Strategies For Mitigating Risk in a Volatile Market

In this article, we will discuss strategies for mitigating risk in a volatile market. The type of volatility that has been experienced by mortgage bankers in 2022 due to a widening basis.

In this article, we will discuss strategies for mitigating risk in a volatile market. The type of volatility that has been experienced by mortgage bankers in 2022 due to a widening basis.

In MCT’s latest installment of Rasori’s Relentless Releases, Phil Rasori covers the new Fannie Mae purchase advice API. View the episode to get the scoop on these timely updates.

In MCT’s latest installment of Rasori’s Relentless Releases, Phil Rasori covers the features of the MCTlive! Mobile App. View the episode to get the scoop on these timely updates.

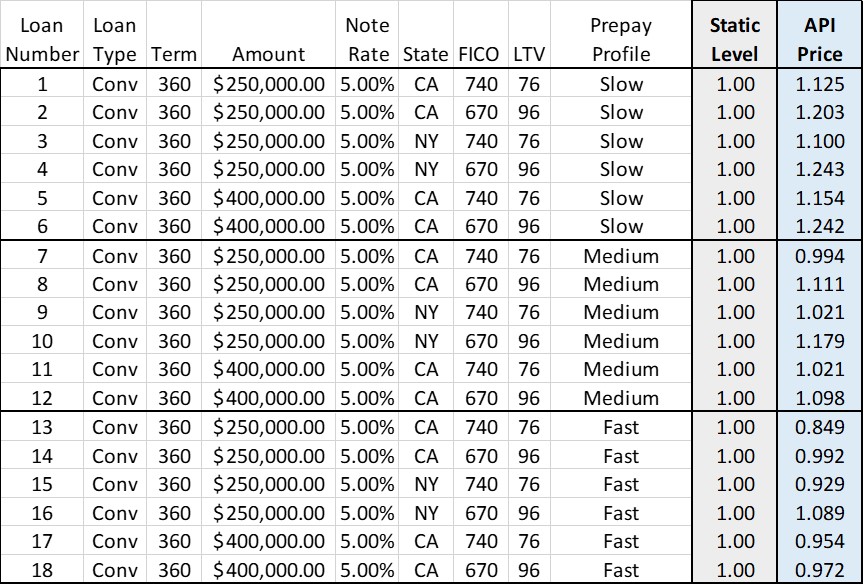

With the new MSRlive! API, you can develop pricing that includes key loan-level characteristics such as location, FICO, loan-to-value (LTV), and more in real time. By factoring in these elements, there is an opportunity which allows avoiding overpaying for potentially underperforming assets.

In this article, we will discuss the similarities and differences between the market selloffs in 2013 and 2022. 2022 has had the benefit of a much more orderly move and a healthier marketplace.