Weekly Technology Improvement Series:

Pricing Granularity

Published 9/10/2021

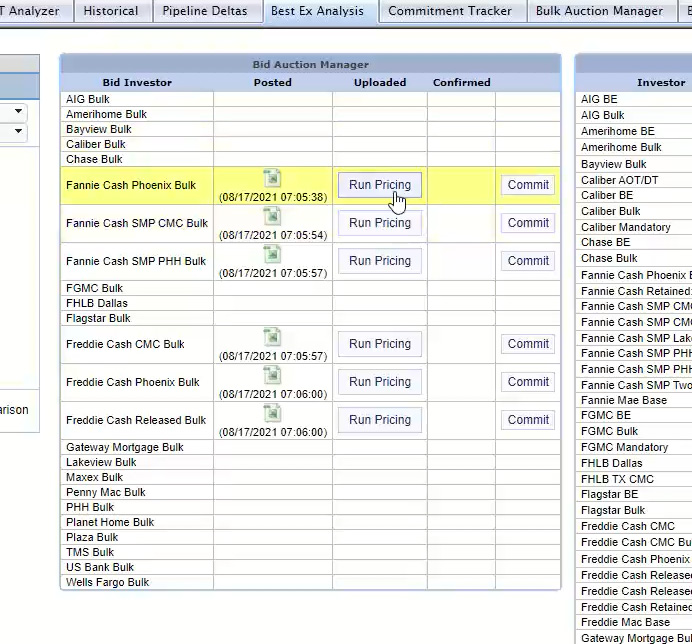

MCT Marketplace features recent improvements on both the buy side and the sell side.

One of the primary functionality enhancements is in the Autobid software, which has new features for granularity on pricing and margins on bids.

For certain types of loans, investors can now easily manage pricing for sellers via new margining features on loans with specified value payups that allow the user to define in either bps or as a % of the total payup.

For example, maybe you want 50 bps and 50% of the spec payup on a particular loan.

Specs for Fannie, Freddie, and GNMA are handled in different ways and the new functionality in MCTlive! provides users the ability to load their own spec payup grid or use the derived payups to margin off of.

You can now build out your own programming rules. So, for example, on a Freddie cash retained loan, you can now choose from all applicable spec values and get as granular as you want on the filters.

It will recalculate daily pickup as the spec values get updated. It will also display a hit to price on a global level, such as for a low loan amount, and can adjust on a client level for loan attributes.

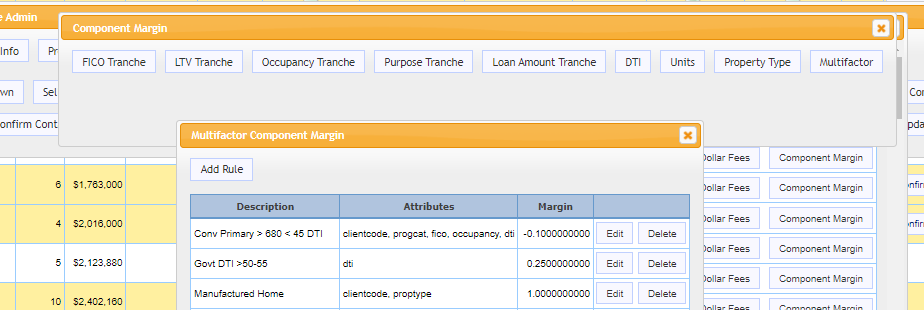

Our new multifactor rule builder for margins and overlays really drives home your point of being a self-managed, very sharp pricing tool for buyers.

This tool allows you to combine any attribute to define when a rule should apply. So, if you want a 5pt hit on loans with a PIW, TX, < 640 FICO, > 80% LTV, MH, for 5 of your sellers. You can do that!

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

Top 5 Takeaways for Bulk MSR Market: Q1 2021

With the first quarter over in 2021, the market for MSR sales is beginning to shift. Take a look below and review our Top 5 Takeaways for Bulk MSR Market.

How Does the Federal Reserve Affect Mortgage Rates?

In this article, we will discuss the structure of the Federal Reserve, how the Federal reserve supports the economy, and how it influences the demand of the three monetary policy tools.

2021 HW Tech100 Mortgage Award Announces MCT as Leader in Innovation

MCT® was announced as a 2021 HousingWire Tech100 Mortgage Winner. The Tech100 Mortgage Award recognized the most innovative and impactful technology companies serving the mortgage industry and forever changing the home sales process.

HousingWire & MCT Webinar – MSR Strategies in 2021

As MSR pricing and volatility begin to normalize in 2021, many portfolio managers are revisiting their short-term and long-term servicing strategy. In this webinar, MCT’s Phil Laren, David Burruss and several mortgage lenders reviewed current MSR market trends and strategies to optimize your portfolio.

How to Choose a Mortgage Hedge Advisor

In this article, we’ll provide some questions that will help you in your decision to select the best hedge advisor to help your company succeed. We’ll also review some key differentiating characteristics and services found in a full-service hedge advisory firm that will put you ahead of the competition for the long term.

MCT Whitepaper: Strategies for Credit Unions to Add Value to Members

In this whitepaper, we will examine a credit union’s process flow to identify potential improvements in areas such as secondary marketing, technology, automation, and business processes. The strategies explored in this whitepaper amount to over 50 basis points of potential improvement to margins based on the experiences of Credit Unions who have put them to use.

Case Study: MSR Services Improves Profitability of Doorway Home Loans

In this case study, Mr. Danilowicz explains how MCT’s MSR team helped Doorway Home Loans successfully facilitated a $1 billion MSR Sale. He also describes how MCT was instrumental in providing critical guidance through the 2020 market uncertainty and volatility.

MCT Webinar – Moving to Mandatory Loan Sale Delivery

In this webinar, MCT will discuss how lenders are leveraging mandatory loan sale delivery to improve profitability and manage risk with pipeline hedging. MCT will also review operational changes needed to move from best efforts to mandatory loan sales. Complete the form to join us on Wednesday, March 10th at 10AM PT.

New Agency Delivery Limits: Analysis & Recommendations Webinar

On January 14, new limits on agency cash window deliveries were announced for implementation in 2022. Set at $1.5MM per agency, these limits would require lenders who anticipate exceeding these limits in a rolling previous four quarters to switch to MBS delivery. Complete the form to join us for a webinar discussing these changes on February 19th at 10AM PT.

MCTlive! Pool Optimizer – Rasori’s Relentless Releases Episode 6

In this episode, phil Rasori covers the MCTlive Pool Optimizer functionality. This technology enables the use of actual cash window execution for optimization on each individual loan.