Weekly Technology Improvement Series:

Data “Writeback” in MCTlive!

Published 9/24/2021

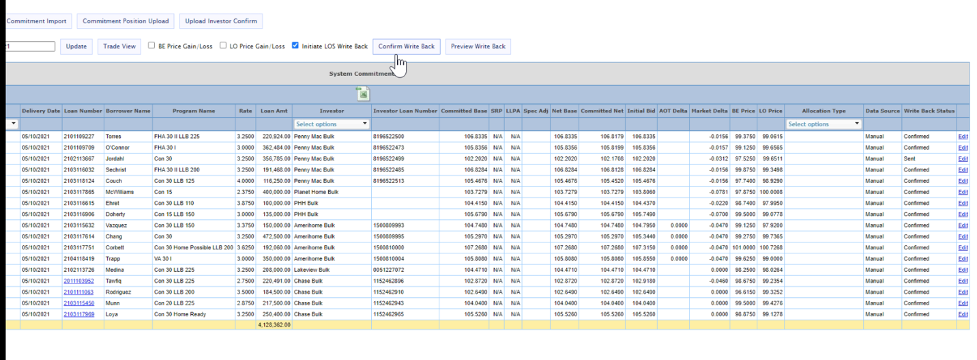

Looking to conduct your “write backs” from the MCTlive! platform?

Our Commitment Tracker Tab confirms come in via API or are uploaded by investors.

All that information is organized and displayed on a loan level in the commitment tracker.

You can initiate, preview, and confirm data write back to your LOS.

We conduct error checking to catch things such as duplicate sends or missing data to prevent mistakes.

Differentiators MCTlive! has that others may not include: populating custom fields, doing custom calculation and doing write backs at the loan-level rather than the trade-level.

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

MCTlive! Lock Volume Indices: April 2023 Data

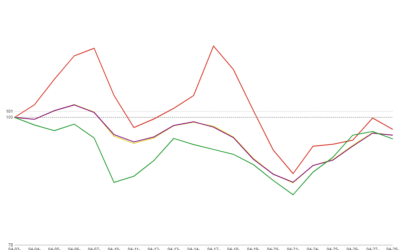

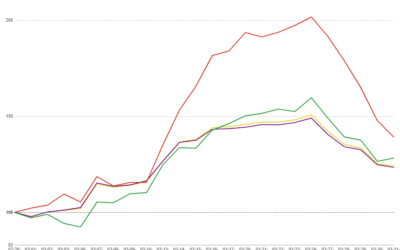

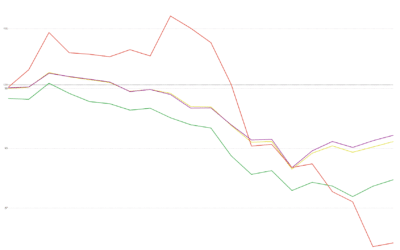

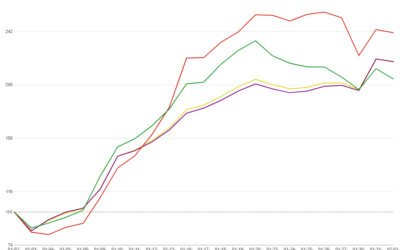

MCTlive! Mortgage Lock Volume Indices covers the period from April 1 through April 30, 2023, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.

MCT AOT Automation Improves Mortgage Lender Profitability and Investor Efficiency

Mortgage Capital Trading, Inc. (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, announced that it has automated the process of digital TBA trade assignment during the loan sale process for both mortgage lenders and participating correspondent investors.

MCTlive! Lock Volume Indices: March 2023 Data

MCTlive! Mortgage Lock Volume Indices covers the period from March 1 through March 31, 2023, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.

March Housing Market Update: After Silicon Valley Bank Collapse

Unless you live under a rock, or in an increasingly blissful state of ignorance, you have likely noticed that government-bond yields have fallen the most since 2008

2023 HW Tech100 Mortgage Award Announces MCT as Leader in Innovation

MCT® was announced as a 2023 HousingWire Tech100 Mortgage Winner. The Tech100 Mortgage Award recognized the most innovative and impactful technology companies serving the mortgage industry and forever changing the home sales process.

BSI Financial Joins MCT’s Co-Issue Marketplace

BSI Financial Services (BSI) has become the latest investor to join BAMCO, MCT’s new marketplace for co-issue loan sales. BAMCO brings co-issue transactions directly into MCT’s whole loan trading platform and improves price transparency by connecting unapproved sellers to live executions from potential buyers.

MCTlive! Lock Volume Indices: February 2023 Data

MCTlive! Mortgage Lock Volume Indices covers the period from February 1 through February 28, 2023, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.

Special Feature – Market Commentary

We wanted to broach three newsworthy stories from 2023 that have not been addressed in the weekly commentary: changes to the Loan Level Price Adjustment (LLPA) matrix, Wells Fargo’s exit from the correspondent lending space, and the U.S. breaching its debt ceiling.

MCTlive! Lock Volume Indices: January 2023 Data

MCTlive! Mortgage Lock Volume Indices covers the period from January 1 through January 31, 2023, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.

The Fed’s Latest Moves and Market Impact

After six consecutive rate increases of 50 BPS or more, as expected, the Fed raised rates by 25 BPS today (Wednesday), lifting fed funds to a new target range of 4.5-4.75%. More importantly, the committee continued to promise “ongoing increases” in overnight borrowing costs as part of its ongoing and unresolved battle against inflation. By keeping the promise of future rate hikes, the Fed pushed back against investor expectations that it was ready to signal the end of the current tightening cycle.