Weekly Technology Improvement Series:

Data “Writeback” in MCTlive!

Published 9/24/2021

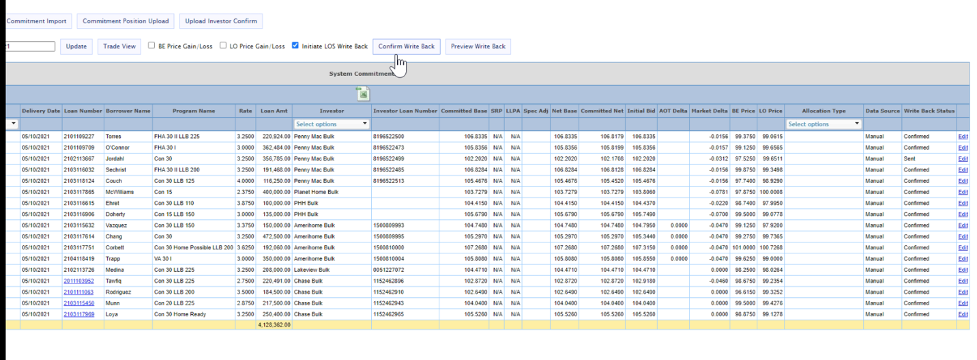

Looking to conduct your “write backs” from the MCTlive! platform?

Our Commitment Tracker Tab confirms come in via API or are uploaded by investors.

All that information is organized and displayed on a loan level in the commitment tracker.

You can initiate, preview, and confirm data write back to your LOS.

We conduct error checking to catch things such as duplicate sends or missing data to prevent mistakes.

Differentiators MCTlive! has that others may not include: populating custom fields, doing custom calculation and doing write backs at the loan-level rather than the trade-level.

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

15 Strategies for Improving Profitability in the Current Market

Our latest white paper outlines 15 actionable strategies mortgage lenders use to improve profitability. These include secondary marketing strategies, business operations and technology.

National Mortgage Professional Magazine Designates MCT’s CMO Ian Miller to 2019 Most Connected Mortgage Professionals List

MCT announced that its Chief Marketing Officer (CMO) Ian Miller, has been honored by National Mortgage Professional (NMP) magazine with its 2019 Most Connected Mortgage Professionals award.

National Mortgage Professional Magazine Honors MCT’s Rhiannon Bolen with 2019 Mortgage Banking’s Most Powerful Women Award

SAN DIEGO, Calif., October 22, 2019 – Mortgage Capital Trading, Inc. (MCT), a leading mortgage hedge advisory and secondary marketing software firm, announced that Regional Sales Director Rhiannon Bolen was selected as one of Mortgage Banking’s Most Powerful Women for 2019 by National Mortgage Professional Magazine’s (NMP).

Case Study: Mountain West Financial Improves Efficiency & Improves Margins with Trade Auction Manager (TAM)

In this case study, Mrs. Mohr describes how MCTlive!, BAM, and bid tape AOT have enabled her team to realize time savings and efficiency gains along with improved margins.

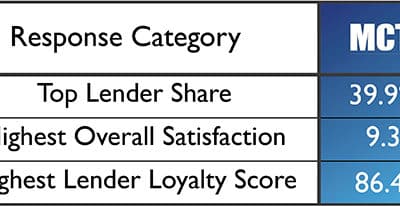

STRATMOR Group’s 2019 Technology Insight Study Again Scores MCT Highest for Overall Satisfaction, Lender Loyalty, and Lender Share

STRATMOR Group’s 2019 Technology Insight Study show MCT as the industry leader in lender share, overall satisfaction, and Lender Loyalty Score® in the Production Pipeline Hedging category.

UPDATE: MCT Integrates its MCTlive!® Secondary Marketing Software with Freddie Mac for Automated Loan Sale Pricing & Commitment

UPDATE Oct. 10, 2019 – MCT is proud to announce the addition of the Freddie Mac Cash-Released XChange browse price API to the integration between Freddie Mac and the MCTlive! platform. Leveraging the browse price API, MCTlive! lenders can now accurately and conveniently utilize Freddie Mac Cash-Released XChange in their best execution analysis.

MCT’s COO Phil Rasori Honored with HousingWire Tech Trendsetters Award

Phil Rasori, has been designated to HousingWire’s inaugural Tech Trendsetters award list. Phil is credited with being instrumental in the architecture and launch of multiple innovative capital markets solutions.

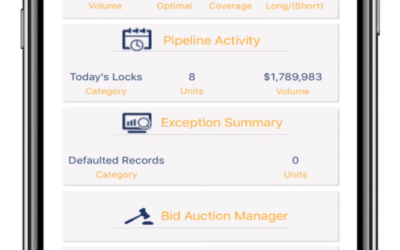

New MCTlive! Mobile App Puts Secondary Marketing at Lenders’ Fingertips

SAN DIEGO, Calif., Sept 18, 2019 – Mortgage Capital Trading, Inc. (MCT), a leading mortgage hedge advisory and secondary marketing software firm, debuted a new MCTlive! mobile application at its MCT Exchange client conference last Friday. The app enables secondary marketing managers to review reporting, manage loan pipelines, and conduct whole loan trading from the convenience of their mobile phone.

Livestream Recordings – MCT Exchange 2022

Sign up for access to the broadcast live from the 2022 MCT Exchange on September 13th at 12pm PT. The live broadcast will feature a selection of representatives from some of the industry’s leading investors as they discuss what’s next for secondary marketing executions and how new technology is improving loan sale processes.

Drive More Leads & Increase Conversions with Borrower & Realtor Facing Technology

In this MCT Community Webinar on August 28, 2019, LenderLogix will use Premium Mortgage to show how their technology has helped improve purchase volumes by 20%, improve pre-qualification conversions by 20%, and improved consumer self-service without removing the loan officer.