Weekly Technology Improvement Series:

Pricing Granularity

Published 9/10/2021

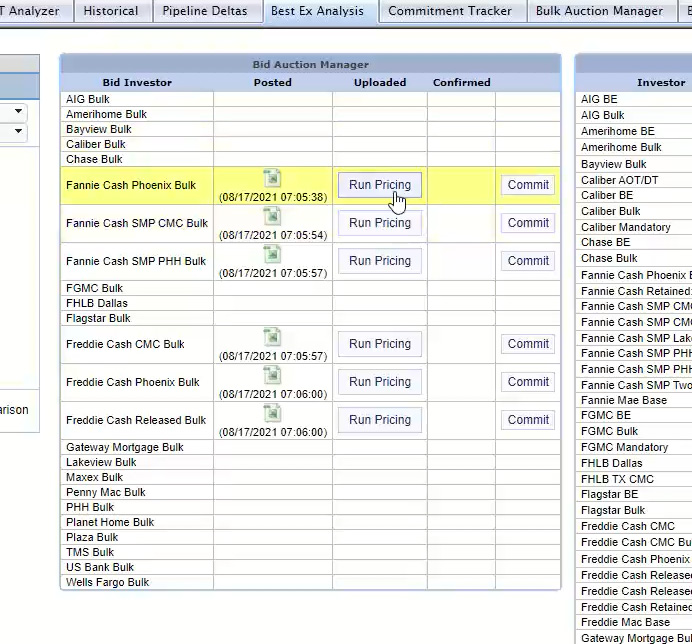

MCT Marketplace features recent improvements on both the buy side and the sell side.

One of the primary functionality enhancements is in the Autobid software, which has new features for granularity on pricing and margins on bids.

For certain types of loans, investors can now easily manage pricing for sellers via new margining features on loans with specified value payups that allow the user to define in either bps or as a % of the total payup.

For example, maybe you want 50 bps and 50% of the spec payup on a particular loan.

Specs for Fannie, Freddie, and GNMA are handled in different ways and the new functionality in MCTlive! provides users the ability to load their own spec payup grid or use the derived payups to margin off of.

You can now build out your own programming rules. So, for example, on a Freddie cash retained loan, you can now choose from all applicable spec values and get as granular as you want on the filters.

It will recalculate daily pickup as the spec values get updated. It will also display a hit to price on a global level, such as for a low loan amount, and can adjust on a client level for loan attributes.

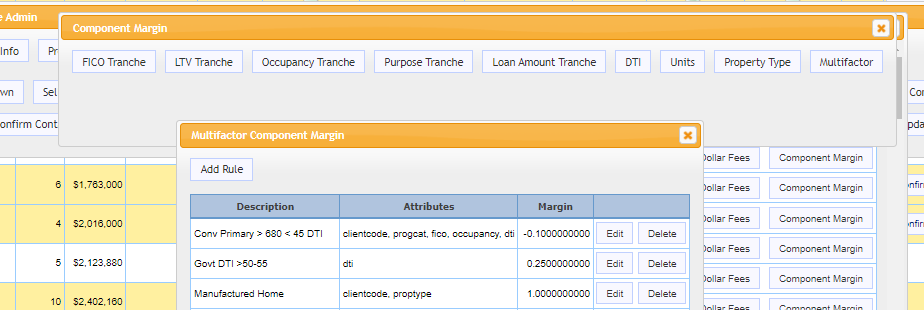

Our new multifactor rule builder for margins and overlays really drives home your point of being a self-managed, very sharp pricing tool for buyers.

This tool allows you to combine any attribute to define when a rule should apply. So, if you want a 5pt hit on loans with a PIW, TX, < 640 FICO, > 80% LTV, MH, for 5 of your sellers. You can do that!

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

Case Study: Vellum Mortgage Improves Profitability & Efficiency with MCT

Through MCT’s software and services, Vellum Mortgage has improved profitability, efficiency, and added new investors. To accomplish this goal, they rely on BAM Marketplace, MCTlive!, and the Business intelligence tool.

MCT Whitepaper: Getting Started with Agency Approvals

This whitepaper outlines why having a Fannie Mae, Freddie Mac, or Ginnie Mae approval adds value to a mortgage company or depository and offers some important tips on how to obtain that valuable approval.

MCT Webinar – MCT Geocoding & Bid Tape Protection Initiatives

In this webinar, MCT’s Phil Rasori, Chris Anderson, and Justin Grant discuss MCT’s efforts to improve data security in the loan sale process.

MCT Appoints Steve Pawlowski Head of Technology Solutions to Continue Industry-Changing Innovation

SAN DIEGO, Calif., Aug. 10, 2023 – Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, today announced the appointment of Steve Pawlowski as Managing Director, Head of Technology Solutions.

July’s Mortgage Lock Volume Flat Amongst Rising Rates in Latest MCT Indices Report

MCTlive! Mortgage Lock Volume Indices covers the period from July 1 through July 31, 2023, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.

MCT Client Webinar – Our Work to Protect Your Data

Join MCT’s Phil Rasori and Chris Anderson for an important webinar on data security at MCT and in the loan sale process.

Monthly Mortgage Lock Volume Increases 31% in Latest MCT Indices Report

MCTlive! Mortgage Lock Volume Indices covers the period from June 1 to June 30, 2023, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.

MCT Client Webinar – Streamlining and Standardizing AOT Executions

MCT’s Phil Rasori and Andrew Rhodes, as well as Agile’s Greg Vacura present this webinar on MCT’s effort to standardize AOT executions and confirmations from July 13th.

Case Study – NBH Bank Leverages 10 Day MCT Rapid Onboarding

In this case study, Ajay Timothy and Thia Kaleta of NBH Bank describe their process getting started with MCT and how they were able to get mortgage pipeline hedging and best execution loan sales up and running in just ten days.

MCTlive! Lock Volume Indices: May 2023 Data

MCTlive! Mortgage Lock Volume Indices covers the period from May 1 through May 31, 2023, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.