I’m sure there are plenty of us who would love to forget 2022, but let’s recap what happened in the bond and housing markets and put a bow on the year before we move to a hopefully more profitable 2023.

Read on for our synopsis and summary of this past year in the housing and bonds market. We recommend you also read our housing market predictions for 2023 blog post for an outlook on the future.

The 2022 Housing Market Environment

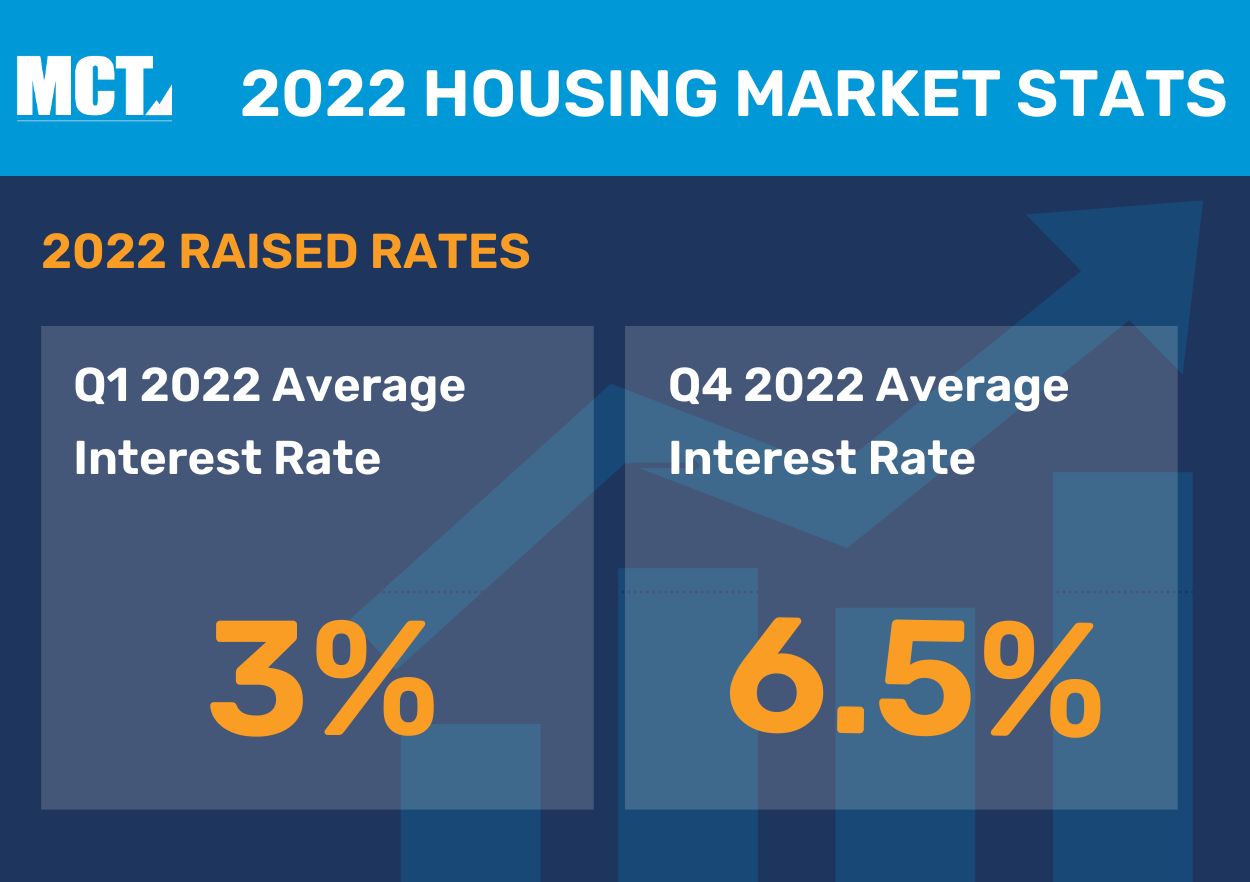

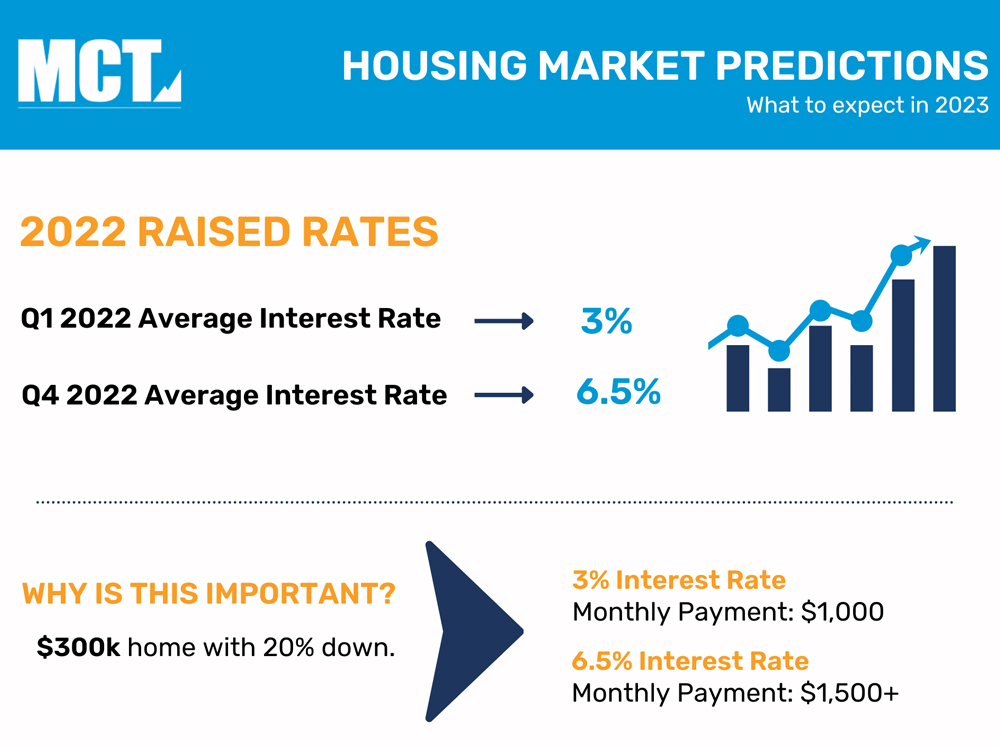

As traders returned to action at the beginning of 2022, it was to a market dominated by milder COVID concerns, that had been replaced by worries over inflation and monetary tightening by the Fed.

The high demand for housing coupled with low rates over 2020 and 2021 saw originators thrive, but the housing market in 2022 shifted into a new era heavily influenced by inflation and lack of supply.

Rates were artificially low over the past couple of years due to the Fed’s actions (Since January of 2020, the Fed’s MBS balance sheet grew more than 93% to $2.7 trillion), and there was a big displacement in the MBS market as the Fed’s presence waned.

Low mortgage rates helped create the current balance of supply and demand. Millions of homeowners refinanced into historically low mortgage rates after the onset of the pandemic, which helped keep existing home supply low.

Those low mortgage rates also increased home purchasing power and spurred those on the fence about buying a home to hop in on the action, or at least try to. The result is that nobody wants to sell their home, and purchasing power has declined with the rise in rates.

Rising incomes are expected to offset the increase in mortgage rates, meaning DTIs aren’t going to change all that much, and professional investors will still find mortgage assets attractive relative to other investment opportunities.

Housing supply is expected to remain tight, and demand is still there due to the wave of millennial first-time buyers, work-from-home individuals looking to buy, and millions of refinance candidates. It would take a considerable decrease in home buyer demand and/or an increase in housing inventory to return things toward a balanced real estate market.

The Federal Reserve\’s Calculus

With inflation sitting at its highest level in four decades, the question for much of the year was (and is) how much the Fed will put the brakes on the economy and cause demand to subside, and how much monetary tightening the economy can take. The Fed’s most aggressive actions since the 1980’s this year lifted the target range of their benchmark rate from nearly zero in March to a current 4.25% to 4.5%.

Investors were forced to constantly re-calibrate expectations for further rate hikes; expectations in January were for a Fed funds rate between 2.5% and 2.75% by the end of 2022. Following four straight 75 BPS moves, the Fed most recently enacted a 50 BPS hike after its December meeting.

There are the unfortunate costs of reducing inflation (higher interest rates, slower growth, and softer labor market conditions) that will bring some pain to households and businesses, but a failure to restore price stability would mean far greater economic pain.

Markets have interpreted recent Fed comments as: “We are going to raise rates higher and keep them there longer than the market is anticipating. There is a serious commitment to getting inflation back down to 2%, and if that causes a recession, so be it.” The Fed has repeated that price stability is essential if we are going to have another sustained period of strong labor market conditions.

The Fed’s Aggressive Strategy in 2022

In addition to raising the overnight Fed funds rate, the Fed exited the MBS and security purchase space as it wrapped up QE4. QE4 was by far the most aggressive and largest of all the QE programs, helping spark both record levels of agency mortgage bond issuance and a home price boom. It is not the role of the Federal Reserve to keep such an extensive amount of MBS on its balance sheet. A more appropriate place for MBS is in the hands of private investors, mutual funds, and insurance companies, traditional owners.

In a plan outlined at the Fed’s May meeting, policymakers began winding down its $9 trillion balance sheet on June 1 at an initial combined monthly pace of $47.5 billion of Treasuries and agency MBS. The runoff rate increased to $95 billion in September which puts the Fed on track to reduce its balance sheet by about $3 trillion over the next three years. The exit of the largest buyer in the MBS space caused a huge hole in demand and helped drive up interest rates.

The rise in interest rates this year has caused MBS spreads, the difference in yield between a Treasury security and corresponding MBS, to widen considerably compared to what has been seen over the past half-decade. Wide spreads means that mortgage rates are high relative to underlying interest rates. Because agency MBS have no credit risk (they are guaranteed by the government), the widening was due to overall liquidity and volatility in the bond market.

MBS spreads in 2022 were wider than they were at the peak of the financial crisis in December 2008 and wider than they were at the start of the pandemic in 2020 when the MBS market froze and the mortgage REITs were bedeviled by margin calls.

New home sales are about 5% below the average seen over the past decade, but down roughly 25% from the 764,000 average seen over the past two years. Stay tuned to see if housing prices will continue to drop.

The Case for Optimism in 2023 Market

Let’s make no bones about it, we are in a tough environment. Fortunately, we have seen a rally in rates from the 2022 high of 7.16% on 30-year mortgage lending rates in late October. For the mortgage industry, a large focus throughout the year was on taking share in a shrinking market. Housing demand still drastically outpaces supply, and high mortgage rates do little to change that dynamic. Builders aren’t building enough to keep up with demand, and very few people are selling.

There is, of course, optimism on the horizon for 2023. Many indicators depict a healthy economy as we enter the new year, especially if supply chain issues clean themselves up. The labor market is tight, wages are rising, and many households have excess savings accrued over the last two years that will help to cushion the blow against rising prices. The Fed will eventually reach its peak target rate, pause, allow roll off to continue, and let the economy adjust. There are rising odds of a rate cut by next November, but before we get ahead of ourselves, remember that rates are set to rise further and stay at restrictive levels for some time.

Remember to read housing market predictions for 2023 blog for an outlook on the future!

Time to Fully-leverage Secondary Mortgage Markets

In times of lean volume, lenders need to maximize their gain on sale, as such they must fully-leverage the secondary mortgage markets.

At MCT, we are always pushing the boundaries of digitization and automation in pursuit of efficiency, transparency, and profitability for our clients. At the same time, we pay cautious and necessary consideration to security and privacy of client data and information. We have a 20-year track record of doing what’s right for our clients.

We meet clients wherever they are in their growth cycle. And if they opt for autonomous use of our award-winning, all-inclusive capital markets platform, we’re ready to enable them. Near-term and long-term, it’s about helping our clients thrive.

Contact us today to learn more.

Subscribe for More Housing Market Updates

When you join our newsletter you get access to our daily and weekly housing industry commentary.