Weekly Technology Improvement Series:

Pricing Granularity

Published 9/10/2021

MCT Marketplace features recent improvements on both the buy side and the sell side.

One of the primary functionality enhancements is in the Autobid software, which has new features for granularity on pricing and margins on bids.

For certain types of loans, investors can now easily manage pricing for sellers via new margining features on loans with specified value payups that allow the user to define in either bps or as a % of the total payup.

For example, maybe you want 50 bps and 50% of the spec payup on a particular loan.

Specs for Fannie, Freddie, and GNMA are handled in different ways and the new functionality in MCTlive! provides users the ability to load their own spec payup grid or use the derived payups to margin off of.

You can now build out your own programming rules. So, for example, on a Freddie cash retained loan, you can now choose from all applicable spec values and get as granular as you want on the filters.

It will recalculate daily pickup as the spec values get updated. It will also display a hit to price on a global level, such as for a low loan amount, and can adjust on a client level for loan attributes.

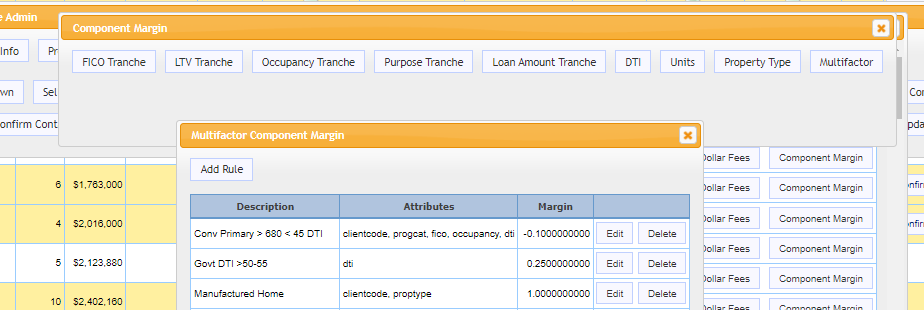

Our new multifactor rule builder for margins and overlays really drives home your point of being a self-managed, very sharp pricing tool for buyers.

This tool allows you to combine any attribute to define when a rule should apply. So, if you want a 5pt hit on loans with a PIW, TX, < 640 FICO, > 80% LTV, MH, for 5 of your sellers. You can do that!

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

MCT & Verity Webinar | Don’t Let Margin Compression Scare You

In this Halloween webinar, Chris Anderson is joined by Verity, Sam Mehta, to discusses labor optimization utilizing High Performance Activity (HPA) calculations, geographic workforce allocation, and utilizing technology for increased production.

MCT Deepens MSR Expertise with Hire of Azad Rafat

SAN DIEGO, CA, 10-08-2021 – MCT announced today that Azad Rafat has joined the company as the new Senior Director of MSR Services. Mr. Rafat will leverage his hands-on experience designing, building and managing mortgage servicing products to help MCT clients achieve their mortgage servicing goals.

MCT Webinar | Filling CRA Requirements with MCT Marketplace

In this webinar from October 12th, MCT staff review how you can leverage MCT’s new CRA sourcing functionality to identify and make offers on loans across the MCT client base to help meet your yearly CRA quotas.

Considerations for Internalizing Your Best Execution Loan Sales: Are You Ready?

In this post, we will explore the necessary considerations for lenders seeking to take ownership of their secondary market performance by internalizing their Best Execution Process (Best Ex).

Inc. 5000 Ranks MCT® on its 2021 Fastest Growing Private Companies List Again

Inc. 5000, the most prestigious ranking of the nation’s fastest-growing private companies, has named MCT to its annual list of winners. MCT ranked number 4176 with three-year sales growth of 71% percent and 2020 revenue of $32.3M. Though MCT did not make the list in 2020, this is our 10th year making the list.

Data Writeback – Rasori’s Relentless Releases: Weekly Technology Improvement Series

In MCT’s latest Rasori’s Relentless Releases, we discuss data writeback in MCTlive!.

Bid Tape Mapping for Non-Platform Tapes – Rasori’s Relentless Releases: Weekly Technology Improvement Series

In MCT’s latest Rasori’s Relentless Releases, we discuss bid tape mapping for non platform tapes in MCTlive!.

MCT Webinar | Impact of FHFA & Treasury Suspending Certain Portions of the 2021 PSPA

In this webinar, Phil Rasori reviews how changes to FHFA’s Preferred Stock Purchase Agreement and corresponding reactions from Fannie Mae and Freddie Mac will impact your business.

HousingWire Designates MCT’s Paul Yarbrough to Insiders Award List

Mortgage Capital Trading, Inc. (MCT®), an industry-leading mortgage hedge advisory firm, announced that Paul Yarbrough, Director of the Client Success Group, has been named to HousingWire’s Insider Awards list. The list is designed to honor an organization’s operational all-stars — those insiders who are the company’s best-kept secret, yet vital to its success.

The Future of Fannie Mae and Freddie Mac – A Conversation with Phil Rasori and Rob Chrisman

In this article, we sit down with Phil Rasori and Rob Chrisman to discuss the future of Fannie Mae and Freddie Mac with the impending appointment of a new FHFA director.