Weekly Technology Improvement Series:

Bid Tape Mapping for Non-Platform Tapes

Published 9/17/2021

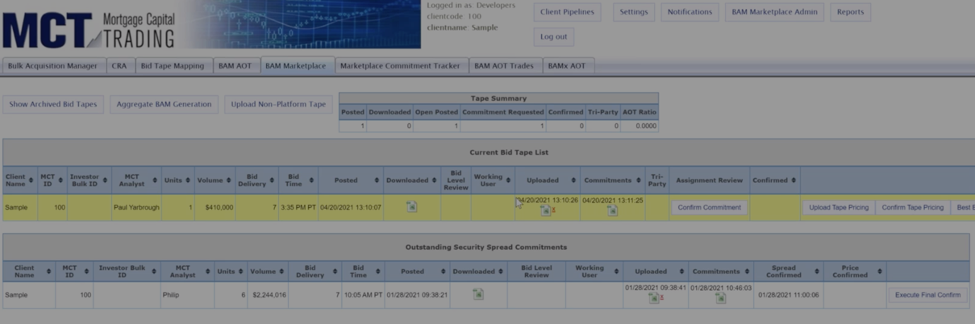

We aren’t naïve. Sellers use other services than ours, such as Resitrader, to sell loans.

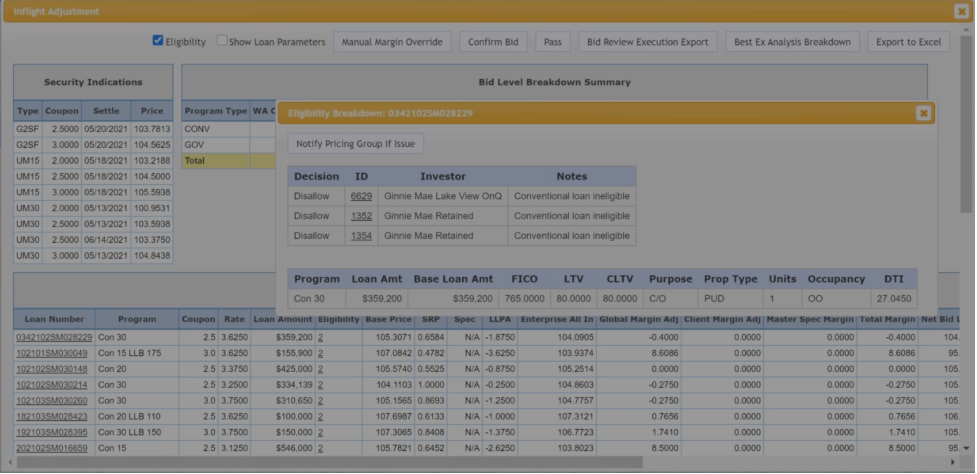

With our easy and robust tape mapping tool that includes eligibility breakdown, we map and normalize tapes for you.

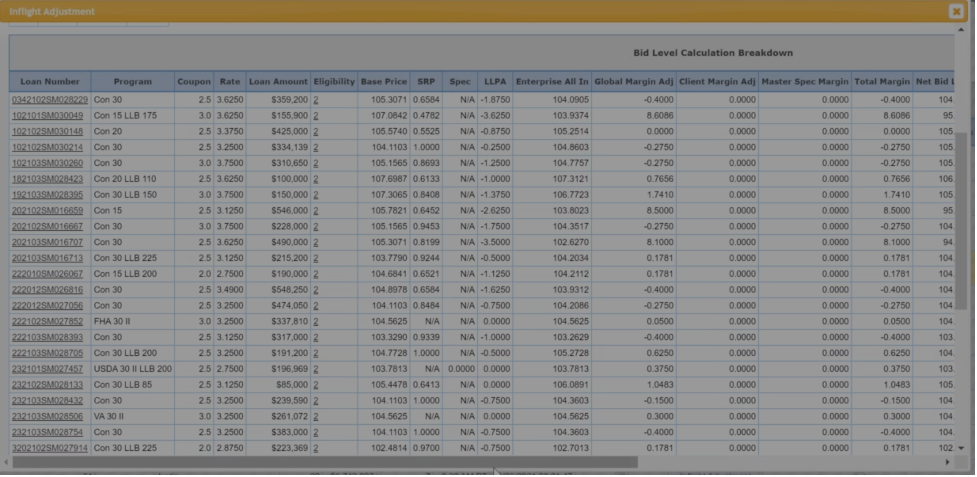

Pull rules that make a loan ineligible for a particular pricing institution. It is a quick and easy way to see eligibility that lets you get as granular as you like.

We also provide a pricing breakdown, which tells you exactly what you need to pay for a loan.

Autobid generates pricing once you hit a button, but you don’t actually need to hit a button.

You can employ Autoprice, which also has controls surrounding tape size, etc.

Price every loan without extra work, providing you with a massive time savings.

Have confidence in the ability to turn tapes without a secondary employee watching it all day.

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

MCTlive! Quarterly Release Notes in Q3 2025

Described below within relevant tabs, you’ll find a listing of our Q3 2025 technology developments. This update also includes technology release notes for MCT’s MSRlive! and Data & Analytics tools.

MSR Market Monthly Update – October 2025

The Federal Reserve lowered its benchmark interest rate by 0.25 percentage points in September. This was the first rate cut since December 2024. Read the full release for the October 2025 MSR update.

Margin Management and Price Optimization in Mortgage Lending

Master margin management with strategies to boost profitability, optimize pricing, and manage production volume for better results in any mortgage market.

MCT’s Enhanced Best Execution (EBX) Technology Allows for True Economics of MSR

MCT’s Enhanced-Best-Execution (EBX) tool is the most comprehensive tool on the market for helping secondary market (MSR portfolio) managers determine which loans to retain or release. Recently, MCT announced it has automated the data reconciliation process to seamlessly transfer (via API) information between MCTlive! (Hedging Platform) and MSRlive! (MSR Platform).

Rate/Term Refis Surge Over 180% as Industry Advised to ‘Stay the Course’ Amid Shutdown

Rate/term refinances surged 183% as borrowers capitalized on lower rates, with MCT advising lenders to stay disciplined amid a data blackout and Fed rate cuts.

Introduction to Mandatory Loan Sale Delivery

Mandatory delivery in mortgage capital markets impacts pricing, risk, and profitability. Discover when to use it and how it can unlock greater profits.

MSR Market Monthly Update – September 2025

All eyes are on the Fed upcoming meeting this month in anticipation of the highly anticipated rate reduction announcement. Read the full release for the September 2025 MSR update.

MCT September Indices: ‘Batten Down the Hatches’ as Markets Await Fed Decision

MCT’s September Lock Volume Indices show mixed performance as markets hold steady ahead of imminent Fed rate decision. Total volume down 0.78% monthly amid cautious positioning.

Unlocking Growth with MCTlive!® and MSR Services: NOLA Lending Group’s Story

NOLA Lending Group relies on MCT’s hedging, loan sale execution, MSR services, and overall client experience to drive performance.

MSR Market Monthly Update – August 2025

Mixed economic signals are causing many economists to remain cautious, even as U.S economic growth rebounded to 3.0 percent in Q2 after a Q1 contraction. Read the full release for the August 2025 MSR update.