2024 is in full swing and MCT experts are here to inform, predict, and guide you through all of your most pressing 2024 housing market questions. With the help of Andrew Rhodes, Senior Director, Head of Trading at MCT, this blog will help you gain clarity and clear up future predictions in regard to the most important topics in the housing market right now.

Housing Market Predictions for 2024

When will mortgage rates drop? Will inflation go down in 2024? Is a recession coming? Read this market predictions for 2024 article to learn our analysis for the future of 2024 and predictions for the 2025 housing market.

The predictions for the 2024 housing market suggest that mortgage rates will fall to approximately 6.6% by the end of the year, leading to a 1% drop in home prices. Let’s explore potential outcomes as we dive deeper into the year!

Once the Fed hits its target inflation number, under 2%, it will cut its rates in which case we will see the overall mortgage rate decrease at that time. When will this happen? Some experts suggest it could be one sharp cut but others suggest it will taper overtime. There are three cuts in 2024 projected. The first is said to be in March but our experts here at MCT believe it will be June or later.

At the latest Fed meeting, they announced what they are coining the “dot plot“. The dot plot shows the estimates each policymaker has for interest rates for the next several years.

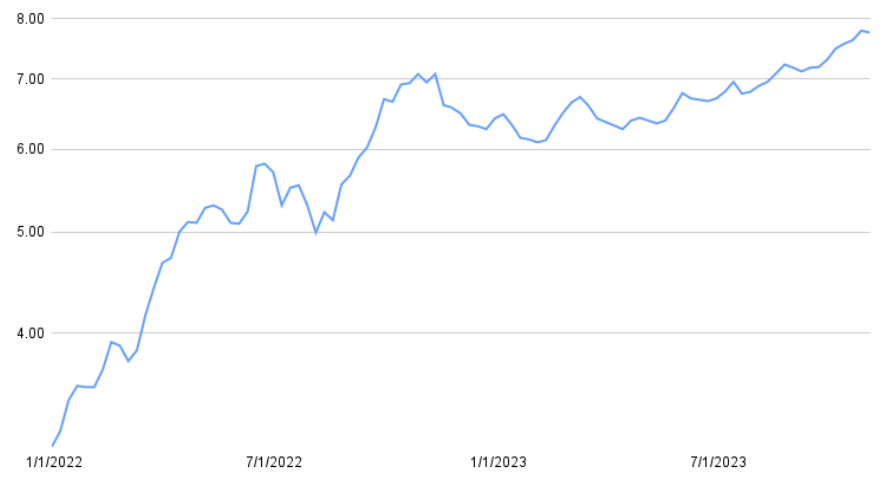

In the mean time, mortgage rates have continued to remain elevated and have returned to the mid-6% range as we start out with 2024. Some experts predict that rates will stabilize through the end of the year, while others suggest rates may hover between 6.5% to 7.5%. The consensus is that rates are unlikely to climb significantly above 8%.

The forecast predicts specifically 30-year conforming mortgage rates in the mid-7’s range through year-end, with a range of 7.25% and 7.75%.

There is disagreement among experts regarding the extent of the decrease in rates in 2024, and mortgage rates are not expected to fall below 6% until 2025.

There are several key factors at play that contribute to potential mortgage rate drop or lack thereof. For one, the Fed’s decision to cut rates would likely lead to a fall in mortgage rates, and there are indications that the Fed may start cutting rates by mid-2024, potentially easing mortgage rates.

The job market cooling has the potential to contribute to a fall in mortgage rates as housing affordability is directly associated with cooling of the job market which, in turn, can influence mortgage rates. In addition to the job market, increasing incomes are a factor that may impact housing affordability and therefore, mortgage rates in 2024.

The consensus among experts is that inflation is expected to decelerate in 2024. However, reaching the Federal Reserve’s 2% target may take until the following year, as projections suggest.

The U.S. Bureau of Labor Statistics shows that the 12-month percentage change of consumer price index (CPI), which was 6.4% as we came into 2023, reached it’s lowest point in June of 2023 and has remained in the three’s for the remainder of 2023. If this trend continues, it may open the gateway for more housing buying power in the coming years.

Private-sector forecasters share a common view, indicating that inflation is likely to dip below 2.5% in 2024. The collective forecast envisions an average inflation rate of 2.5% for 2024, with a subsequent decrease to 2.2% in 2025, aligning with the Fed’s 2% target by 2026.

Nevertheless, there are opposing expectations from some that inflation will average 1.8% from 2024 to 2027, falling below the Fed’s target.

On a separate note, predictions for consumer price inflation suggest an average of 4.1% in 2023 and a slight decline to 4.0% in 2024. These figures encapsulate the economic forces at play and underscore the complexity of the inflationary landscape.

The Survey of Professional Forecasters, a key source of economic insights, predicts a median inflation rate of 2.5% (CPI) and 2.4% (PCE) for 2024. This consensus reinforces the prevailing narrative of a slowing inflation trend but introduces an element of caution, acknowledging the uncertainties in the economic outlook.

In this prediction overview, the immediate future of inflation remains a central theme. As experts project a gradual attenuation of inflation, questions linger about the sustainability of this trend. The figures offer a snapshot of the economic landscape, but whether inflation will indeed subside in 2024 or if this represents a temporary respite remains uncertain. The unfolding economic dynamics will ultimately reveal the answers.

Potentially. The unemployment rate is projected to increase in 2024, a previous year of high inflation has the potential to decelerate, and positive GDP growth in recent years all point to wavering confidence on whether a recession is due in 2024.

Major mixed opinions are floating around. The Federal Reserve Bank of New York predicts that there is a 56% probability of the U.S. economy slipping into a recession by September 2024, however, according to experts’ average forecast in Bankrate’s latest quarterly report, the odds of a recession happening between now and September 2024 have dropped to 46 percent.

The unemployment rate is an essential factor in determining the health of an economy. According to the St. Louis Federal Reserve, the unemployment rate is projected to gradually increase in the coming years. By 2024, it is expected to reach an average of 4.2%, which is 0.5 percentage points higher than its average in the third quarter. This is still relatively low, historically speaking, which leaves us not sold on a recession based on unemployment alone.

Inflation is another major contributor to the overall health of the economy. In 2022, the year-over-year inflation rate was recorded at 6.5% in December. This indicates a relatively high inflation rate, which can potentially affect consumers’ purchasing power and overall economic stability. If we continue on this trend, which some experts are cautiously arguing we will, the overall consensus, and hope, is that inflation will decrease in 2024.

While GDP growth has been positive in recent years, it is essential to analyze whether it is sufficient to sustain economic growth and prevent a recession in 2024. The IMF reports a GDP growth rate of 2.1% for the US in recent years. Although this growth rate is positive, it is important to consider factors such as population growth and productivity to determine if it is sustainable in the long run.

It is challenging to definitively predict whether there will be a recession in 2024. The positive GDP growth, albeit at a slower rate, suggests that the U.S. economy is still expanding. However, the projected rise in unemployment rates and the relatively high inflation rate raise concerns about the stability and potential risks to the economy. Our expert opinion is to continue to seek support from secondary market and economic professionals and to come back to this article, and other informative literature as the year progresses to stay up to date on this ever-changing economy.

Despite the easing we have seen Q4 of 2023, the disappointing reality of still high mortgage rates mixed with historically low housing supply continues to discourage many from homeownership. Most commonly in this predicament are first-time buyers, creating a less hopeful and pessimistic consensus among the millennial-aged generation than ever before.

%

Fewer units of homes available for sale YoY as of July 2023

Additionally, a report by Redfin highlights the competitiveness of the California housing market, providing information on the median house price, demand, supply, and more. While this report does not apply to the US as a whole, it is a small piece that signifies the difficulty of the market currently.

According to the HUD PD&R National Housing Market Summary, the United States is currently experiencing a historic housing shortage. As of July, there were 14.5% fewer units of homes available for sale compared to the previous year. This shortage in housing supply has been one of the main factors driving up housing prices in recent years.

Want to learn more from MCT?

Learn from our secondary marketing experts how you can use hedging as a tactic to mitigate risk and optimize profitability when selling mortgage loans. Fill out the form below to download our latest educational whitepaper!

Download Whitepaper

Experts predict several trends for the housing market in 2025, including a 5.5% increase in home values which has the potential to slowdown in the housing market’s growth rate.

Further analysis discusses the affordability concerns in the Northeast region. It is predicted that by 2025, the median home value in this area will reach approximately $523,017.38, with a year-over-year growth rate of 12%. These projections highlight the challenges buyers may face in affording homes in this region in the coming years.

Interest rates also play a crucial role in the housing market. If inflation rate holds at 2%, as the Fed is pushing, mortgage rates could potentially fall to at least 2% lower than they are right now in 2025. An overview of the next two years from The Mortgage Reports suggests that we will see a gradual decline from the current 7.3% average to 5.5% in 2025. This indicates a potential favorability for buyers as lower interest rates can make homeownership more affordable.

Danushka Nanayakkara-Skillington, the assistant VP of forecasting and analysis for NAHB, also agrees on the downward trend of interest rates. It is predicted that rates will drop to around 6% by an unspecified time. This projection aligns with the general consensus that interest rates may continue to decline or stabilize, which can further stimulate the housing market.

In terms of the types of housing that will come out of such changes in the economy, here are some 2025 housing predictions:

- Increasing Demand and Limited Supply: Experts unanimously agree that the demand for housing will remain robust in 2025. A growing population, coupled with an expanding middle class and urbanization, will continue to fuel the need for housing across various regions. However, a persistent challenge facing the market will be the limited supply of affordable housing, leading to rising prices. This scarcity may further exacerbate the affordability crisis, particularly in densely populated areas. This will increase the amount of renting more than has already been experienced and, therefore, landlords will increase rent.

- Rise of Smart Homes and Sustainable Living: Technological advancements will significantly impact the housing market in the coming years. Experts predict an increased focus on smart homes, integrating Internet of Things (IoT) devices and automation into residential properties. This trend aims to enhance energy efficiency, convenience, and security. Additionally, sustainable living will gain prominence, with a surge in eco-friendly features such as solar panels, rainwater collection systems, and energy-efficient appliances becoming the norm.

- Remote Work and Flexible Living Spaces: The COVID-19 pandemic has accelerated the remote work trend, which is expected to continue influencing the housing market in 2025. Experts predict a shift towards flexible living spaces that accommodate remote work, with the inclusion of home offices, dedicated study areas, and high-speed internet connectivity becoming essential selling points. As more companies adopt remote work policies, individuals will have greater flexibility in choosing their ideal living locations, potentially leading to a rise in suburban and rural housing demand.

- Millennial Homeownership and Renting: Millennials, a significant demographic cohort, will continue to shape the housing market in 2025. While many millennials have been delayed in entering homeownership due to financial constraints, experts project a surge in millennial homebuying as they reach their prime earning years. However, the preference for renting among millennials will persist, driving the demand for rental properties, particularly in urban areas where affordability remains a challenge.

- Impact of Government Policies: Government policies and regulations will play a pivotal role in the housing market’s future. Experts predict an increased focus on affordable housing.

The confluence of factors shaping the housing market landscape in 2024 prompts a nuanced perspective. The anticipation of mortgage rate shifts, the trajectory of inflation, and the potential of a looming recession have invited some uncertainty. While projections suggest a potential easing of mortgage rates by mid-2024, the Fed’s policies balanced with economic variables adds complexity to the forecast. The deceleration in inflation, though predicted, is not promised, leaving open questions about its trajectory in 2024. Meanwhile, the consistent curiosity regarding a recession adds more anxiety to the forecast as well. Yet, housing prices appear poised for stability rather than a significant downturn in 2024, adding hopefulness to the equation. As we navigate the sometimes unstable waters that is the housing market, will 2024 greet us with a life boat or strong headwinds? Only time will tell. In the mean time, lean on MCT as your trusted capital markets advisors by continuing to visit our blogs, whitepapers, webinars, and more to stay updated on the 2024 housing market.

Key Takeaways

- Once the Fed hits its target inflation number, under 2%, it will cut its rates in which case we will see the overall mortgage rate decrease at that time.

- The consensus among experts is that inflation is expected to decelerate in 2024. However, reaching the Federal Reserve’s 2% target may take until the following year, as projections suggest.

- The unemployment rate projected to increase in 2024, a previous year of high inflation with the potential to decelerate, and positive GDP growth in recent years all point to wavering confidence in solidified opinions on whether a recession is due in 2024.

- Research on current housing market trends and indicators suggests that housing prices may not necessarily drop in 2024.

Subscribe for More Housing Market Updates

When you join our newsletter you get access to our daily market commentaries.