![]() In this article, we will discuss how to adjust lock desk best practices to transition loan sales from Mandatory to Best Efforts (only when necessary) during periods of market volatility.

In this article, we will discuss how to adjust lock desk best practices to transition loan sales from Mandatory to Best Efforts (only when necessary) during periods of market volatility.

There are very few, if any, centralized lock desks that will be immune from a major impact on their normal lock activity, when 25, 50, or 100 lock requests come pouring in during a market rally.

Market volatility can complicate things further for mandatory deliveries when trading lines become full and hedgeable product is limited.

Switching to Best Efforts may be the only option to keep up with the demand, but while the grass may seem greener on the Best Efforts side of the fence, we find it’s best to stick with mandatory delivery for as long you can for greater profits and flexibility. When you do need to make the switch, here are some insights and recommendations for your lock desk.

When is it Necessary to Switch Delivery Method During Market Volatility?

One of the million-dollar questions that cross a lenders’ mind during market volatility is “Should I switch to Best Efforts or direct my refi business to Best Efforts?”

The short answer is the grass isn’t necessarily greener on the Best Efforts side of the fence.

So if Mandatory is so much more profitable, why would someone choose to switch to Best Efforts?

Here are some reasons why the make the switch:

- When lenders don’t have enough space on their TBA trading lines to hedge the onslaught of production.

- When a lender’s loan sale outlets begin to raise the bar on requirements for certain types of loans, requiring them to be removed from the hedged pipeline.

- Some lenders may voluntarily choose Best Efforts because they view it as the “safer,” or more conservative option, which is not necessarily the case.

Are Best Efforts and Mandatory subject to a lot of the same risks?

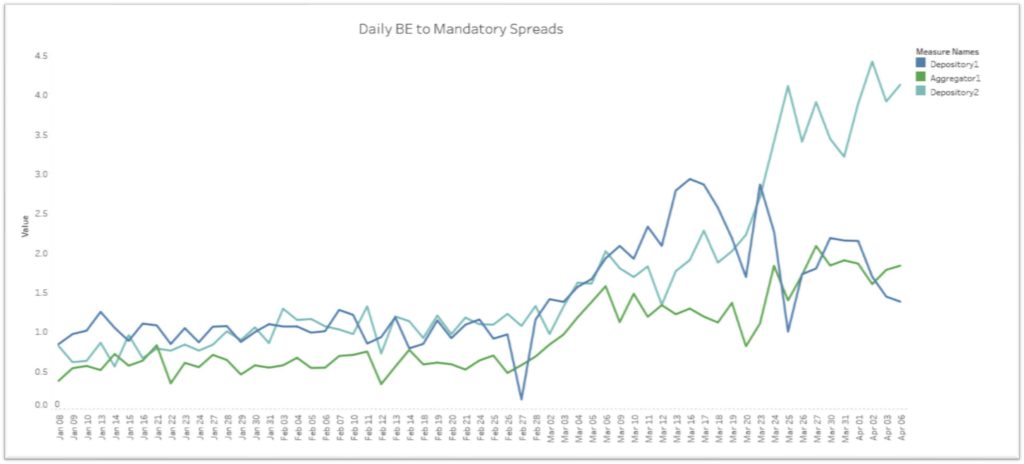

While Best Efforts and Mandatory are subject to a lot of the same risks such as live changes to investor requirements (even on Best Efforts locked loans), forbearance-related repurchase risk, investor capacity issues, and volatile pricing, it’s important to remember that Mandatory delivery still holds the opportunity for greater profits. This is especially relevant when spreads between Best Efforts and Mandatory are widened during periods of market volatility, like what we have observed during March and April of 2020 (shown below).

Best Efforts and Mandatory are widened during periods of market volatility. Examples: March and April of 2020

If you are switching to Best Efforts as a strategy, it’s best to use it as a last resort.

Hedging consistently allows greater flexibility and profits, even during times of volatility. As an alternative to switching to Best Efforts, it’s best to build in the additional margin, even if that means adding enough margin to account for a potential renegotiation during the lock period.

Need a refresher on Lock Desk centralization policies and best practices?

Learn all the steps to establish a centralized lock desk in our whitepaper Lock Desk Centralization 101.

Recommendations for Increasing Best Efforts Lock Production

At MCT, we have seen some of our clients increase Best Efforts locks during market volatility. The results have shown important adjustments you will want to make to your lock desk policies and procedures to ensure a smooth transition.

If you begin locking new production, or a more significant portion of your production than usual, on a Best Efforts basis, here are some considerations to watch out for based on our clients’ recent experience:

Best Efforts Locking Considerations:

- Wait to Confirm Pricing – Do not confirm pricing until lock confirmations are actually received.

- If this is not your current policy, change it and notify originators of the change based on “unprecedented market and global health” issues.

- Lock Later – Consider locking later in the process such as after the loan is cleared for documents. By minimizing the period that you are committed to the borrower, it can decrease the likelihood that events related to the borrower’s employment or finances will affect the viability of loan in the lock to fund period.

- Manage Originator Expectations – be prepared to have some unhappy originators, so proactively manage their expectations.

- Notify originators that turn times will be severely impaired. Depending on the number of requests, estimate how much longer it will take to lock.

- Lock Desk staff will be affected by increased volume of best effort locks (which take longer to process than hedged locks)

- Anticipate Delays with Investors – Investors will be slow to answer general questions, respond to service requests, post confirmations, etc.

- Expect Frequent and Dramatic Investor Reprices – Do not honor requested pricing no matter how long a lock took.

- If you honor the pricing in your pricing engine at the time of request, add margin.

- Anticipate Technology Delays – LOS, PPE, and Investor sites will suffer from latency and failure.

- In some cases, you may be completely unable to obtain pricing, or it may take 20-30 minutes for pricing to import.

- Multiple investor websites may be slow and can crash part way through attempting to lock a loan, requiring lock staff to start all over again.

- Consider Early Lock Desk Closure – Plan to shut down lock desks a few hours early so locks can still be secured before investors close.

- Especially for larger volume clients, it may make sense to close the lock desk earlier in the day.

While we would hope lenders would hold the line with their originators if they lose pricing due to a reprice, experience tells us otherwise. Many find themselves hard-pressed to require an Loan Officer to take a lower price when it has taken hours and hours to process their request. As such, it all comes down to companies adding margin to protect themselves. If they can’t hold the line with their Loan Officers, they have to have additional margin to protect themselves.

Are You Getting the Guidance You Need?

We hope you will consider these recommendations for lock desk best practices during volatile times.

We hope you will consider these recommendations for lock desk best practices during volatile times.

As your trusted capital markets partner, MCT provides laser-focused guidance on market changes and their potential impact to lending businesses during times of market volatility.

It is our duty to serve your needs as a hedge advisor as we weather these challenges together. If you are not currently getting the guidance you need, please contact us for any questions or concerns. We are happy to assist you, no matter your relationship with MCT.

To stay abreast of current market updates, sign up for MCT’s newsletter.