Weekly Technology Improvement Series:

Pricing Granularity

Published 9/10/2021

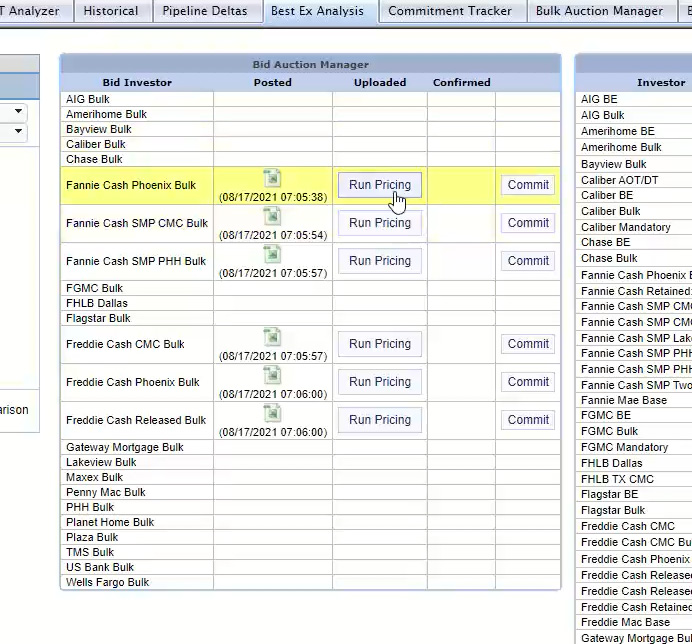

MCT Marketplace features recent improvements on both the buy side and the sell side.

One of the primary functionality enhancements is in the Autobid software, which has new features for granularity on pricing and margins on bids.

For certain types of loans, investors can now easily manage pricing for sellers via new margining features on loans with specified value payups that allow the user to define in either bps or as a % of the total payup.

For example, maybe you want 50 bps and 50% of the spec payup on a particular loan.

Specs for Fannie, Freddie, and GNMA are handled in different ways and the new functionality in MCTlive! provides users the ability to load their own spec payup grid or use the derived payups to margin off of.

You can now build out your own programming rules. So, for example, on a Freddie cash retained loan, you can now choose from all applicable spec values and get as granular as you want on the filters.

It will recalculate daily pickup as the spec values get updated. It will also display a hit to price on a global level, such as for a low loan amount, and can adjust on a client level for loan attributes.

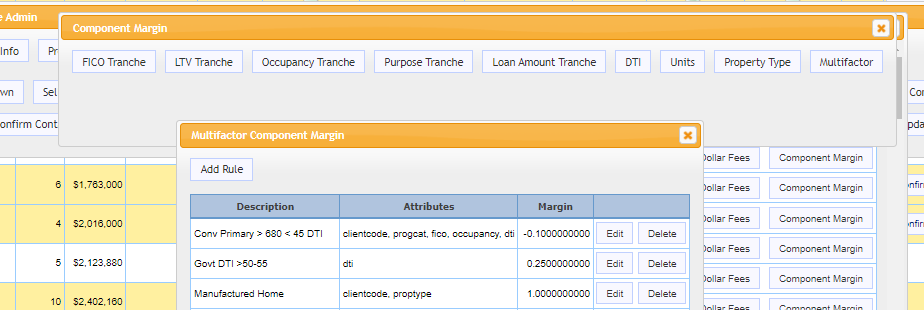

Our new multifactor rule builder for margins and overlays really drives home your point of being a self-managed, very sharp pricing tool for buyers.

This tool allows you to combine any attribute to define when a rule should apply. So, if you want a 5pt hit on loans with a PIW, TX, < 640 FICO, > 80% LTV, MH, for 5 of your sellers. You can do that!

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

MCT Industry Webinar – Deciphering GNMA Approval & Delivery

View the webinar recording and slidedeck from this webinar on June 25 at 11AM PT, where MCT experts discuss the processes for Ginnie Mae approval and delivery.

MCT Whitepapers: Ginnie Mae Field Guide Part 1 & 2

With “Ginnie Field Guides – Parts 1 and 2,” we hope to alleviate some of the nervousness surrounding this unique delivery method and to jump-start your confidence on the subject matter. In these “cliff notes” of the Ginnie Manual, helpful hints are provided by an MCT expert that has had first-hand experience with the nuances of delivering with Ginnie Mae.

MCT Industry Webinar – MSR Management through Market Disruption

In this webinar from May 28th at 11AM PT, MCT’s Phil Laren and Bill Berliner discussed current MSR market conditions, cash management and forbearance strategies.

5 Operational Best Practices for 2020 Market Volatility

COVID-19 has affected more than just people’s health; it has affected people’s ability to work and pay their mortgage. In this blog post, learn five best practices for secondary and operations managers to manage risk and succeed in times of market volatility.

Challenges & Solutions for Correspondent Lending in Crisis

Challenges & Solutions for Correspondent Lending in Crisis Challenges & Solutions for Correspondent Lending in Crisis View Webinar Recordings from April 8th and May 21st View Webinar Recordings from April 8th and May 21st In this post, we have included the...

Considerations for Increasing Best Efforts Lock Production

In this article, we will discuss how to adjust lock desk best practices to transition loan sales to Best Efforts during periods of market volatility. We will also provide some context to explain why switching to Best Efforts loan sales might be a necessity in some cases.

MCT Whitepaper: Lock Desk Centralization 101

Read MCT’s whitepaper Lock Centralization 101 to learn what operational changes to staff, procedures, and technology will need to be made in order to establish a centralized lock desk for your business.

HousingWire Names MCT® to 2020 Tech100 Mortgage List for Secondary Marketing Software Innovations

MCT was designated to HousingWire’s 2020 Mortgage Tech 100 list as one of the most innovative companies in the U.S housing economy as a result of multiple solutions and services it developed and successfully launched in 2019.

MCT Immediate Client Webinar – High Balance Executions

Join us for this immediate client webinar at 10:15AM PT as we discuss high balance executions.

MCT Webinar: Quarter-End Mark-to-Market Strategies for Market Volatility

View the recording from our webinar on March 31st at 11AM PT to learn more about the quarter-end Mark-to-Market reports, recent market events and MCT’s advocacy efforts during market volatility.