Weekly Technology Improvement Series:

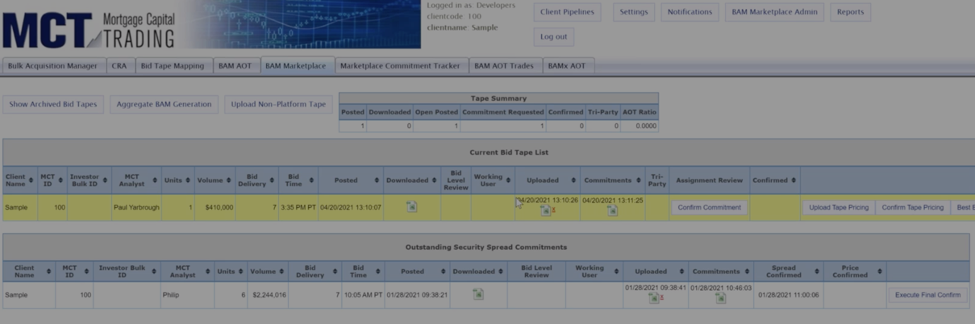

Bid Tape Mapping for Non-Platform Tapes

Published 9/17/2021

We aren’t naïve. Sellers use other services than ours, such as Resitrader, to sell loans.

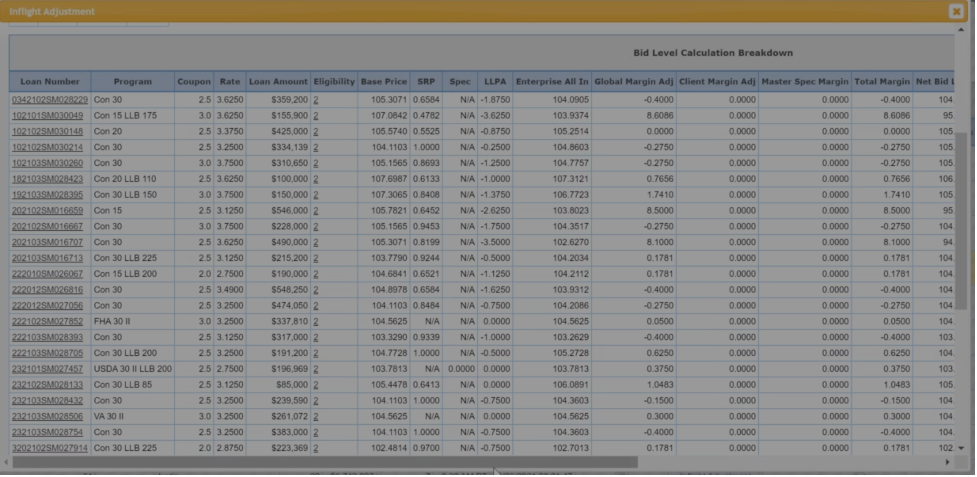

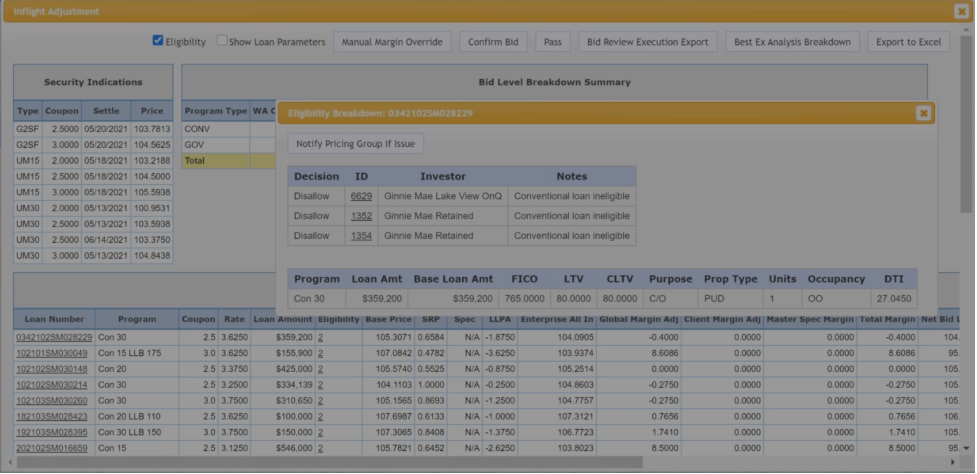

With our easy and robust tape mapping tool that includes eligibility breakdown, we map and normalize tapes for you.

Pull rules that make a loan ineligible for a particular pricing institution. It is a quick and easy way to see eligibility that lets you get as granular as you like.

We also provide a pricing breakdown, which tells you exactly what you need to pay for a loan.

Autobid generates pricing once you hit a button, but you don’t actually need to hit a button.

You can employ Autoprice, which also has controls surrounding tape size, etc.

Price every loan without extra work, providing you with a massive time savings.

Have confidence in the ability to turn tapes without a secondary employee watching it all day.

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

MCT Webinar | Impact of FHFA & Treasury Suspending Certain Portions of the 2021 PSPA

In this webinar, Phil Rasori reviews how changes to FHFA’s Preferred Stock Purchase Agreement and corresponding reactions from Fannie Mae and Freddie Mac will impact your business.

Pricing Granularity – Rasori’s Relentless Releases: Weekly Technology Improvement Series

In MCT’s latest Rasori’s Relentless Releases, we discuss new pricing granularity features in MCTlive!.

HousingWire Designates MCT’s Paul Yarbrough to Insiders Award List

Mortgage Capital Trading, Inc. (MCT®), an industry-leading mortgage hedge advisory firm, announced that Paul Yarbrough, Director of the Client Success Group, has been named to HousingWire’s Insider Awards list. The list is designed to honor an organization’s operational all-stars — those insiders who are the company’s best-kept secret, yet vital to its success.

The Future of Fannie Mae and Freddie Mac – A Conversation with Phil Rasori and Rob Chrisman

In this article, we sit down with Phil Rasori and Rob Chrisman to discuss the future of Fannie Mae and Freddie Mac with the impending appointment of a new FHFA director.

How The 10-Year U.S. Treasury Note Impacts Mortgage Rates

In this article, we examine the relationship between the 10-year U.S. Treasury yield and fixed mortgage rates.

Cash-Window APIs – Rasori’s Relentless Releases: Weekly Technology Improvement Series

In MCT’s sixth episode of Rasori’s Relentless Releases, Phil Rasori covers the January 14th proposal of volume caps on agency cash window deliveries, the features of the MCTlive! Pool Optimizer and also reviews a new comparison tool.

MCT Study of Digital RFQ Implementation

This report measures the change in phone use, productivity and TBA execution associated with the implementation of Agile Trading Technology’s RFQ platform (Agile RFQ). Complete the form to receive a copy of the report summarizing experiences of platform users.

A Credit Union’s Guide to Moving to Mandatory Loan Sale Delivery

Credit unions can leverage mandatory loan sale delivery to improve profitability and manage risk with pipeline hedging. This paper discusses that, as well as all the operational changes needed to move from best efforts to mandatory loan sales.

MCT & Freddie Mac Webinar | Selling Guarantor: Ensuring a Successful Transition

In this webinar, Freddie Mac and MCT explore the execution, operations, and costs lenders should analyze when considering the move from Cash to Guarantor.

Mortgage Banker Announces Natalie Arshakian as 2021 Powerful Women of Mortgage Banking

MCT®’s Natalie Arshakian was announced as one of the 2021 Powerful Women of Mortgage Banking. Ms. Arshakian was selected for the Marketing Leader Award by a panel of industry leaders that viewed and voted on submissions before the final list was reviewed and confirmed by a committee.