Weekly Technology Improvement Series:

Pricing Granularity

Published 9/10/2021

MCT Marketplace features recent improvements on both the buy side and the sell side.

One of the primary functionality enhancements is in the Autobid software, which has new features for granularity on pricing and margins on bids.

For certain types of loans, investors can now easily manage pricing for sellers via new margining features on loans with specified value payups that allow the user to define in either bps or as a % of the total payup.

For example, maybe you want 50 bps and 50% of the spec payup on a particular loan.

Specs for Fannie, Freddie, and GNMA are handled in different ways and the new functionality in MCTlive! provides users the ability to load their own spec payup grid or use the derived payups to margin off of.

You can now build out your own programming rules. So, for example, on a Freddie cash retained loan, you can now choose from all applicable spec values and get as granular as you want on the filters.

It will recalculate daily pickup as the spec values get updated. It will also display a hit to price on a global level, such as for a low loan amount, and can adjust on a client level for loan attributes.

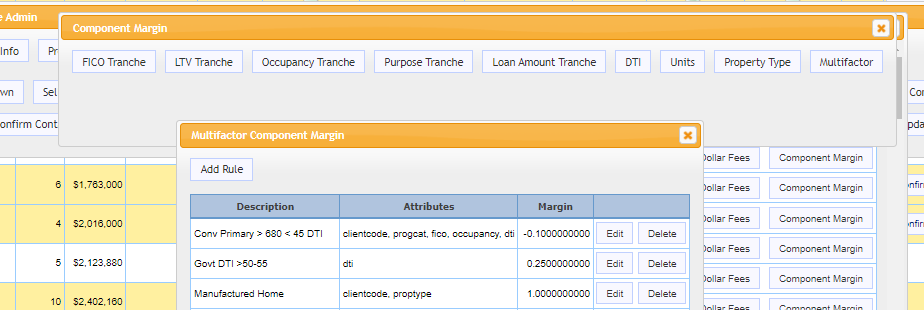

Our new multifactor rule builder for margins and overlays really drives home your point of being a self-managed, very sharp pricing tool for buyers.

This tool allows you to combine any attribute to define when a rule should apply. So, if you want a 5pt hit on loans with a PIW, TX, < 640 FICO, > 80% LTV, MH, for 5 of your sellers. You can do that!

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

Lock Volume Drops in December as Market Confronts Seasonal Lull and Uncertainty

Steeper-than-expected December mortgage lock volume drop as seasonality, shutdown uncertainty, and stubborn rates keep borrowers cautious.

Seasonal Slowdown Sets In as Mortgage Market Prepares to “Tread Water” into 2026

Lock volume fell 4% MoM on seasonal trends, while YoY gains persisted as markets await jobs data to guide rates and Fed policy into 2026.

MSR Market Monthly Update – December 2025

After the latest Federal Reserve 25 basis points rate cut, the Fed appears divided over the frequency and amount of future rate cuts. Read the full release for the December 2025 MSR update.

MCT and FICO Expand Collaboration to Integrate Predictive FICO® Score 10T with MSR Valuation and Investor Price Discovery

MCT and FICO expand integration of predictive FICO® Score 10T across MSR valuation, risk models, and investor pricing to enhance accuracy and market transparency.

MCT Hires Director of AI Solutions to Accelerate Agentic Workflows, Internal Efficiency, and Next-Generation Product Innovation

MCT appoints Rick Chakra as Director of AI Solutions to accelerate agentic workflows, boost internal efficiency, and advance next-gen innovation across the mortgage secondary market.

MSR Market Monthly Update – November 2025

Mortgage rates initially moved lower immediately after the Federal Reserve October’s 25 basis points rate cut. However, mortgage rates have since reversed course and have increased since the announcement. Read the full release for the November 2025 MSR update.

Agency Execution: What’s Changing and What It Means for Lenders

Join MCT’s client-exclusive webinar on agency execution changes, opt-in updates, and associated risks, plus a brief look at Non-QM executions in today’s market.

MCT November Indices: Mortgage Pricing Drops After Powell’s Comments, but October Lock Activity Held Steady as Shutdown Drags On

MCT’s November Indices show mortgage pricing dip after Powell’s comments, steady October lock activity, and signs of rate stabilization heading into 2026.

MCT Client Webinar – MCTlive!® Release Notes – Q3 2025

Join MCT’s client-exclusive webinar to explore Q3 2025 updates in MCTlive!® and Analytics tools, featuring live demos and expert insights.

Intro To Mortgage Banking

Learn the mortgage origination process, key loan and borrower characteristics, execution considerations, and the lasting impact of the GSEs and financial crisis on modern mortgage markets in this industry webinar.