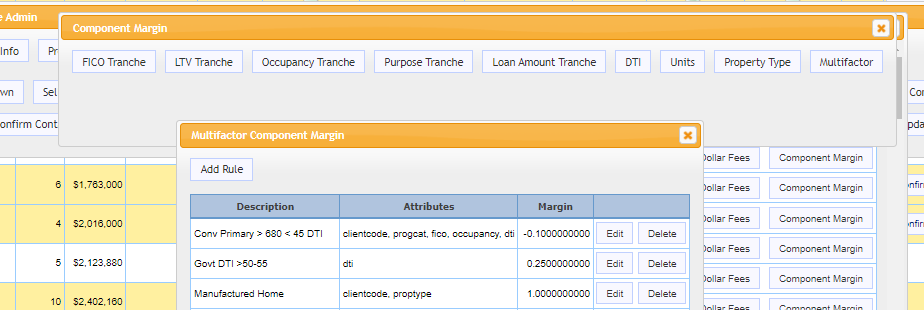

Our new multifactor rule builder for margins and overlays really drives home your point of being a self-managed, very sharp pricing tool for buyers.

This tool allows you to combine any attribute to define when a rule should apply. So, if you want a 5pt hit on loans with a PIW, TX, < 640 FICO, > 80% LTV, MH, for 5 of your sellers. You can do that!

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

MCT Client Webinar: Market Strategies for Hedging, Pull-Through Rates & Pricing

Join us Monday, March 9th at 10am PT for this client-exclusive webinar as we discuss recent market changes.

Rate Renegotiation: Policies that Protect Profit

View recommendations on how to employ rate renegotiation policies to guide your staff in mitigating profit loss using three example best practices.

MCT Client Webinar: MarketFlash Rate Renegotiations

This client-exclusive webinar focused on recent market volatility, as well as tools to help manage your pipeline and ongoing market movements. MCT’s Chief Operating Officer, Phil Rasori, will also review pull-through management and new functionality.

MCT’s Response to the FHFA’s Proposed Changes, Jan. 2020

Read MCT’s Response to the FHFA’s Proposed Changes, January 2020 to learn how elements of the proposal would be detrimental to the mortgage lending community and MBS market participants.

UPDATE: MCT® Integrates its MCTlive!® Secondary Marketing Software with Fannie Mae’s Pricing & Execution – Whole Loan® Application

UPDATE Jan. 23, 2020 – MCT is proud to announce that on December 18th they became the first organization to connect lenders to Fannie Mae’s Loan Pricing API via its Bid Auction Manager (BAM) loan trading platform for live Servicing Marketplace® (SMP) pricing.

MCT® Bolsters Growing Sales Team with Addition of Industry Veteran Bill Shirreffs as Senior Director of Sales Operations

Bill Shirreffs joins MCT as Senior Director of Sales Operations to help manage the expansion of MCT’s entire sales team along with operations, sales leadership and overall strategy.

Market Summary & Outlook 2020

In this report, we review a few recent developments and explore trends in the mortgage and capital markets that have the greatest potential to impact mortgage lending in 2020.

15 Strategies for Improving Profitability in the Current Market

Our latest white paper outlines 15 actionable strategies mortgage lenders use to improve profitability. These include secondary marketing strategies, business operations and technology.

National Mortgage Professional Magazine Designates MCT’s CMO Ian Miller to 2019 Most Connected Mortgage Professionals List

MCT announced that its Chief Marketing Officer (CMO) Ian Miller, has been honored by National Mortgage Professional (NMP) magazine with its 2019 Most Connected Mortgage Professionals award.

National Mortgage Professional Magazine Honors MCT’s Rhiannon Bolen with 2019 Mortgage Banking’s Most Powerful Women Award

SAN DIEGO, Calif., October 22, 2019 – Mortgage Capital Trading, Inc. (MCT), a leading mortgage hedge advisory and secondary marketing software firm, announced that Regional Sales Director Rhiannon Bolen was selected as one of Mortgage Banking’s Most Powerful Women for 2019 by National Mortgage Professional Magazine’s (NMP).