Weekly Technology Improvement Series:

Pricing Granularity

Published 9/10/2021

MCT Marketplace features recent improvements on both the buy side and the sell side.

One of the primary functionality enhancements is in the Autobid software, which has new features for granularity on pricing and margins on bids.

For certain types of loans, investors can now easily manage pricing for sellers via new margining features on loans with specified value payups that allow the user to define in either bps or as a % of the total payup.

For example, maybe you want 50 bps and 50% of the spec payup on a particular loan.

Specs for Fannie, Freddie, and GNMA are handled in different ways and the new functionality in MCTlive! provides users the ability to load their own spec payup grid or use the derived payups to margin off of.

You can now build out your own programming rules. So, for example, on a Freddie cash retained loan, you can now choose from all applicable spec values and get as granular as you want on the filters.

It will recalculate daily pickup as the spec values get updated. It will also display a hit to price on a global level, such as for a low loan amount, and can adjust on a client level for loan attributes.

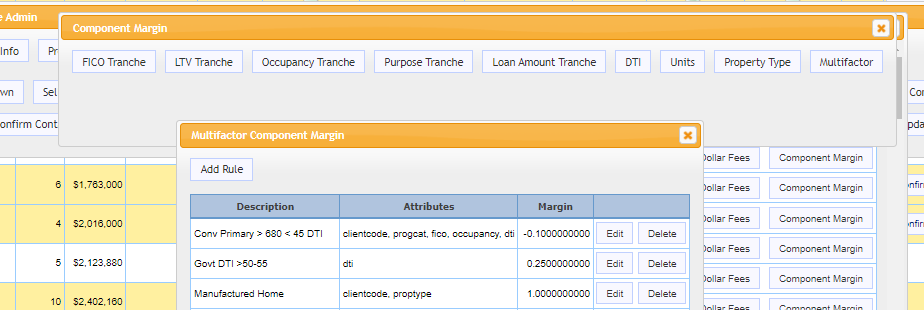

Our new multifactor rule builder for margins and overlays really drives home your point of being a self-managed, very sharp pricing tool for buyers.

This tool allows you to combine any attribute to define when a rule should apply. So, if you want a 5pt hit on loans with a PIW, TX, < 640 FICO, > 80% LTV, MH, for 5 of your sellers. You can do that!

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

MCT & ACUMA Webinar – Strategies for Credit Unions to Mitigate Market Risk

This webinar will provide a current market overview and include actionable insights and recommendations for credit unions to mitigate market risk.

MCT & Lenders One Webinar – Strategies to Improve Profitability in the Current Market

This webinar will provide a current market overview and include actionable insights and recommendations for lenders to mitigate market risk and improve profitability.

MCT Webinar – Strategies to Improve Profitability in the Current Market

In this webinar, MCT’s Phil Rasori and Paul Yarbrough will provide a current market overview and include actionable insights to improve profitability for lenders. Attendees will receive key hedging, trading, best execution, and MSR recommendations, as well as how to leverage technology to improve profitability and efficiency.

MCTlive! Lock Volume Indices: April 2023 Data

MCTlive! Mortgage Lock Volume Indices covers the period from April 1 through April 30, 2023, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.

MCT AOT Automation Improves Mortgage Lender Profitability and Investor Efficiency

Mortgage Capital Trading, Inc. (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, announced that it has automated the process of digital TBA trade assignment during the loan sale process for both mortgage lenders and participating correspondent investors.

MCTlive! Lock Volume Indices: March 2023 Data

MCTlive! Mortgage Lock Volume Indices covers the period from March 1 through March 31, 2023, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.

March Housing Market Update: After Silicon Valley Bank Collapse

Unless you live under a rock, or in an increasingly blissful state of ignorance, you have likely noticed that government-bond yields have fallen the most since 2008

2023 HW Tech100 Mortgage Award Announces MCT as Leader in Innovation

MCT® was announced as a 2023 HousingWire Tech100 Mortgage Winner. The Tech100 Mortgage Award recognized the most innovative and impactful technology companies serving the mortgage industry and forever changing the home sales process.

BSI Financial Joins MCT’s Co-Issue Marketplace

BSI Financial Services (BSI) has become the latest investor to join BAMCO, MCT’s new marketplace for co-issue loan sales. BAMCO brings co-issue transactions directly into MCT’s whole loan trading platform and improves price transparency by connecting unapproved sellers to live executions from potential buyers.

MCTlive! Lock Volume Indices: February 2023 Data

MCTlive! Mortgage Lock Volume Indices covers the period from February 1 through February 28, 2023, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.