Mortgage-backed securities (MBS) are investment products composed of pools of home loans that generate returns for investors and provide liquidity for lenders. These securities fluctuate with the market and directly impact mortgage pricing and mortgage rates.

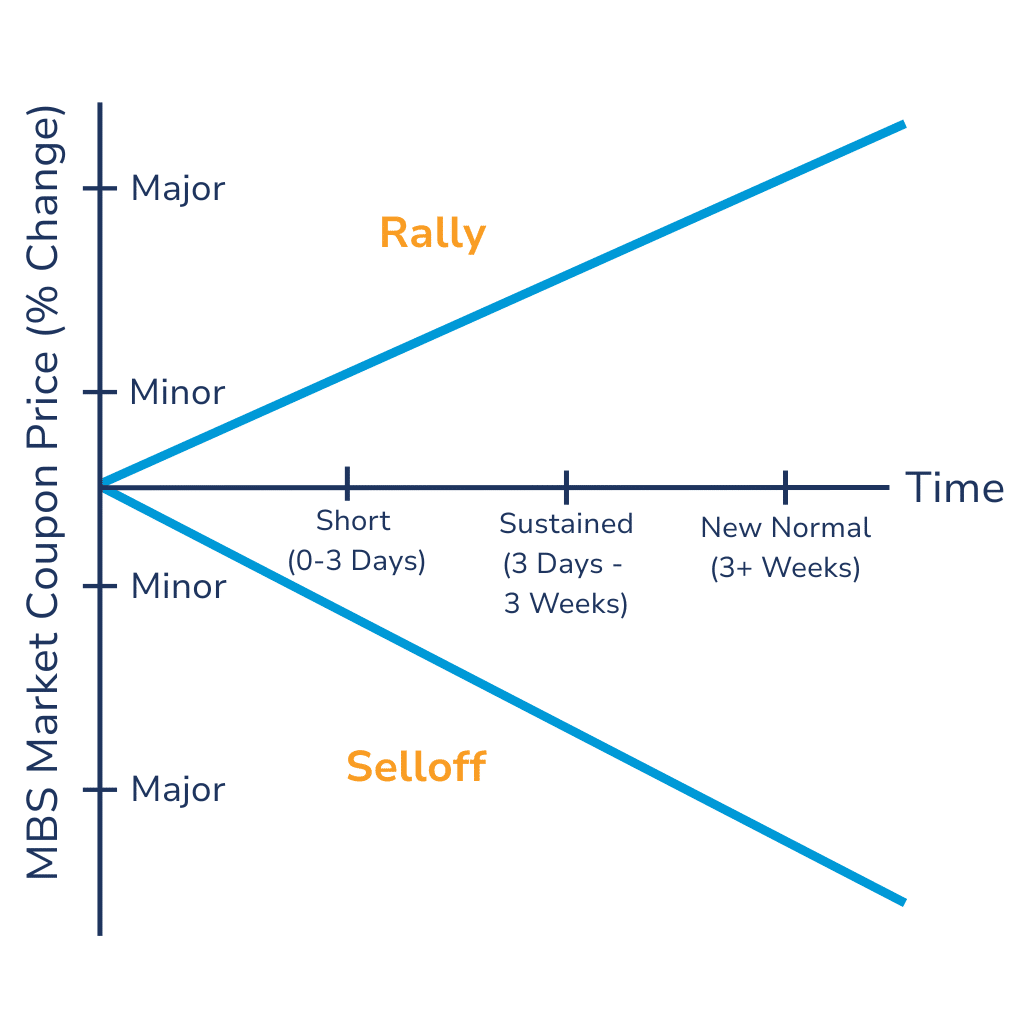

When the price of mortgage-backed securities fluctuates, whether due to a market rally or a bond selloff, lenders can face acute risk or recognize opportunity depending on how they respond.

Given the dynamic nature of the MBS market, mortgage professionals must be informed and adapt quickly to market movements.

Explore the dynamics behind movements in the MBS market, insights on adapting a hedge strategy to changing conditions, and functions to use within MCTlive! during MBS market movement.

Table of Contents:

How to React to MBS Market Movement

Understanding what causes bond yields to rise is crucial to navigating market shifts and protecting mortgage loan pipelines.

Bond yields rise when bond prices fall, but the reasons behind those price drops vary, and so should the response.

In both scenarios, adjusting MCTlive! pipeline management strategy based on market sentiment can improve performance and reduce unnecessary exposure.

Learn More

Scenario 1: Risk-On Market Sentiment (“Animal Spirits”) & MBS Market Deterioration

Note: The scenarios below represent observed market patterns, but MBS movements can be influenced by multiple factors simultaneously. Always consider the broader economic context and multiple indicators when making operational or strategic decisions.

When bond yields rise and prices fall, it sometimes reflects returning macroeconomic confidence and “risk-on” sentiment as investors move capital from bonds back into stocks and other risk assets. This represents the opposite of a “flight from safety” as investors seek higher returns in equity markets.

- Potential signal: Capital rotation from bonds to stocks driven by optimism and risk appetite.

- What to do: Monitor pipeline fallout and status migration closely, use the live data tools and pull-through adjustments in MCTlive! to reassess hedge coverage, watch for margin exposure, and consider deploying AOTs.

Event: Donald Trump’s surprise victory in the 2016 U.S. presidential election.

Market Reaction: Equities surged, Treasury yields spiked, and MBS prices fell sharply.

Scenario 2: Standard MBS Rally (Risk-Off/Flight to Safety)

During an MBS market rally, investors seek safety and purchase bonds as they move capital away from stocks and other risk assets. This drives up bond prices and pushes yields lower, often in response to economic uncertainty.

- Potential signal: A flight to safety driven by investor caution or expectations of economic slowdown.

- What to do: Watch for increased borrower renegotiation requests and update rate renegotiation policies if needed. Use coupon breakdown tools and TBA indications in MCTlive! to refine hedge precision, avoid stale pipeline data, and preserve pricing discipline.

Event: Global markets unraveled in early March and April 2020 as COVID-19 spread rapidly, prompting lockdowns and widespread economic shutdowns.

Market Reaction: Risk-off sentiment. Investors fled to cash and ultra-safe assets like U.S. Treasuries. Even typically “safe” assets like MBS experienced severe dislocation.

Scenario 3: The “Double Sell-Off” (Fear-Driven Volatility)

During periods of extreme market stress, investors may simultaneously sell both stocks and bonds, driving yields higher across most assets as capital flees to cash, money market funds, or ultra-short Treasuries. This scenario typically occurs during financial crises, severe economic shocks, or periods of extreme uncertainty when the appetite for even traditionally “safe” bonds is reduced.

- Potential signal: Systemic fear, liquidity concerns, margin calls across asset classes, or expectations of severe economic disruption that makes cash the only perceived haven.

- What to do: Prepare for significant pipeline fallout and potential margin calls. Monitor cash positions closely and ensure adequate liquidity. Consider defensive positioning and avoid over-leveraging.

Event: Silicon Valley Bank (SVB) collapsed seemingly overnight in March 2023, triggering the third-largest bank failure in U.S. history. Fears spread quickly through the financial system, leading to dramatic shifts in investor behavior.

Market Reaction: While U.S. Treasuries rallied on safe-haven demand, the MBS market buckled under pressure as liquidity evaporated and bid-ask spreads widened. The typical relationship between Treasuries and MBS broke down, causing severe pricing dislocation. Mortgage lenders were left exposed as hedges lost effectiveness and execution became unpredictable.

What is a Rally in the MBS Market?

An MBS market rally happens when bond prices rise and yields fall. In general, this reflects a shift in investor sentiment towards safety, which can be triggered by economic uncertainty among other factors.

During a bond market rally, mortgage rates are pushed lower to align with falling MBS yields. Lenders, in turn, may lower the rate they offer borrowers to match the market and reduce the risk of fallout in their pipeline.

If the lender has already locked rates with borrowers at higher levels, but market rates decline, the hedge may no longer align perfectly due to changes in their pipeline (i.e. increased fallout/floatdowns/renegotiations). If the lender has already locked rates with borrowers at higher levels when market rates decline, those locked loans increase in value since they carry above-market rates, while the corresponding hedge position (typically TBA MBS) will decrease in value.

The heightened risk during market fluctuations comes from changes to the pipeline itself and overall market dynamics: new loans entering at different rate levels, funded loans exiting the pipeline, TBA MBS liquidity and shifts in pull-through expectations and investor appetite.

These pipeline changes may alter the optimal hedge coverage ratio, and the consequences of being under-covered or over-covered become much more severe when markets are swinging dramatically up or down.

Learn More

Best Practices in a MBS Market Rally

When the MBS market rallies and rates begin to fall, lenders should take proactive steps to protect margins, manage risk, and stay operationally adaptable.

- Review and enforce rate renegotiation policies: Falling rates often lead to an increase in borrower renegotiation requests. Review and enforce Rate Renegotiation Policies & Procedures. A consistent approach can help protect profitability and support borrower relationships.

- Ensure liquidity for trading: Ensure enough liquidity to act quickly during market movement.

- Bid tape AOT executions can help relieve the pressure on TBA pair-offs by reducing pair-off risk and improving pricing.

- Margin calls can come at any time, especially in volatile conditions, and are not applied uniformly by all broker-dealers. Lenders should be prepared and understand each dealer’s policies.

- Broker-dealer trading line availability and capacity should be monitored to ensure there’s room to maneuver and execute in fast-moving markets.

- Liquidity of “fringe” coupons at either end of the stack will be more susceptible to larger market swings making it more difficult and expensive to get in or out of those positions as the bid/ask spread widens.

- Ensure liquidity for funding and cash on hand: Loans need to be funded quickly during a market rally. As rates drop and volume increases, having access to cash is crucial for closing on time and meeting investor deadlines.

- Fannie Mae and Freddie Mac typically fund within 24–48 hours, offering a reliable secondary market outlet.

- Warehouse lines vary in capacity and turn times, so lenders should maintain strong communication with partners and avoid overextending.

- Best execution and cash management trade-offs should be evaluated regularly to balance profitability and liquidity needs.

- Manage new production strategically: In a fast-moving market, it’s important to be thoughtful about how new loans are added to your hedge. If conditions are volatile, temporarily locking some new production as Best Efforts can help limit risk and allow more flexibility while the market settles. Another risk mitigation strategy is to limit or restrict after-hr locks during periods of high volatility.

- Protect profit margins: Use lock and pricing strategies to compete and control volume when needed. This ensures operations remain profitable and manageable as rates shift.

What is a Bond Market Selloff?

An MBS market selloff occurs when bond prices fall and yields rise. This can signal a shift toward riskier assets, concerns about inflation, strong economic data, or potential Fed rate hikes. A bond market selloff can also signal a return to investor optimism and appetite for risk, as capital flows out of bonds and into stocks and other higher-yielding assets.

During a bond market selloff, mortgage rates are pushed higher to align with rising MBS yields. Lenders may respond by increasing the rates they offer to borrowers to stay aligned with the market.

If a lender has committed to lower mortgage rates before the selloff, their locked loans may now be priced below market, exposing them to potential losses on those loans. If they were properly hedged, they should be insulated against the initial movement with those corresponding TBA MBS trades being in the money, but increased vigilance is needed during a sustained selloff.

To stay protected, lenders should trade consistently as production comes in, maintain coupon/duration alignment between hedge positions and front-end locks, and ensure that secondary policies are executed accurately to reduce risk as rates rise. This helps preserve profitability through turbulent market swings.

Learn More

Best Practices for Volatility Preparedness

When prices drop and yields rise, volatility in the mortgage-backed securities market can challenge even the most seasoned secondary teams. In these conditions, prioritize margin protection, liquidity, and discipline in execution.

Monitor Coupon Liquidity and Maintain a Dynamic Hedge Strategy

“Liquidity profiles can shift dramatically during volatility. Being nimble with your hedging strategies and monitoring coupon activity is essential.”

– Andrew Rhodes, Senior Director, Head of Trading, MCT

Volatile markets can shift coupon liquidity quickly. Stay responsive by monitoring trading activity and adjusting hedge coverage accordingly. A dynamic strategy ensures that a lender’s hedge remains effective as conditions change.

Trade as Production Comes In

“During volatility, we need to make sure that we’re trading with a higher frequency to maintain your margin. This provides a more realistic mark-to-market position and better protects your initial margins. For example, instead of hedging $20MM at once in anticipation of future locks, hedge as loans actually enter your pipeline.”

– Andrew Rhodes, Senior Director, Head of Trading, MCT

Maintain a consistent trading cadence that aligns with actual loan production. Hedging too early or too late can result in missed opportunities or unwanted risk. Trading as locks enter the pipeline protects margin and provides a more accurate mark-to-market view.

Match Market Levels of Hedge Positions to Front-End Locks

Ensure hedges align closely with front-end rate locks to minimize exposure to pricing mismatches. Review and reconcile loan pipelines and hedge coverage regularly, especially during periods of sharp market movement.

Tighten and Execute Secondary Policies and Procedures

Well-documented, consistently executed policies protect profitability during turbulent markets. To verify everything runs smoothly from lock to delivery, revisit:

- Lock desk guidelines

- Renegotiation policies

- Pull-through modeling

- Team handoffs

Regular audits of secondary marketing processes can identify potential weaknesses before they impact profitability, especially during high-stress market periods.

Ensure Access to Diverse Execution Outlets

Each investor has a different process for valuing loans and may offer more for loans that fit well into their strategy or portfolio. A broader investor base allows more flexibility when execution windows tighten. Strategies to diversify execution outlets include:

- Expanding investor approvals (the average MCT client has nearly 30 investor approvals)

- Leveraging Lender Analytics (formerly known as Business Intelligence) to identify opportunities and optimize investor selection

- Using MCT Marketplace to test and commit with unapproved investors before formal approval

- Exploring both mandatory and best-efforts execution options based on market conditions

Lenders who actively manage their investor relationships and explore new outlets can often add 3-12 basis points to their margins.

Leverage Assignment of Trade Options

Assignment of Trade (AOT) executions can bring pricing benefits and cash flow relief. Bid-tape AOT programs let you roll smaller trades into assignable blocks, avoiding pair-offs and enhancing profitability. Many lenders realize 6–10 basis points in value by strategically integrating AOTs.

Learn More

MCTlive! Functions to Use During MBS Market Movement

In a changing MBS market, leveraging the right tools in MCTlive! can significantly enhance a lender’s ability to manage risk and protect margins.

Use functions like real-time pipeline data, advanced hedging techniques, and cash flow management strategies to respond proactively to market shifts.

Manage loan pipeline risk, conduct electronic TBA trading, and optimize profit

AOTs & Cash Flow Management – Automation of tri-party agreements and immediate investor acceptance in MCTlive! are potent tools for lenders to relieve themselves of out-of-the-money trades, lowering exposure and limiting the possibility of a margin call.

Take Advantage of Live Data – The live aspect of MCTlive! is a game changer in a volatile market. Via MCT’s Data Integration Services, MCTlive! has pipelines refreshing throughout the day. This gives a more precise look at the hedge position rather than relying on a static shock profile, monitoring spreads during the day to predict how a position is going to be impacted given market movement, new locks, fallout, status migration, etc.

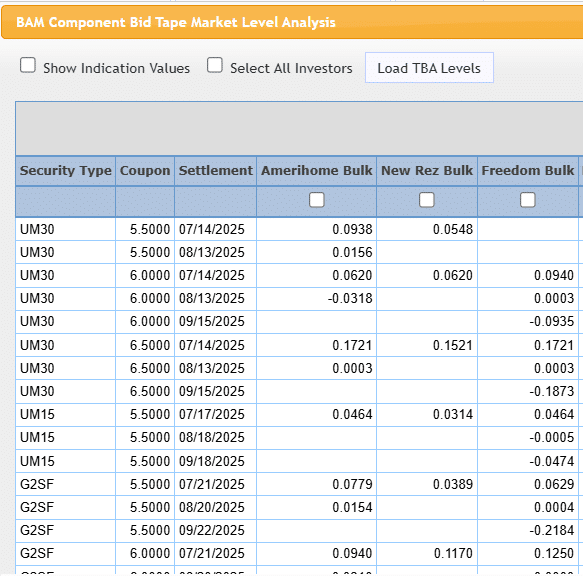

Track and Apply Live Market Movement to Loan Sale Bids – Running a Best Execution analysis in a volatile market can be challenging as investor bids come in at different market levels. Utilizing the “Analyze BAM Market Levels” tab within the Best Ex functionality allows you to view how each loan’s price has been impacted vs current market and allow you to apply those market deltas to your investor bids before deciding where to commit:

Full Dealer Analysis – Using the full dealer analysis tool on the Master Trader screen helps monitor trade exposure and at-risk areas for margin calls.

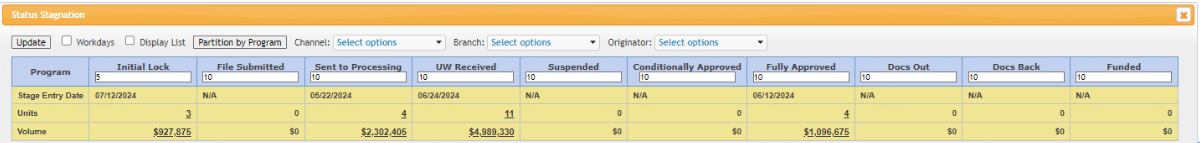

Status Stagnation – Watch for loans that are stagnating in the pipeline and may not actually close. Using the Status Stagnation tools can help a lender monitor their pipeline and identify loans that are stagnating.

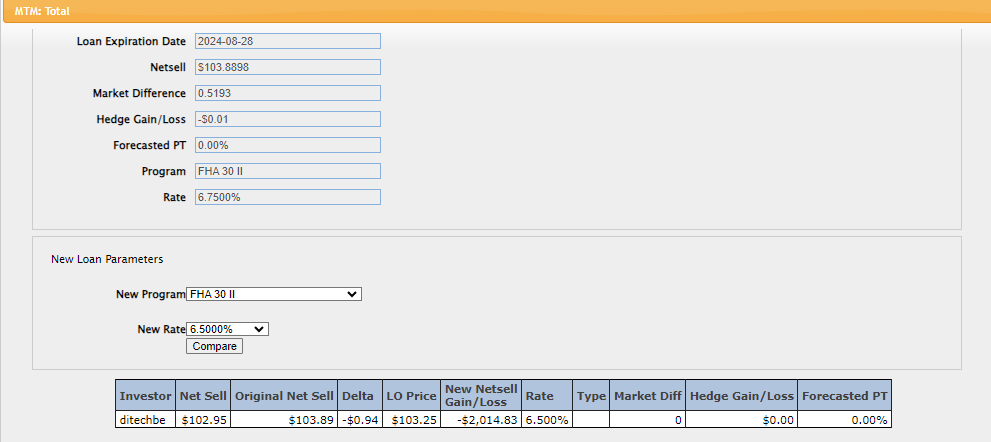

Rate Renegotiation Tool – Lenders should follow their renegotiation policy, be vigilant about the rate drop, and make sure they are not giving away too much or more than necessary. Using the MCTlive! Renegotiation Tool can help with this analysis.

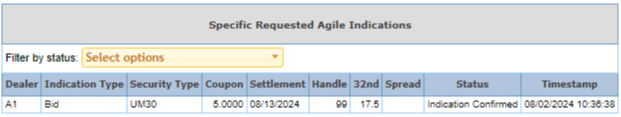

Agile TBA Indications – As markets move in coupon, using Agile indications can give lenders a better idea of the current market on the lower liquidity coupons.

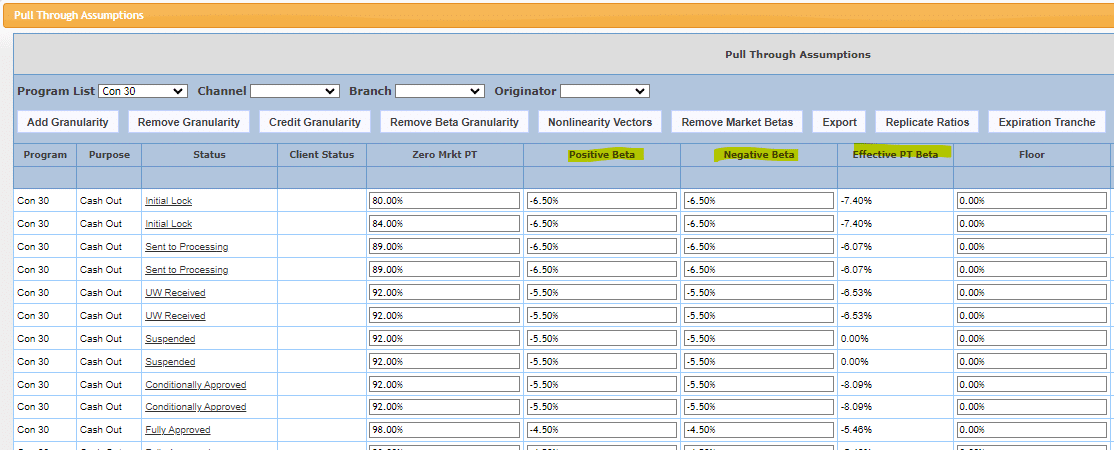

Pull Through Betas – The MCTlive! model will automatically drop the pull through on locks that are experiencing a rally through the pull through betas. These can be differentiated by Stage, Channel, Program, etc.

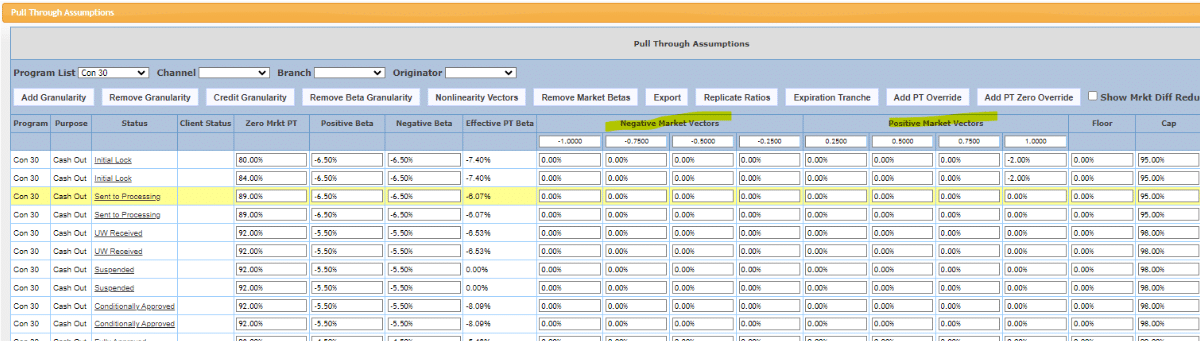

Non-linear Pull Through Vectors – To affect pull through via a curve by breaking out market movements, a lender can have a more drastic effect on pull through depending on the extent to which the market has moved.

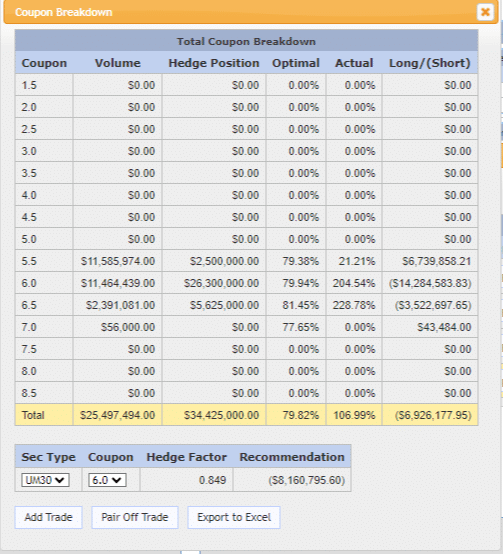

Cross Hedging – As markets move in coupon, locks may appear that are slotted to illiquid coupons. The MCTlive! Coupon Breakdown can help a lender understand how to better hedge these with a more liquid coupon.

Final Thoughts

Navigating MBS market rallies and selloffs requires precise hedge adjustments to align with shifting bond prices and yields. Consistent pipeline management, dynamic hedging, and diversified execution help minimize risk and optimize returns. Using MCTlive! tools enable lenders to respond quickly to market changes and improve financial performance.

For personalized support and strategies in the MBS market, contact us.