Weekly Technology Improvement Series:

Bid Tape Mapping for Non-Platform Tapes

Published 9/17/2021

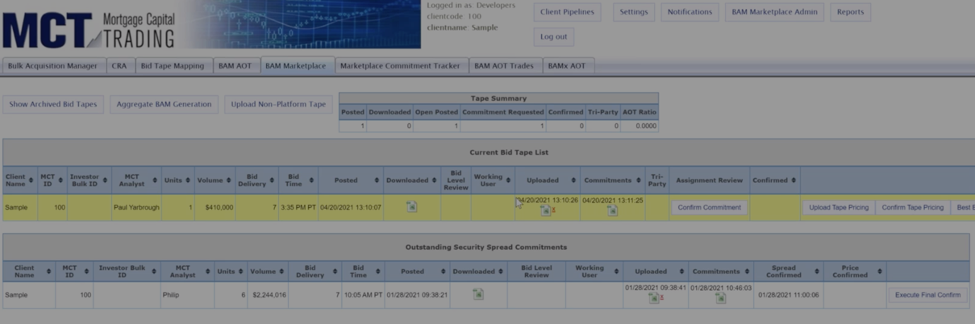

We aren’t naïve. Sellers use other services than ours, such as Resitrader, to sell loans.

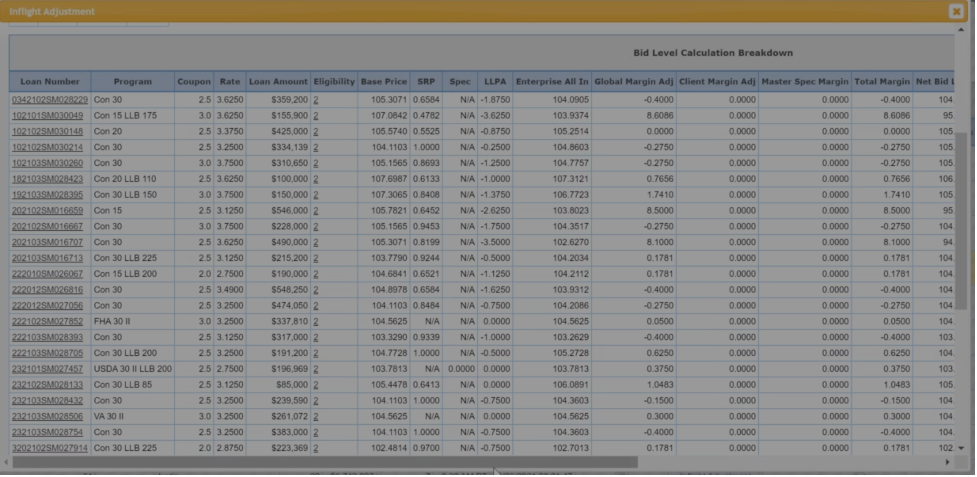

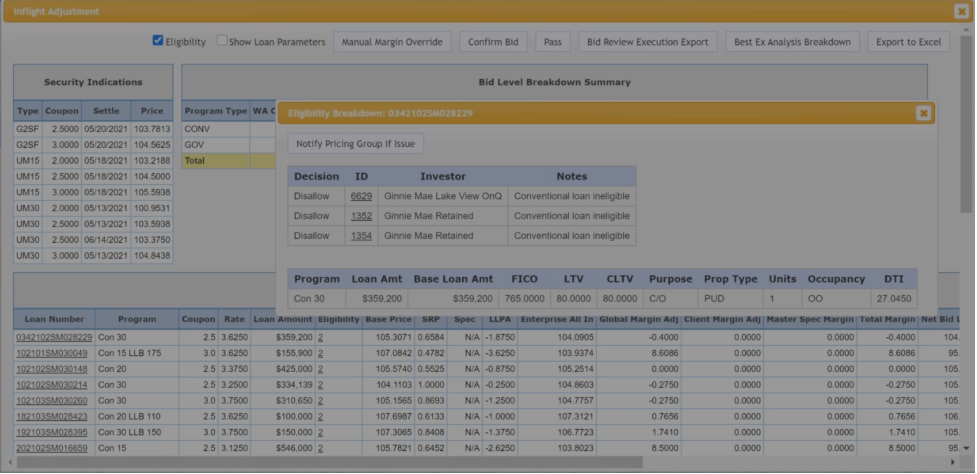

With our easy and robust tape mapping tool that includes eligibility breakdown, we map and normalize tapes for you.

Pull rules that make a loan ineligible for a particular pricing institution. It is a quick and easy way to see eligibility that lets you get as granular as you like.

We also provide a pricing breakdown, which tells you exactly what you need to pay for a loan.

Autobid generates pricing once you hit a button, but you don’t actually need to hit a button.

You can employ Autoprice, which also has controls surrounding tape size, etc.

Price every loan without extra work, providing you with a massive time savings.

Have confidence in the ability to turn tapes without a secondary employee watching it all day.

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

MCT Client Webinar: MarketFlash Rate Renegotiations

This client-exclusive webinar focused on recent market volatility, as well as tools to help manage your pipeline and ongoing market movements. MCT’s Chief Operating Officer, Phil Rasori, will also review pull-through management and new functionality.

MCT’s Response to the FHFA’s Proposed Changes, Jan. 2020

Read MCT’s Response to the FHFA’s Proposed Changes, January 2020 to learn how elements of the proposal would be detrimental to the mortgage lending community and MBS market participants.

UPDATE: MCT® Integrates its MCTlive!® Secondary Marketing Software with Fannie Mae’s Pricing & Execution – Whole Loan® Application

UPDATE Jan. 23, 2020 – MCT is proud to announce that on December 18th they became the first organization to connect lenders to Fannie Mae’s Loan Pricing API via its Bid Auction Manager (BAM) loan trading platform for live Servicing Marketplace® (SMP) pricing.

MCT® Bolsters Growing Sales Team with Addition of Industry Veteran Bill Shirreffs as Senior Director of Sales Operations

Bill Shirreffs joins MCT as Senior Director of Sales Operations to help manage the expansion of MCT’s entire sales team along with operations, sales leadership and overall strategy.

Market Summary & Outlook 2020

In this report, we review a few recent developments and explore trends in the mortgage and capital markets that have the greatest potential to impact mortgage lending in 2020.

15 Strategies for Improving Profitability in the Current Market

Our latest white paper outlines 15 actionable strategies mortgage lenders use to improve profitability. These include secondary marketing strategies, business operations and technology.

National Mortgage Professional Magazine Designates MCT’s CMO Ian Miller to 2019 Most Connected Mortgage Professionals List

MCT announced that its Chief Marketing Officer (CMO) Ian Miller, has been honored by National Mortgage Professional (NMP) magazine with its 2019 Most Connected Mortgage Professionals award.

National Mortgage Professional Magazine Honors MCT’s Rhiannon Bolen with 2019 Mortgage Banking’s Most Powerful Women Award

SAN DIEGO, Calif., October 22, 2019 – Mortgage Capital Trading, Inc. (MCT), a leading mortgage hedge advisory and secondary marketing software firm, announced that Regional Sales Director Rhiannon Bolen was selected as one of Mortgage Banking’s Most Powerful Women for 2019 by National Mortgage Professional Magazine’s (NMP).

Case Study: Mountain West Financial Improves Efficiency & Improves Margins with Trade Auction Manager (TAM)

In this case study, Mrs. Mohr describes how MCTlive!, BAM, and bid tape AOT have enabled her team to realize time savings and efficiency gains along with improved margins.

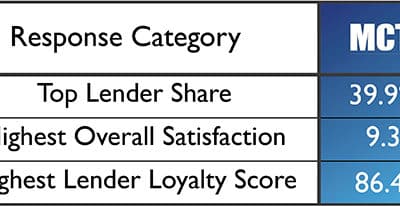

STRATMOR Group’s 2019 Technology Insight Study Again Scores MCT Highest for Overall Satisfaction, Lender Loyalty, and Lender Share

STRATMOR Group’s 2019 Technology Insight Study show MCT as the industry leader in lender share, overall satisfaction, and Lender Loyalty Score® in the Production Pipeline Hedging category.