Weekly Technology Improvement Series:

Pricing Granularity

Published 9/10/2021

MCT Marketplace features recent improvements on both the buy side and the sell side.

One of the primary functionality enhancements is in the Autobid software, which has new features for granularity on pricing and margins on bids.

For certain types of loans, investors can now easily manage pricing for sellers via new margining features on loans with specified value payups that allow the user to define in either bps or as a % of the total payup.

For example, maybe you want 50 bps and 50% of the spec payup on a particular loan.

Specs for Fannie, Freddie, and GNMA are handled in different ways and the new functionality in MCTlive! provides users the ability to load their own spec payup grid or use the derived payups to margin off of.

You can now build out your own programming rules. So, for example, on a Freddie cash retained loan, you can now choose from all applicable spec values and get as granular as you want on the filters.

It will recalculate daily pickup as the spec values get updated. It will also display a hit to price on a global level, such as for a low loan amount, and can adjust on a client level for loan attributes.

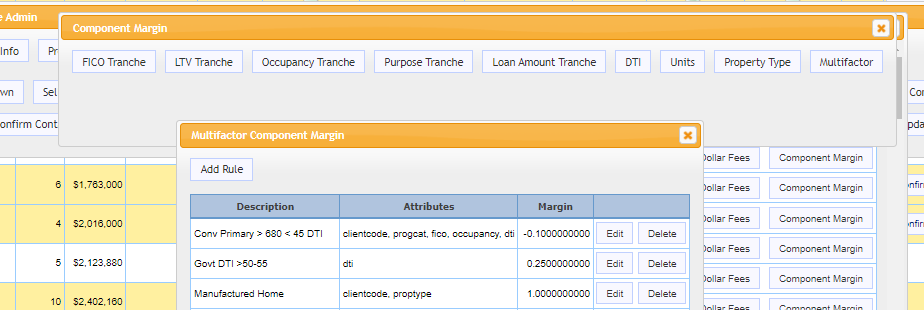

Our new multifactor rule builder for margins and overlays really drives home your point of being a self-managed, very sharp pricing tool for buyers.

This tool allows you to combine any attribute to define when a rule should apply. So, if you want a 5pt hit on loans with a PIW, TX, < 640 FICO, > 80% LTV, MH, for 5 of your sellers. You can do that!

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

Monthly Mortgage Volume Decreases 10.7% in Latest MCT Indices Report

Mortgage Capital Trading, Inc. (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, today announced a 10.7% decrease in mortgage lock volume compared to the previous month. This revelation comes as part of MCT’s monthly Lock Volume Indices report, offering valuable insights into the dynamic landscape of the residential mortgage industry.

MCT Whitepaper: Margin Management Best Practices

This whitepaper reviews the intricate world of margin management, a pivotal driver of success in the ever-transforming mortgage industry. Learn how analyzing market share dynamics and volume trends becomes a strategic compass for effective margin management.

MCT Webinar: The Great Inflation vs. 2024: Analysis & New Tools for the Current Market

In this webinar, Phil Rasori and Andrew Rhodes will share analysis on the current market, comparison to relevant historical precedent, and new MCT software functionality to equip lenders in this challenging market.

Mortgage Volume Continues Downward Trend in Latest MCT November Indices Report

Mortgage Capital Trading, Inc. (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, reported today a drop of 17.76% in mortgage lock volume over the prior month. Complete the form to download the full report.

MCT’s Cara Krause Honored with the Powerful Women of Mortgage Banking Award by Mortgage Banker Magazine

– Mortgage Capital Trading, Inc. (MCT), the de facto leader in innovative mortgage capital markets technology, announced that Cara Krause, VP, Northeast Regional Sales, has been selected as one of the Powerful Women of Mortgage Banking 2023 by Mortgage Banker Magazine. The annual awards recognize successful women who are shattering the glass ceiling and making significant impact in the industry.

MCT Mortgage Industry Perspectives

What Gets You Through Down Cycles in the Mortgage Market? In this new MCT series, we are asking secondary market professionals topical questions you’re also probably pondering as well.

MCT Industry Webinar: Maximize Loan Trading Profits with MCT Marketplace

With limited mortgage volume, you need to make the most of every loan trade. MCT Marketplace is the largest mortgage asset exchange for the U.S. secondary market that is pushing the industry forward with new efficiencies and executions. View this webinar featuring MCT’s Phil Rasori, Paul Yarbrough, and Justin Grant for a practical guide to maximizing your loan trading profits.

High Rates & Low Supply Drag Down Mortgage Volume in MCT October Indices Report

MCTlive! Mortgage Lock Volume Indices covers the period from September 1 to September 30, 2023, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.

Mortgage Capital Trading Named Best Place to Work 2023 by SDBJ

Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced that it has been named one of the Best Places to Work 2023 by the San Diego Business Journal (SDBJ).

MCT and Freddie Mac Webinar: Current Economic and Housing Outlook, Affordable Lending Strategies and Technology Solutions

Complete the form to join Freddie Mac’s Ajita Atreya and Mia Jones, along with MCT’s Paul Yarbrough for this webinar on Thursday, October 5th, 10-11a.m. PT.